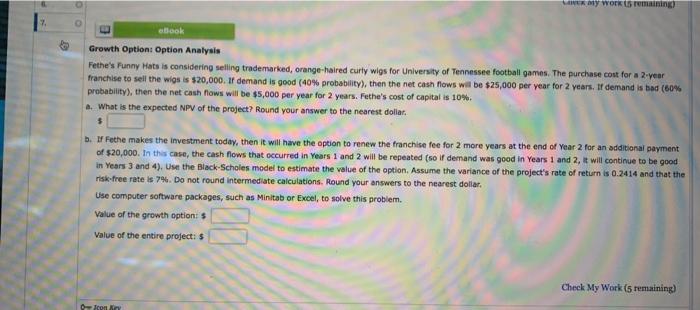

LR MY WOER to remaining ebook Growth Option: Option Analysis Fethe's Funny Hats is considering selling trademarked, orange-haired curty wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $25,000 per year for 2 years. If demand is had (60% probability), then the net cash flows will be $5,000 per year for 2 years. Fethe's cost of capital is 10%. . What is the expected NPV of the project? Round your answer to the nearest dollar b. Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this case, the cash flows that occurred in Years 1 and 2 will be repeated (so If demand was good in Years 1 and 2, it will continue to be good in Years 3 and 4). Use the Black-Scholes model to estimate the value of the option. Assume the variance of the project's rate of return is 0.2414 and that the risk-free rate is 7%. Do not round Intermediate calculations. Round your answers to the nearest dollar Use computer software packages, such as Minitab or Excel, to solve this problem. Value of the growth option: Value of the entire project: Check My Work (5 remaining) Icon LR MY WOER to remaining ebook Growth Option: Option Analysis Fethe's Funny Hats is considering selling trademarked, orange-haired curty wigs for University of Tennessee football games. The purchase cost for a 2-year franchise to sell the wigs is $20,000. If demand is good (40% probability), then the net cash flows will be $25,000 per year for 2 years. If demand is had (60% probability), then the net cash flows will be $5,000 per year for 2 years. Fethe's cost of capital is 10%. . What is the expected NPV of the project? Round your answer to the nearest dollar b. Fethe makes the investment today, then it will have the option to renew the franchise fee for 2 more years at the end of Year 2 for an additional payment of $20,000. In this case, the cash flows that occurred in Years 1 and 2 will be repeated (so If demand was good in Years 1 and 2, it will continue to be good in Years 3 and 4). Use the Black-Scholes model to estimate the value of the option. Assume the variance of the project's rate of return is 0.2414 and that the risk-free rate is 7%. Do not round Intermediate calculations. Round your answers to the nearest dollar Use computer software packages, such as Minitab or Excel, to solve this problem. Value of the growth option: Value of the entire project: Check My Work (5 remaining) Icon