Answered step by step

Verified Expert Solution

Question

1 Approved Answer

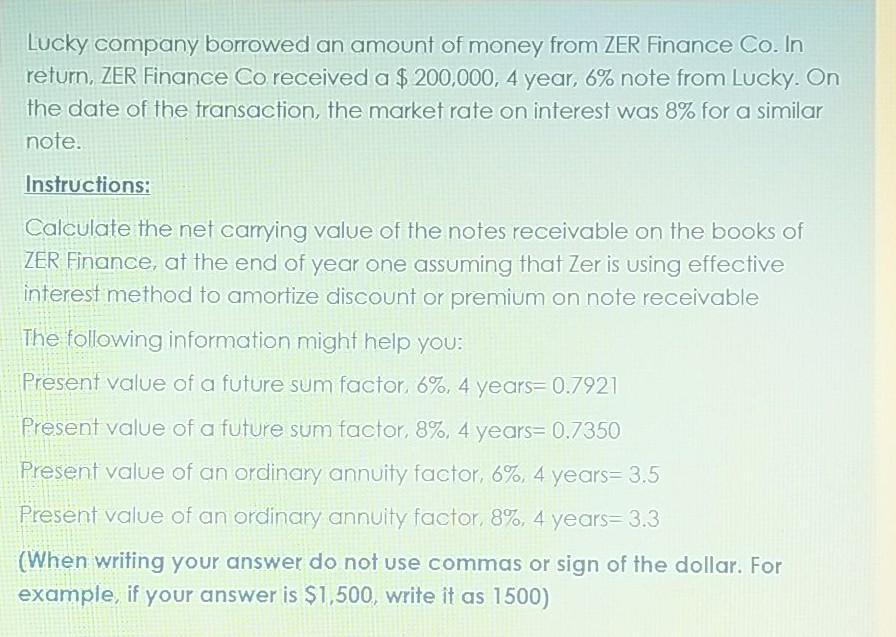

Lucky company borrowed an amount of money from ZER Finance Co. In return, ZER Finance Co received a $ 200,000, 4 year, 6% note

Lucky company borrowed an amount of money from ZER Finance Co. In return, ZER Finance Co received a $ 200,000, 4 year, 6% note from Lucky. On the date of the fransaction, the market rate on interest was 8% for a similar note. Instructions: Calculate the net carying value of the notes receivable on the books of ZER Finance, at the end of year one assuming that Zer is using effective interest method to amortize discount or premium on note receivable The following information might help you: Present value of a future sum factor, 6%, 4 years= 0.7921 Present value of a future sum factor, 8%, 4 years= 0.7350 Present value of an ordinary annuity factor, 6%, 4 years= 3.5 Present value of an ordinary annuity factor, 8%, 4 years=3.3 (When wrifing your answer do not use commas or sign of the dollar. For example, if your answer is $1,500, write it as 1500)

Step by Step Solution

★★★★★

3.49 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started