Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lucy is a single taxpayer, aged 37. Her income consisted of $157,000 from wages, $400 in interest from a certificate of deposit, and $200 in

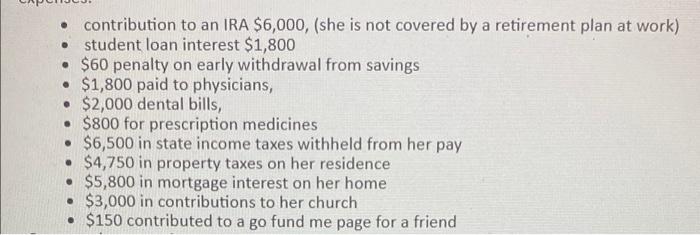

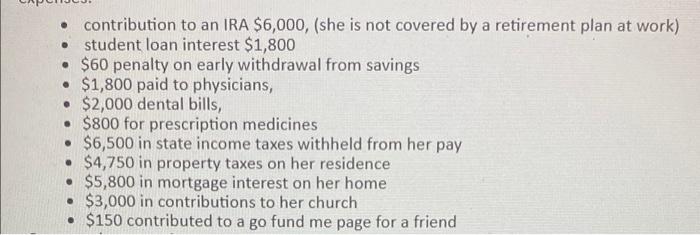

Lucy is a single taxpayer, aged 37. Her income consisted of $157,000 from wages, $400 in interest from a certificate of deposit, and $200 in interest from Texas Turnpike Authority Bonds. she has the following expenses:

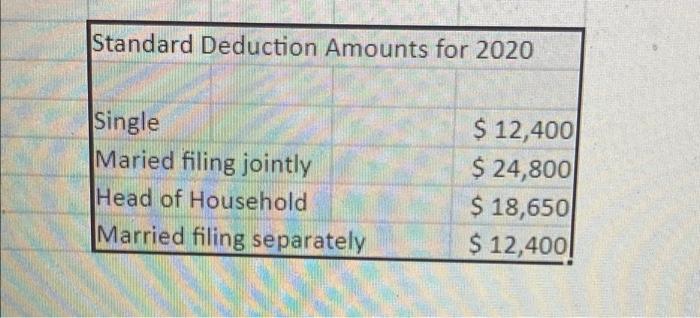

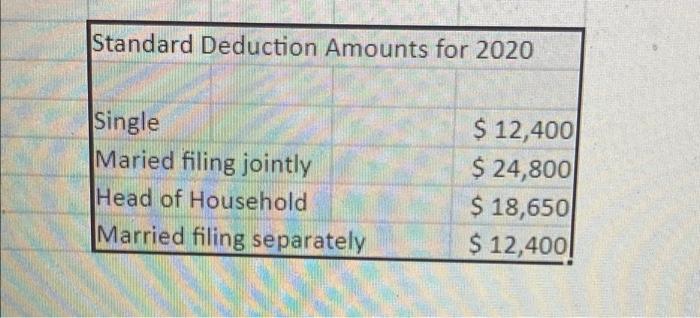

contribution to an IRA $6,000, (she is not covered by a retirement plan at work) student loan interest $1,800 $60 penalty on early withdrawal from savings $1,800 paid to physicians, $2,000 dental bills, $800 for prescription medicines $6,500 in state income taxes withheld from her pay $4,750 in property taxes on her residence $5,800 in mortgage interest on her home $3,000 in contributions to her church $150 contributed to a go fund me page for a friend Standard Deduction Amounts for 2020 Single Maried filing jointly Head of Household Married filing separately $ 12,400 $ 24,800 $ 18,650 $ 12,400 A Compute her gross income

B Compute her adjusted income

C Compute her taxable income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started