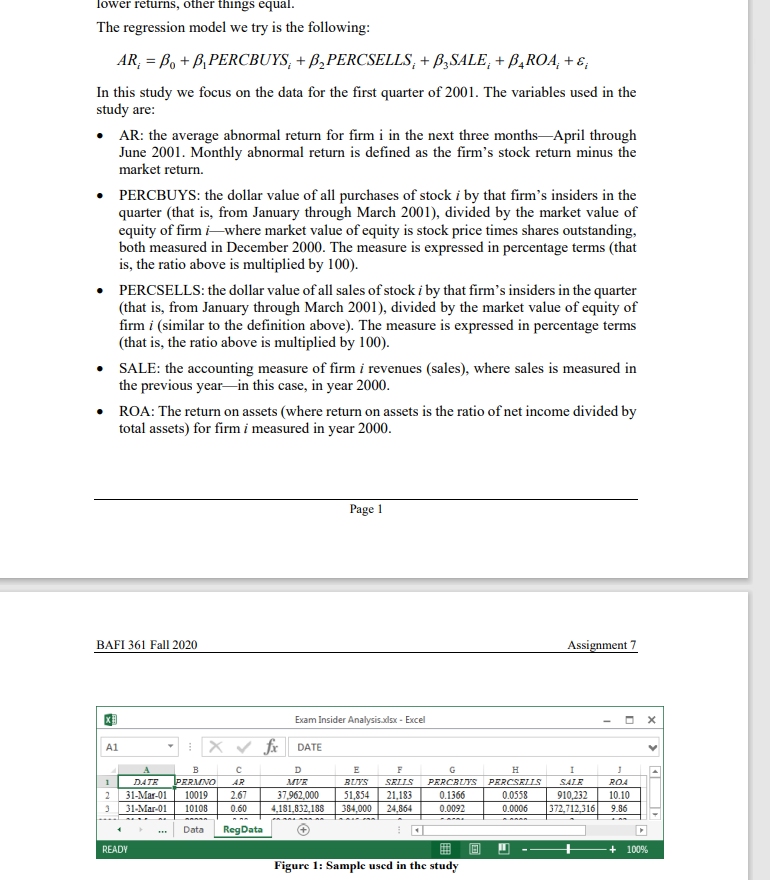

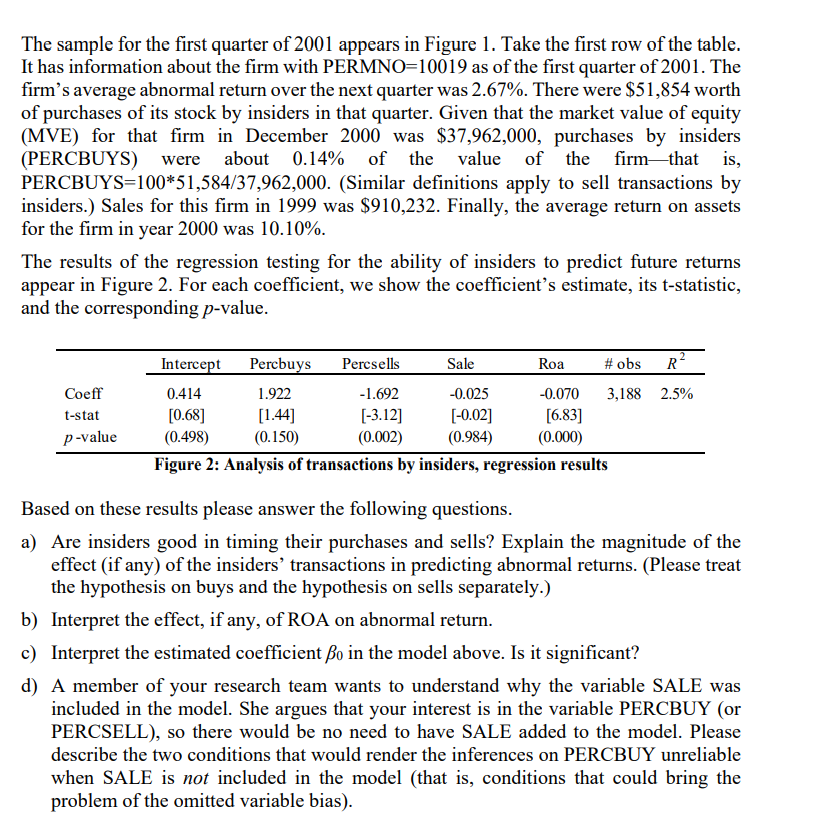

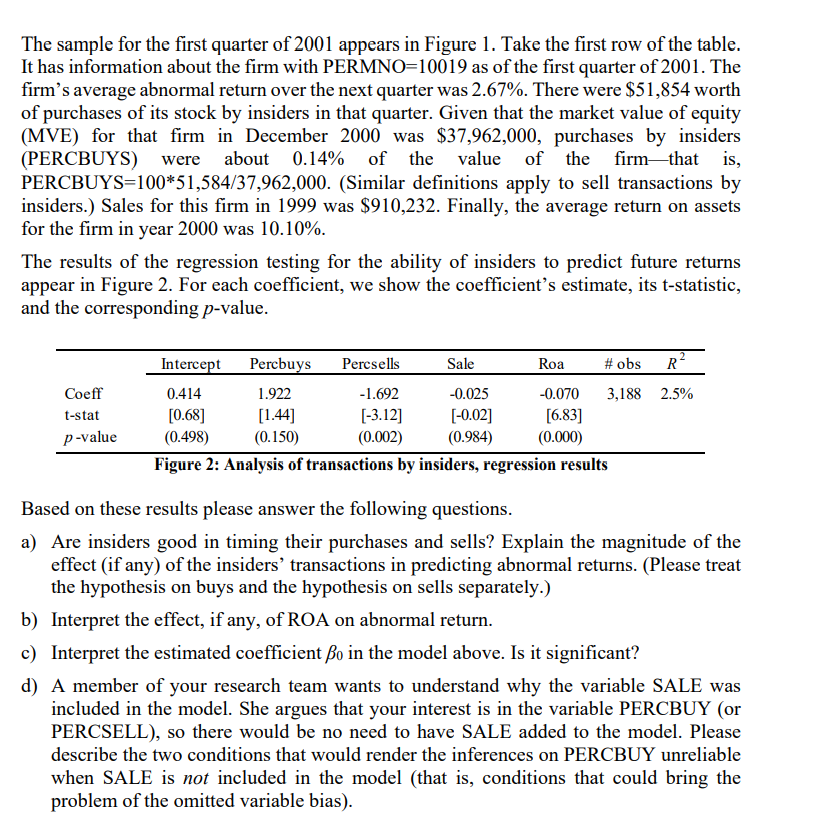

lower returns, other things equal. The regression model we try is the following: AR, = Be + B,PERCBUYS+B_PERCSELLS; + B,SALE; +B_RO, + &; In this study we focus on the data for the first quarter of 2001. The variables used in the study are: AR: the average abnormal return for firm i in the next three monthsApril through June 2001. Monthly abnormal return is defined as the firm's stock return minus the market return PERCBUYS: the dollar value of all purchases of stock i by that firm's insiders in the quarter (that is, from January through March 2001), divided by the market value of equity of firm iwhere market value of equity is stock price times shares outstanding, both measured in December 2000. The measure is expressed in percentage terms (that is, the ratio above is multiplied by 100). PERCSELLS: the dollar value of all sales of stock i by that firm's insiders in the quarter (that is, from January through March 2001), divided by the market value of equity of firm i (similar to the definition above). The measure is expressed in percentage terms (that is, the ratio above is multiplied by 100). SALE: the accounting measure of firm i revenues (sales), where sales is measured in the previous yearin this case, in year 2000. ROA: The return on assets (where return on assets is the ratio of net income divided by total assets) for firm i measured in year 2000. Page 1 BAFI 361 Fall 2020 Assignment 7 Exam Insider Analysis.adsx - Excel -- A1 DATE 1 2 3 DATE 31-Mar-01 31-Mar-01 B PERMINO 10019 10108 2.67 0.60 D MVE 37,962,000 4,181,832,188 E BUYS 51,854 384.000 F SELLS 21,183 24,864 PERCBUYS 0.1366 0.0092 H PERCSELLS 0.0558 0.0006 SALE 910,232 372,712 316 RO4 10.10 9.86 Data Reg Data READY - + 100% Figure 1: Sample used in the study The sample for the first quarter of 2001 appears in Figure 1. Take the first row of the table. It has information about the firm with PERMNO=10019 as of the first quarter of 2001. The firm's average abnormal return over the next quarter was 2.67%. There were $51,854 worth of purchases of its stock by insiders in that quarter. Given that the market value of equity (MVE) for that firm in December 2000 was $37,962,000, purchases by insiders (PERCBUYS) were about 0.14% of the value of the firm that is, PERCBUYS=100*51,584/37,962,000. (Similar definitions apply to sell transactions by insiders.) Sales for this firm in 1999 was $910,232. Finally, the average return on assets for the firm in year 2000 was 10.10%. The results of the regression testing for the ability of insiders to predict future returns appear in Figure 2. For each coefficient, we show the coefficients estimate, its t-statistic, and the corresponding p-value. Coeff t-stat p-value Intercept Percbuys Percsells Sale Roa #obs R? 0.414 1.922 -1.692 -0.025 -0.070 3,188 2.5% [0.68] [1.44] [-3.12] [-0.02] [6.83] (0.498) (0.150) (0.002) (0.984) (0.000) Figure 2: Analysis of transactions by insiders, regression results Based on these results please answer the following questions. a) Are insiders good in timing their purchases and sells? Explain the magnitude of the effect (if any) of the insiders' transactions in predicting abnormal returns. (Please treat the hypothesis on buys and the hypothesis on sells separately.) b) Interpret the effect, if any, of ROA on abnormal return. c) Interpret the estimated coefficient o in the model above. Is it significant? d) A member of your research team wants to understand why the variable SALE was included in the model. She argues that your interest is in the variable PERCBUY (or PERCSELL), so there would be no need to have SALE added to the model. Please describe the two conditions that would render the inferences on PERCBUY unreliable when SALE is not included in the model (that is, conditions that could bring the problem of the omitted variable bias). lower returns, other things equal. The regression model we try is the following: AR, = Be + B,PERCBUYS+B_PERCSELLS; + B,SALE; +B_RO, + &; In this study we focus on the data for the first quarter of 2001. The variables used in the study are: AR: the average abnormal return for firm i in the next three monthsApril through June 2001. Monthly abnormal return is defined as the firm's stock return minus the market return PERCBUYS: the dollar value of all purchases of stock i by that firm's insiders in the quarter (that is, from January through March 2001), divided by the market value of equity of firm iwhere market value of equity is stock price times shares outstanding, both measured in December 2000. The measure is expressed in percentage terms (that is, the ratio above is multiplied by 100). PERCSELLS: the dollar value of all sales of stock i by that firm's insiders in the quarter (that is, from January through March 2001), divided by the market value of equity of firm i (similar to the definition above). The measure is expressed in percentage terms (that is, the ratio above is multiplied by 100). SALE: the accounting measure of firm i revenues (sales), where sales is measured in the previous yearin this case, in year 2000. ROA: The return on assets (where return on assets is the ratio of net income divided by total assets) for firm i measured in year 2000. Page 1 BAFI 361 Fall 2020 Assignment 7 Exam Insider Analysis.adsx - Excel -- A1 DATE 1 2 3 DATE 31-Mar-01 31-Mar-01 B PERMINO 10019 10108 2.67 0.60 D MVE 37,962,000 4,181,832,188 E BUYS 51,854 384.000 F SELLS 21,183 24,864 PERCBUYS 0.1366 0.0092 H PERCSELLS 0.0558 0.0006 SALE 910,232 372,712 316 RO4 10.10 9.86 Data Reg Data READY - + 100% Figure 1: Sample used in the study The sample for the first quarter of 2001 appears in Figure 1. Take the first row of the table. It has information about the firm with PERMNO=10019 as of the first quarter of 2001. The firm's average abnormal return over the next quarter was 2.67%. There were $51,854 worth of purchases of its stock by insiders in that quarter. Given that the market value of equity (MVE) for that firm in December 2000 was $37,962,000, purchases by insiders (PERCBUYS) were about 0.14% of the value of the firm that is, PERCBUYS=100*51,584/37,962,000. (Similar definitions apply to sell transactions by insiders.) Sales for this firm in 1999 was $910,232. Finally, the average return on assets for the firm in year 2000 was 10.10%. The results of the regression testing for the ability of insiders to predict future returns appear in Figure 2. For each coefficient, we show the coefficients estimate, its t-statistic, and the corresponding p-value. Coeff t-stat p-value Intercept Percbuys Percsells Sale Roa #obs R? 0.414 1.922 -1.692 -0.025 -0.070 3,188 2.5% [0.68] [1.44] [-3.12] [-0.02] [6.83] (0.498) (0.150) (0.002) (0.984) (0.000) Figure 2: Analysis of transactions by insiders, regression results Based on these results please answer the following questions. a) Are insiders good in timing their purchases and sells? Explain the magnitude of the effect (if any) of the insiders' transactions in predicting abnormal returns. (Please treat the hypothesis on buys and the hypothesis on sells separately.) b) Interpret the effect, if any, of ROA on abnormal return. c) Interpret the estimated coefficient o in the model above. Is it significant? d) A member of your research team wants to understand why the variable SALE was included in the model. She argues that your interest is in the variable PERCBUY (or PERCSELL), so there would be no need to have SALE added to the model. Please describe the two conditions that would render the inferences on PERCBUY unreliable when SALE is not included in the model (that is, conditions that could bring the problem of the omitted variable bias)