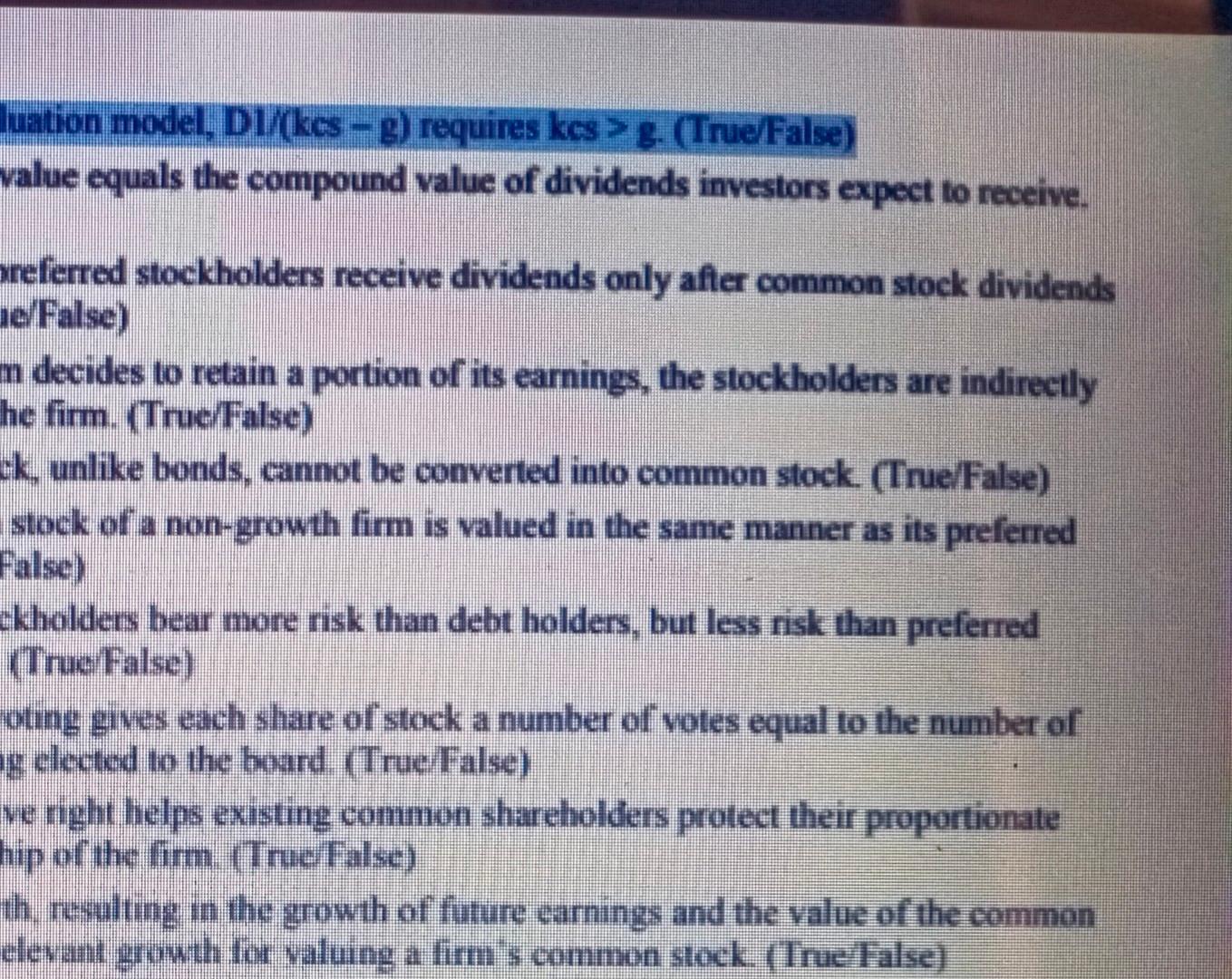

Question: luation model, Di/kes-g) requires kes > g. (True/False) value equals the compound value of dividends investors expect to receive. preferred stockholders receive dividends only after

luation model, Di/kes-g) requires kes > g. (True/False) value equals the compound value of dividends investors expect to receive. preferred stockholders receive dividends only after common stock dividends ne/False) m decides to retain a portion of its earnings, the stockholders are indirectly he fimm. (True/False) ck, unlike bonds, cannot be converted into common stock. (True/False) stock of a non-growth firm is valued in the same manner as its preferred ckholders bear more risk than debt holders, but less risk than preferred (True False) oting gives each share of stock a number of votes equal to the number of og elected to the board (True False) ve nght helps existing common shareholders protect their proportionate hip of the fimm (TrueFalse) th, resulting in the growth of future carnings and the value of the common elevant growth for valuing a firm's common stock. (True False) luation model, Di/kes-g) requires kes > g. (True/False) value equals the compound value of dividends investors expect to receive. preferred stockholders receive dividends only after common stock dividends ne/False) m decides to retain a portion of its earnings, the stockholders are indirectly he fimm. (True/False) ck, unlike bonds, cannot be converted into common stock. (True/False) stock of a non-growth firm is valued in the same manner as its preferred ckholders bear more risk than debt holders, but less risk than preferred (True False) oting gives each share of stock a number of votes equal to the number of og elected to the board (True False) ve nght helps existing common shareholders protect their proportionate hip of the fimm (TrueFalse) th, resulting in the growth of future carnings and the value of the common elevant growth for valuing a firm's common stock. (True False)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts