State-sponsored lotteries are extremely popular and highly successful methods by which state governments in many countries raise much-needed funds for financing public expenses, especially

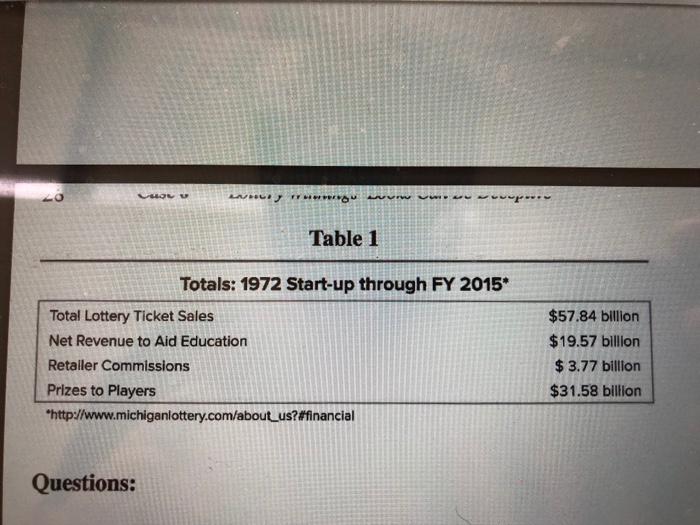

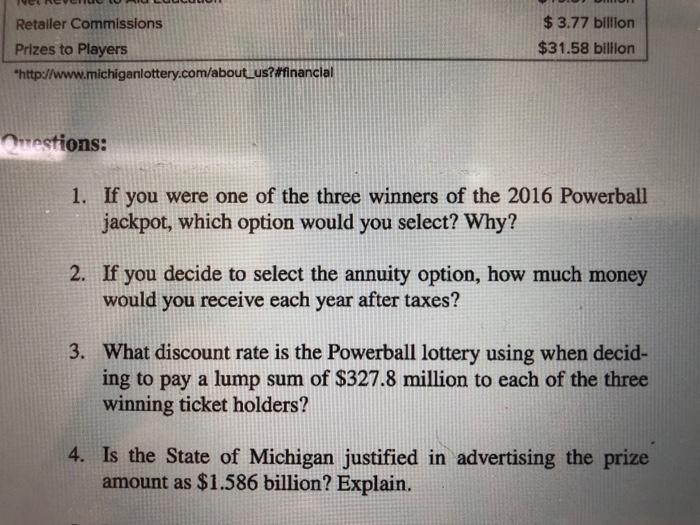

State-sponsored lotteries are extremely popular and highly successful methods by which state governments in many countries raise much-needed funds for financing public expenses, especially education. In Michigan alone, during the year 2015, Michigan Lottery reported annual sales of $2.7 billion, and generated $795.5 million in net revenue for the state School Aid Fund, supporting public education (K-12) programs through- out the state. Retailers received annual commissions of $203.6 million, while Michigan Lottery players collected prizes worth $1.69 billion. Table 1 presents sales and funding figures accounted for by the Michigan Lottery since its inception in 1972 up until fiscal year 2015. The numbers are quite impressive! Mega Millions is a multi-state draw game, formerly known as The Big Game. On January 31, 2010, the Multi-State Lottery Association (MUSL). an association of 37 member lotteries, joined with the 10 participating Mega Millions states including California, Georgia, Illinois, Massachusetts, New Jersey, New York, Ohio, Virginia, and Washington to participate in the Mega Millions game with Michigan. On December 12, 2010, Megaplier, an add-on game to Mega Millions, began where players can increase their prize by two to five times. The Megaplier number is selected at random before each drawing. If a player wins a non-jackpot prize on their Mega Millions wager, their prize is increased by the Megaplier number drawn and they can win up to $5 million. Beginning October 19, 2013, the Mega 26 Lottery Winnings-Looks Can Be Deceptive 27 Millions prize matrix changed: players select from two pools of num- bers, five white ball with numbers between 1 and 75, and one gold mega balls number between 1 and 15 for a chance to win a multimillion-dollar jackpot prize. The jackpot starts at $15 million and is guaranteed to increase $5 million with every time it rolls. This game offers a second prize of $1 million and nine ways to win with guaranteed prize amounts at lower prize levels. Drawings are conducted twice a week on Tuesday and Friday. Powerball is another multi-state draw game in which Michigan Lottery participates. It is considered nationally to be the "marquee big jackpot game." It was introduced on January 31, 2010. Players select 5 of 59 white balls and 1 of 39 red balls for a chance to win a multimillion-dollar jackpot. On January 15, 2012, the Powerball game was reintroduced at a $2 price point, with jackpots starting at $40 million. This game offers nine ways to win, with guaranteed prize amounts on lower prize levels, and includes a $1 million second prize. Drawings are conducted twice a week on Wednesday and Saturday. Power Play is an add-on game to Powerball, with a fixed prize-structure that includes prizes ranging from $8 to $2 million. A total of 47 member lotteries, Mega Millions and MUSL members partici- pate in the Powerball game with Michigan. Case o In January 2016, the record-shattering Powerball jackpot amounting to $1.5864 billion was won by three ticket holders, John and Lisa Robinson, Maureen Smith, and Mae and Marvin Acosta. Each winner was awarded a nominal sum of $528.8 million. The Michigan Lottery can pay Powerball and Mega Millions jackpot winnings in one of two ways: as an annuity or in one lump-sum/cash-option payment for the present cash value of the jackpot share. When a winner selects annuity payments, the jackpot is paid out in equal installments over 30 years. When a winner selects the cash option, the Lottery pays the winner the present cash value of the announced jackpot in one lump-sum payment. In effect, the Lottery takes all of the money that would have been invested to fund the 30-year annuity and turns it all over to the winner, retaining absolutely none of the prize. All three winners of the January 2016 Powerball jackpot opted to take a cash-option payment amounting to $327.8 million per ticket. Regardless of which option the winner selects, the Michigan Lottery is required by law to withhold estimated income taxes for federal (25%) and state (4.9%) on any prize over $5,000. These amounts are estimates only, and the winner is required to satisfy any further tax liability for the year in which the prize award is claimed. SAMSUNG SHOL U WILLY Questions: Total Lottery Ticket Sales Net Revenue to Aid Education Retailer Commissions Prizes to Players LUVIW um wwwpor Table 1 Totals: 1972 Start-up through FY 2015* *http://www.michiganlottery.com/about_us?#financial $57.84 billion $19.57 billion $ 3.77 billion $31.58 billion Retailer Commissions Prizes to Players "http://www.michiganlottery.com/about_us?#financial Questions: $ 3.77 billion $31.58 billion 1. If you were one of the three winners of the 2016 Powerball jackpot, which option would you select? Why? 2. If you decide to select the annuity option, how much money would you receive each year after taxes? 3. What discount rate is the Powerball lottery using when decid- ing to pay a lump sum of $327.8 million to each of the three winning ticket holders? 4. Is the State of Michigan justified in advertising the prize amount as $1.586 billion? Explain.

Step by Step Solution

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 If you were one of the winners which option would you select Why Most winners would select ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started