Question

Lucas Wagg, trading as Fairlock Fashions, ends his financial year on 31 March. At 1 April 20X5 he had goods in inventory valued at

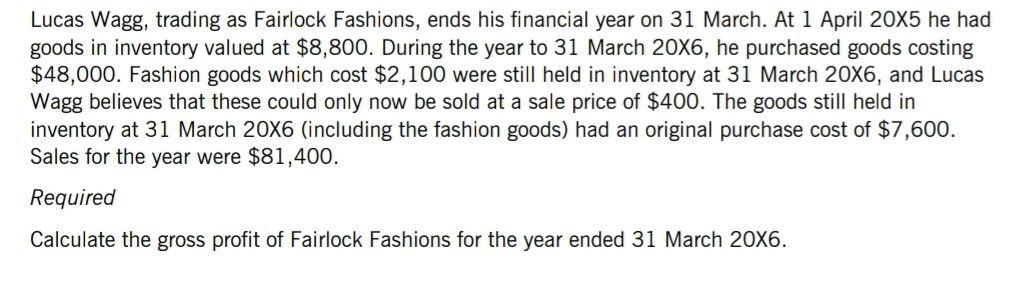

Lucas Wagg, trading as Fairlock Fashions, ends his financial year on 31 March. At 1 April 20X5 he had goods in inventory valued at $8,800. During the year to 31 March 20X6, he purchased goods costing $48,000. Fashion goods which cost $2,100 were still held in inventory at 31 March 20X6, and Lucas Wagg believes that these could only now be sold at a sale price of $400. The goods still held in inventory at 31 March 20X6 (including the fashion goods) had an original purchase cost of $7,600. Sales for the year were $81,400. Required Calculate the gross profit of Fairlock Fashions for the year ended 31 March 20X6.

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Solution Inventory are valued l0 wer of Cost or Net Realisable ralue In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cambridge IGCSE And O Level Accounting Coursebook

Authors: Catherine Coucom

2nd Edition

1316502775, 978-1316502778

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App