Question

Lucas has $2,000 that he wishes to invest for one year. He has narrowed his choices down to one of the following two actions: a1:

Lucas has $2,000 that he wishes to invest for one year. He has narrowed his choices down to one of the following two actions:

a1: Buy bonds of X Ltd., a company that has a very high debtequity ratio. These bonds pay 8% interest, unless X defaults, in which case Lucas will receive no interest but will recover his principal.

a2: Buy Government Savings Bonds, paying 3% interest.

Lucas assesses his prior probability of X Ltd. defaulting as 0.45, and of the savings bonds defaulting as zero. His utility for money is given by the square root of the amount of his net payoff. Lucas is a rational decision maker.

Required

Based on his prior probabilities, which action should Lucas take? Show your calculations.

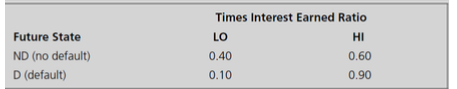

Before making a final decision, Lucas decides he needs more information. He obtains X Ltds current financial statements and examines its times-interest-earned ratio. This ratio can be either HI or LO. Upon calculating the ratio, Lucas observes that it is HI. On the basis of his prior experience in bond investments, Lucas knows the following conditional probabilities:

Which action should Lucas now take? Show your calculations, taken to two decimal places.

c. An accounting standard allows X Ltd. to value its property, plant, and equipment at fair value providing this can be done reliably. The company plans to adopt this option, since it will reduce its debtequity ratio. Evaluate (in words only) the likely impact of this adoption on the main diagonal probabilities of the information system in part b.

Future State ND (no default) D (default) Times Interest Earned Ratio LO HI 0.60 0.40 0.10 0.90Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started