Answered step by step

Verified Expert Solution

Question

1 Approved Answer

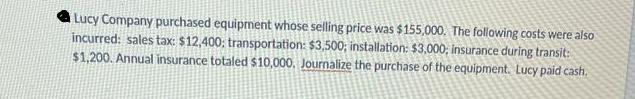

Lucy Company purchased equipment whose selling price was $155,000. The following costs were also incurred: sales tax: $12,400; transportation: $3,500; installation: $3,000, insurance during

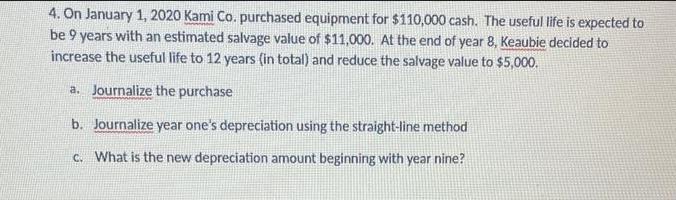

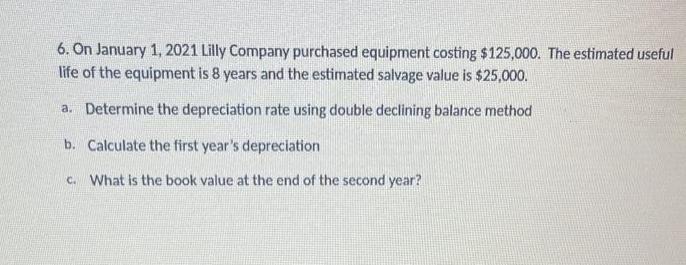

Lucy Company purchased equipment whose selling price was $155,000. The following costs were also incurred: sales tax: $12,400; transportation: $3,500; installation: $3,000, insurance during transit: $1,200. Annual insurance totaled $10,000. Journalize the purchase of the equipment. Lucy paid cash. 4. On January 1, 2020 Kami Co. purchased equipment for $110,000 cash. The useful life is expected to be 9 years with an estimated salvage value of $11,000. At the end of year 8, Keaubie decided to increase the useful life to 12 years (in total) and reduce the salvage value to $5,000. a. Journalize the purchase b. Journalize year one's depreciation using the straight-line method c. What is the new depreciation amount beginning with year nine? 6. On January 1, 2021 Lilly Company purchased equipment costing $125,000. The estimated useful life of the equipment is 8 years and the estimated salvage value is $25,000. a. Determine the depreciation rate using double declining balance method b. Calculate the first year's depreciation c. What is the book value at the end of the second year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Here are the journal entries and calculations for the provided scenarios 1 Lucy Company purchased equipment Equipment Cost 155000 Additional ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started