Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Louis works at XZY Incorporated as a finance manager. Karen, his supervisor, is considering making a new investment. Karen wants the weighted average cost

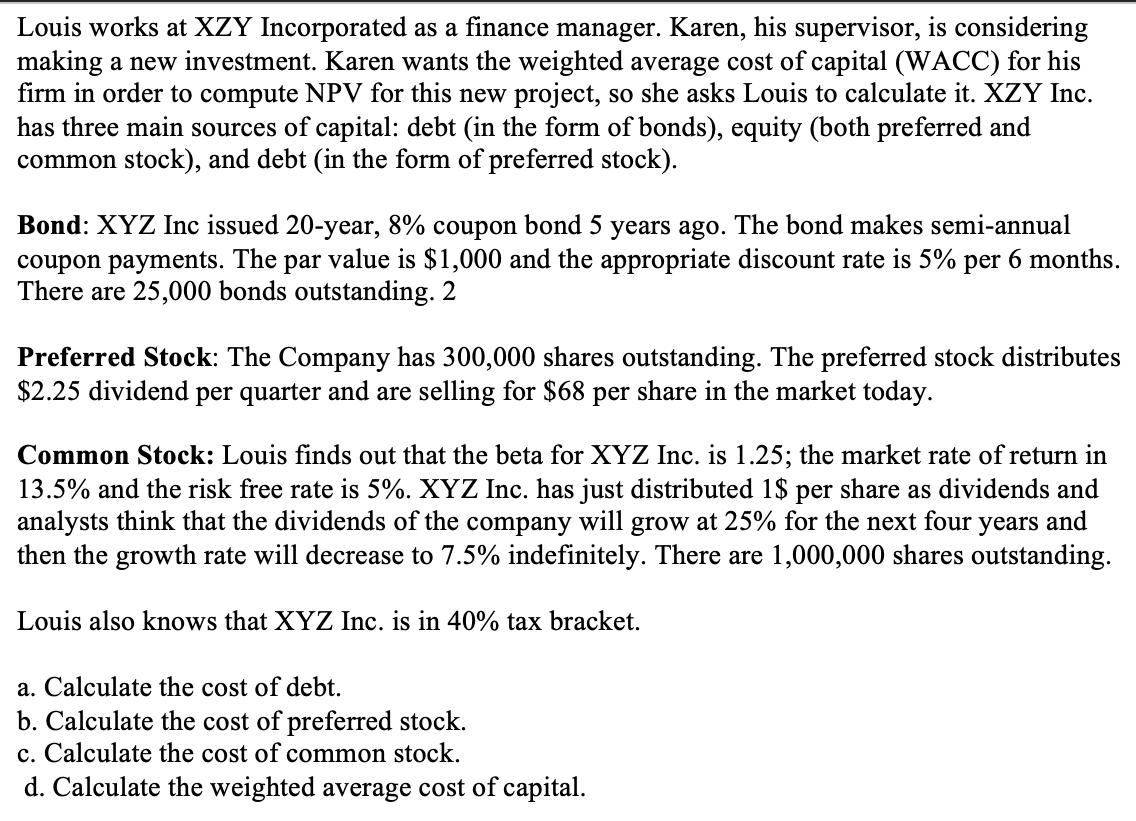

Louis works at XZY Incorporated as a finance manager. Karen, his supervisor, is considering making a new investment. Karen wants the weighted average cost of capital (WACC) for his firm in order to compute NPV for this new project, so she asks Louis to calculate it. XZY Inc. has three main sources of capital: debt (in the form of bonds), equity (both preferred and common stock), and debt (in the form of preferred stock). Bond: XYZ Inc issued 20-year, 8% coupon bond 5 years ago. The bond makes semi-annual coupon payments. The par value is $1,000 and the appropriate discount rate is 5% per 6 months. There are 25,000 bonds outstanding. 2 Preferred Stock: The Company has 300,000 shares outstanding. The preferred stock distributes $2.25 dividend per quarter and are selling for $68 per share in the market today. Common Stock: Louis finds out that the beta for XYZ Inc. is 1.25; the market rate of return in 13.5% and the risk free rate is 5%. XYZ Inc. has just distributed 1$ per share as dividends and analysts think that the dividends of the company will grow at 25% for the next four years and then the growth rate will decrease to 7.5% indefinitely. There are 1,000,000 shares outstanding. Louis also knows that XYZ Inc. is in 40% tax bracket. a. Calculate the cost of debt. b. Calculate the cost of preferred stock. c. Calculate the cost of common stock. d. Calculate the weighted average cost of capital.

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the weighted average cost of capital WACC for XYZ Inc we need to determine the cost of debt cost of preferred stock cost of common stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started