Answered step by step

Verified Expert Solution

Question

1 Approved Answer

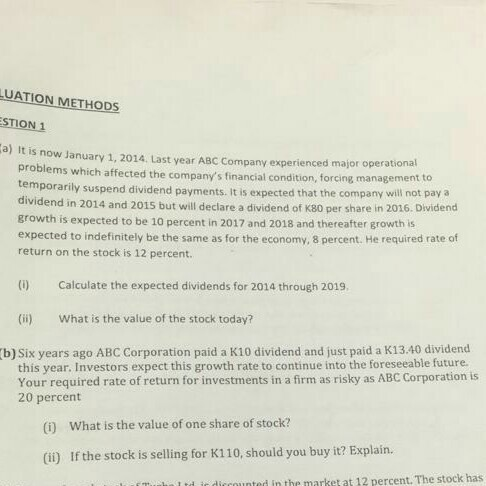

LUATION METHODS ESTION 1 a) It is now January 1, 2014. Last year ABC Company experienced major operational problems which affected the company's financial condition,

LUATION METHODS ESTION 1 a) It is now January 1, 2014. Last year ABC Company experienced major operational problems which affected the company's financial condition, forcing management to temporarily suspend dividend payments. It is expected that the company will not pay a dividend in 2014 and 2015 but will declare a dividend of K80 per share in 2016. Dividend growth is expected to be 10 percent in 2017 and 2018 and thereafter growth is expected to indefinitely be the same as for the economy, 8 percent. He required rate of return on the stock is 12 percent. (i) Calculate the expected dividends for 2014 through 2019. (ii) What is the value of the stock today? b) Six years ago ABC Corporation paid a K10 dividend and just paid a K13.40 dividend this year. Investors expect this growth rate to continue into the foreseeable future. Your required rate of return for investments in a firm as risky as ABC Corporation is 20 percent What is the value of one share of stock? () (ii) If the stock is selling for K110, should you buy it? Explain. diccounted in the market at 12 percent. The stock has I td

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started