LP's Design & Hardware Ltd. had the following Balance Sheet & Income Statement activity during the August 31 2021 fiscal year-ended: Net income Depreciation

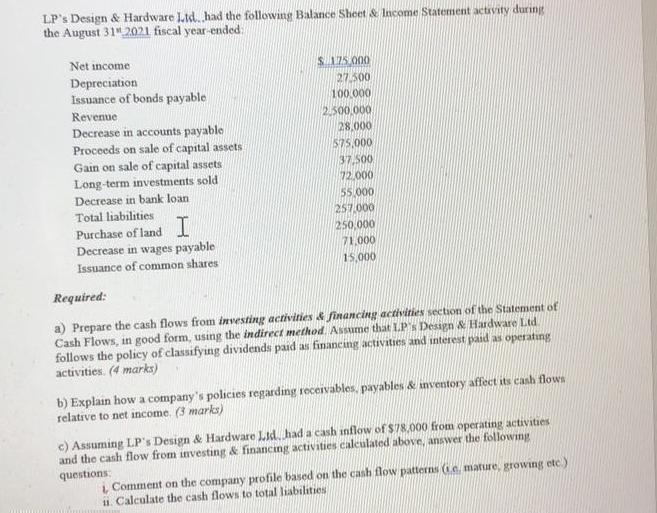

LP's Design & Hardware Ltd. had the following Balance Sheet & Income Statement activity during the August 31 2021 fiscal year-ended: Net income Depreciation Issuance of bonds payable Revenue Decrease in accounts payable Proceeds on sale of capital assets Gain on sale of capital assets Long-term investments sold Decrease in bank loan Total liabilities Purchase of land Decrease in wages payable Issuance of common shares $ 175,000 27.500 100,000 2.500,000 28,000 575,000 37.500 72,000 55,000 257,000 250,000 71,000 15,000 Required: a) Prepare the cash flows from investing activities & financing activities section of the Statement of Cash Flows, in good form, using the indirect method. Assume that LP's Design & Hardware Ltd. follows the policy of classifying dividends paid as financing activities and interest paid as operating activities. (4 marks) b) Explain how a company's policies regarding receivables, payables & inventory affect its cash flows relative to net income. (3 marks) c) Assuming LP's Design & Hardware Ltd. had a cash inflow of $78,000 from operating activities and the cash flow from investing & financing activities calculated above, answer the following questions: i, Comment on the company profile based on the cash flow patterns (ie, mature, growing etc.) ii. Calculate the cash flows to total liabilities,

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a LPs Design Hardware Cash Flow from Investing Activit...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started