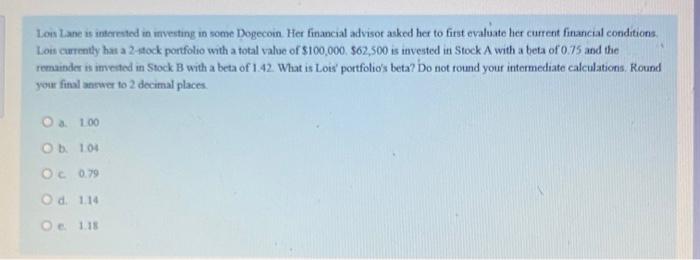

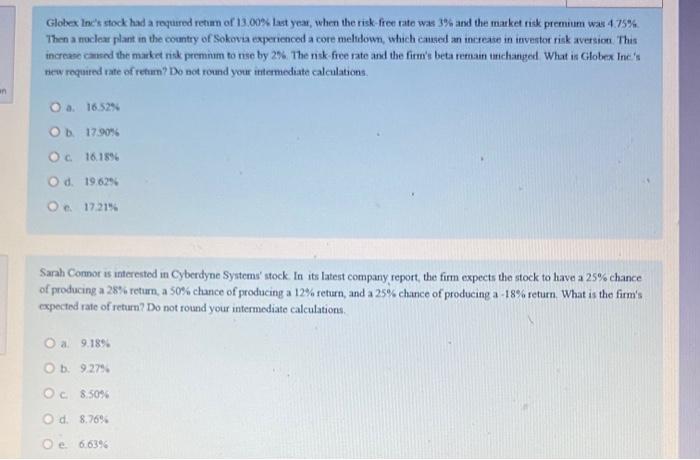

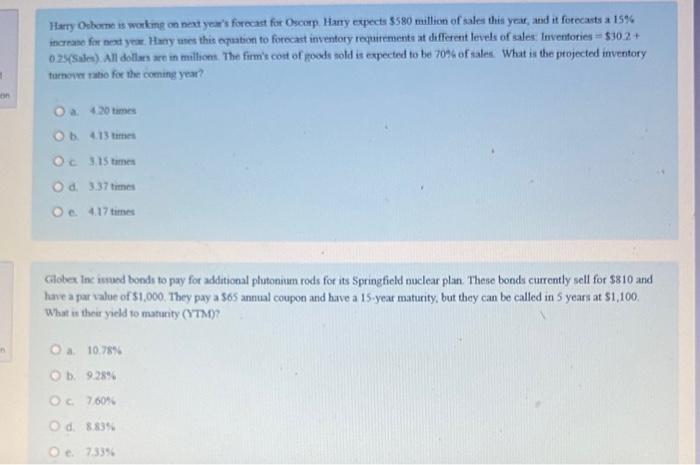

Low Lane is interrsted in urvesting in some Dogecoin. Her financial advisor auked her to first evaluate her current financial conditions. Lous carrently har a 2 -4tock portfolio with a total value of $100,000,$62,500 is invested in Stock A with a beta of 0.75 and the remainder is imested in Stock B with a beta of 1.42. What is Lois' portfolio's beta? Do not round your intermediate calculations. Round your fimal answer to 2 decimal places. a. 1.00 b. 104 c. 079 d. 1.14 c. 1.18 Globex Inc's stock had a royurred retam of 13.00% last yea, when the risk-free rate was 3% and the market riak premum was 4.75% Then a noclear plant in the country of Sokova experienced a core melidown, which cased an increase in ievertor risk aversion. This increase cansed the makket nik premnm to nse by 2%. The nisk-free rate and the firm's beta remain urichanged What is Globex Inc's new required rate of retum? Do not round your ititemediate calculations. a. 16.524 b. 17900% c. 16.15% d. 1962% c. 17.21% Sarah Comor is interested in Cyberdyne Systems' stock. In its latest company report, the firm expects the stock to have a 25% chance of producing a 28%% return, a 50% chance of producing a 12% feturn, and a 25% chance of producing a 18% return. What is the firm's expected rate of return? Do not round your intermediate calculations. (a. 9.18% b. 9275 : c. 8.50% d. 8.76% e. 6.6396 Harry Ophome is working on next year's forecast for Oscap. Hany expects 5580 million of sales this year, and it forecarts a 15% increase for box year. Hany utes thic equaben to forecast inventory requirments at different levels of ales: Inventories =$302+ 0.25(Sales) All dollms are in mullions. The firm's cost of goods sold is expected to be 70sh of sales. What is the projected inveritory turnovr tabo for the coming yea? a. 420 times b. 4.13 turnet c 3,15 tamet d. 3.37 times e. 4.17 times cilobex inc isuad bonds to pay for additional phutonium rods for its Springfield nuclear plan. These bonds currently sell for $810 and have a par value of 51,000 . They pay a $65 annual coupon and have a 15 -year maturity, but they can be called in 5 years at $1,100. What in their yeld to maturity (YTM)? a. 1078% b. 928% (c. 7.60% d. 8.83% e. 7.39%