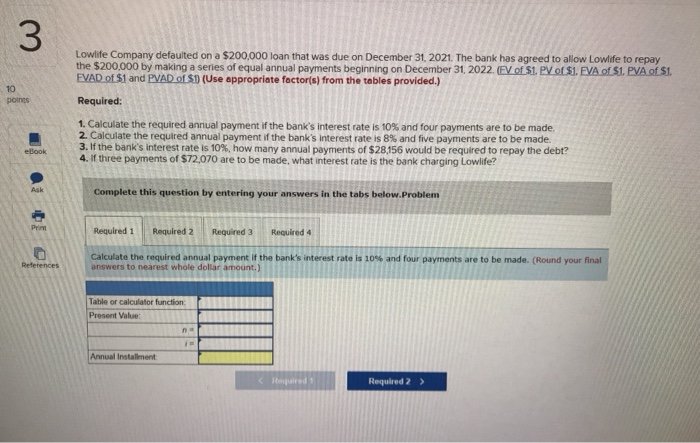

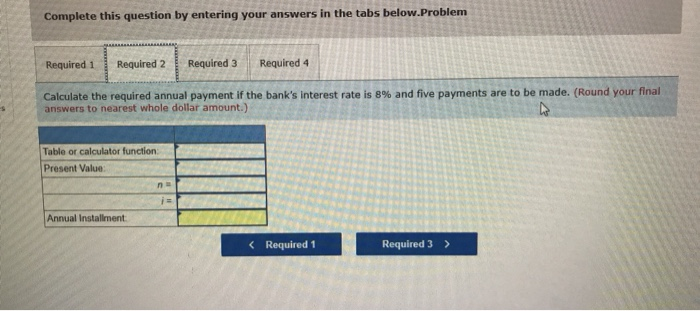

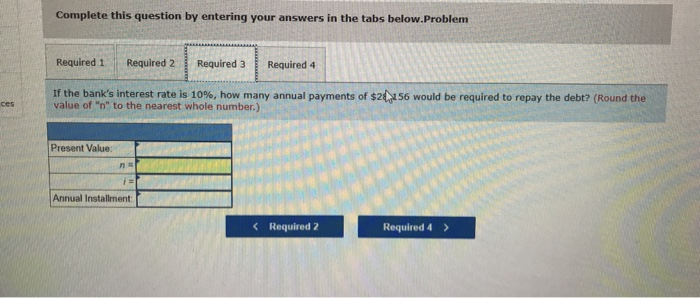

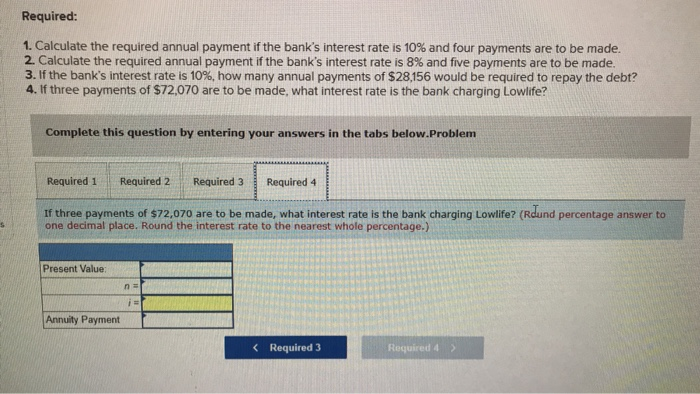

Lowlife Company defaulted on a $200,000 loan that was due on December 31, 2021. The bank has agreed to allow Lowlife to repay the $200.000 by making a series of equal annual payments beginning on December 31, 2022. EVO 51. PV 51. EVA of $1. PVA SI EVAD of $1 and PVAD of SD (Use appropriate factor(s) from the tables provided.) poines Required: 1. Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. 2. Calculate the required annual payment of the bank's interest rate is 8% and five payments are to be made. 3. If the bank's interest rate is 10%, how many annual payments of $28,156 would be required to repay the debt? 4. If three payments of $72,070 are to be made, what interest rate is the bank charging Lowlife? Complete this question by entering your answers in the tabs below.Problem Required 1 Required 2 Required 3 Required 4 Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. (Round your final answers to nearest whole dollar amount.) Table or calculator function Present Value Required 2 > Complete this question by entering your answers in the tabs below.Problem Required 1 Required 2 Required 3 Required 4 Calculate the required annual payment if the bank's Interest rate is 8% and five payments are to be made. (Round your final answers to nearest whole dollar amount.) Table or calculator function Present Value Annual Installment Complete this question by entering your answers in the tabs below.Problem Required 1 Required 2 Required 3 Required 4 If the bank's interest rate is 10%, how many annual payments of $23456 would be required to repay the debt? (Round the value of "n" to the nearest whole number.) Present Value: Annual Installment Required: 1. Calculate the required annual payment if the bank's interest rate is 10% and four payments are to be made. 2. Calculate the required annual payment if the bank's interest rate is 8% and five payments are to be made. 3. If the bank's interest rate is 10%, how many annual payments of $28,156 would be required to repay the debt? 4. If three payments of $72,070 are to be made, what interest rate is the bank charging Lowlife? Complete this question by entering your answers in the tabs below.Problem Required 1 Required 2 Required 3 Required 4 If three payments of $72,070 are to be made, what interest rate is the bank charging Lowlife? (Rdund percentage answer to one decimal place. Round the interest rate to the nearest whole percentage.) Present Value: Annuity Payment