Question

Low Nail Co. now reports the following data: Annual demand increased to 2,200 kegs per year Inventory carrying costs has increased to $1.52 per keg

Low Nail Co. now reports the following data:

Annual demand increased to 2,200 kegs per year

Inventory carrying costs has increased to $1.52 per keg

Order processing costs are now only $52.00 per order

Inflation has raised interest to 1.3% per month and kegs to a cost of $42.00 each

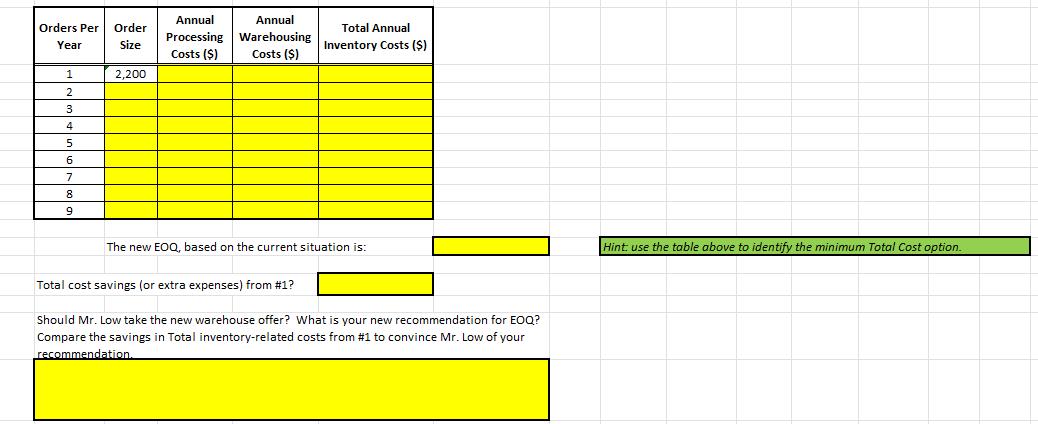

Taking into account all the factors listed in Questions 1, 2, 3, and 5, calculate Low’s EOQ for kegs of nails. Given the new Cost of Capital, should Mr. Low still take t rebate and new warehouse offer? How much do these now save him? he supplier Which of these 6 EOQs Murphy, P . are correct? What is your final recommendation to Mr. Low?

Orders Per Order Year Size 1 2 3 4 5 6 7 8 9 2,200 Annual Processing Costs ($) Annual Warehousing Costs ($) Total Annual Inventory Costs (S) The new EOQ, based on the current situation is: Total cost savings (or extra expenses) from #1? Should Mr. Low take the new warehouse offer? What is your new recommendation for EOQ? Compare the savings in Total inventory-related costs from #1 to convince Mr. Low of your recommendation. Hint use the table above to identify the minimum Total Cost option.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets calculate the EOQ with the new information provided Annual demand is 2200 kegs Inventory c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started