Question

Lowes is required by law to collect and send sales taxes to the state. If Lowes has $87,000 of cash sales that are subject

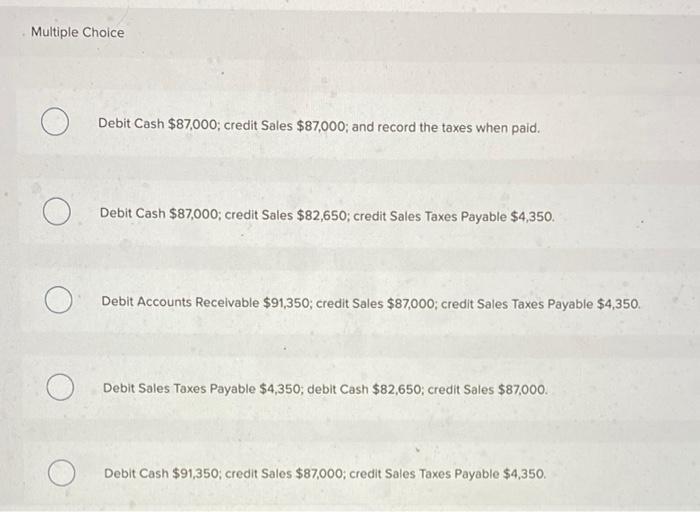

Lowes is required by law to collect and send sales taxes to the state. If Lowes has $87,000 of cash sales that are subject to a 5% sales tax, what is the journal entry to record the cash sales? Multiple Choice O O Debit Cash $87,000; credit Sales $87,000; and record the taxes when paid. Debit Cash $87,000; credit Sales $82,650; credit Sales Taxes Payable $4,350. Debit Accounts Receivable $91,350; credit Sales $87,000; credit Sales Taxes Payable $4,350. Debit Sales Taxes Payable $4,350; debit Cash $82,650; credit Sales $87,000. Debit Cash $91,350; credit Sales $87,000; credit Sales Taxes Payable $4,350.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The correct answer is the fourth option Debit Sales Taxes Payable 4350 Debit 82650 Cre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Price theory and applications

Authors: Steven E landsburg

8th edition

538746459, 1133008321, 780538746458, 9781133008323, 978-0538746458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App