Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lowell Company is considering adding a robotic paint sprayer to the production line. The prayer's base price is $100,000, and it would cost another

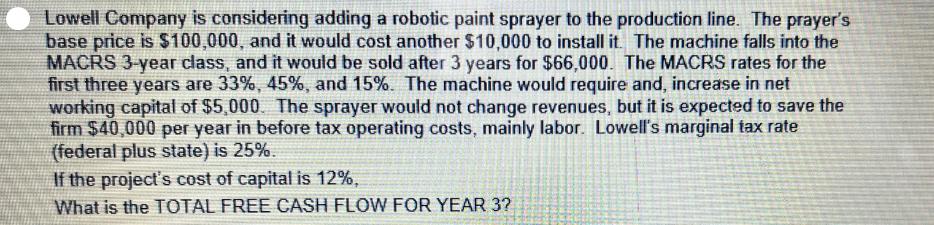

Lowell Company is considering adding a robotic paint sprayer to the production line. The prayer's base price is $100,000, and it would cost another $10,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $66,000. The MACRS rates for the first three years are 33%, 45%, and 15%. The machine would require and, increase in net working capital of $5,000. The sprayer would not change revenues, but it is expected to save the firm $40,000 per year in before tax operating costs, mainly labor. Lowell's marginal tax rate (federal plus state) is 25%. If the project's cost of capital is 12%, What is the TOTAL FREE CASH FLOW FOR YEAR 3? Lowell Inc. has $2 million in inventory and $5 million in accounts receivable. Its average daily sales are $100.000 and daily purchases are $50,000. The company's payables deferral period (accounts payable divided by daily purchases) is 40 days. What is the length of the company's cash conversion cycle? Lowell Company is considering adding a robotic paint sprayer to the production line. The prayer's base price is $100,000, and it would cost another $10,000 to install it. The machine falls into the MACRS 3-year class, and it would be sold after 3 years for $66,000. The MACRS rates for the first three years are 33%, 45%, and 15%. The machine would require and, increase in net working capital of $5,000. The sprayer would not change revenues, but it is expected to save the firm $40,000 per year in before tax operating costs, mainly labor. Lowell's marginal tax rate (federal plus state) is 25%. If the project's cost of capital is 12%, What is the TOTAL FREE CASH FLOW FOR YEAR 3? Lowell Inc. has $2 million in inventory and $5 million in accounts receivable. Its average daily sales are $100.000 and daily purchases are $50,000. The company's payables deferral period (accounts payable divided by daily purchases) is 40 days. What is the length of the company's cash conversion cycle?

Step by Step Solution

★★★★★

3.35 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

First problem To calculate the total free cash flow for Year 3 we have to consider the cash inflows and outflows associated with the project and the j...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started