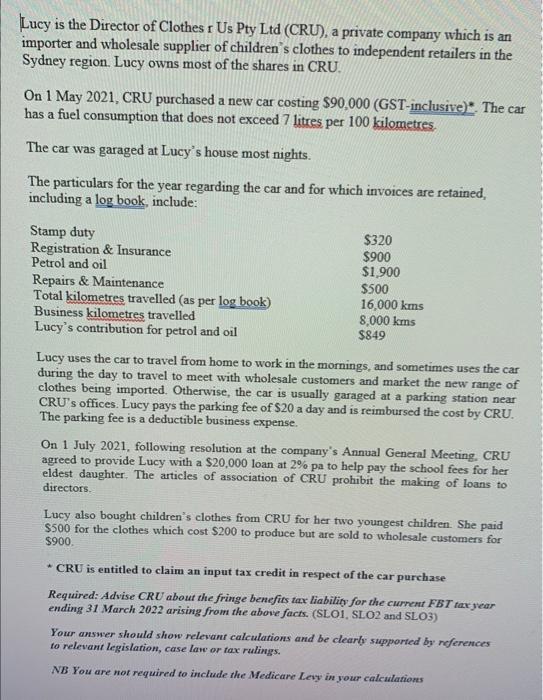

Lucy is the Director of Clothes r Us Pty Ltd (CRU), a private company which is an importer and wholesale supplier of children's clothes to independent retailers in the Sydney region. Lucy owns most of the shares in CRU. On 1 May 2021, CRU purchased a new car costing $90,000 (GST-inclusive)* The car has a fuel consumption that does not exceed 7 litres per 100 kilometres. The car was garaged at Lucy's house most nights. The particulars for the year regarding the car and for which invoices are retained, including a log book, include: Lucy uses the car to travel from home to work in the mornings, and sometimes uses the car during the day to travel to meet with wholesale customers and market the new range of clothes being imported. Otherwise, the car is usually garaged at a parking station near CRU's offices. Lucy pays the parking fee of $20 a day and is reimbursed the cost by CRU. The parking fee is a deductible business expense. On 1 July 2021, following resolution at the company's Annual General Meeting. CRU agreed to provide Lucy with a $20,000 loan at 2% pa to help pay the school fees for her eldest daughter. The articles of association of RRU prohibit the making of loans to directors. Lucy also bought children's clothes from CRU for her two youngest children. She paid $500 for the clothes which cost $200 to produce but are sold to wholesale customers for $900. * CRU is entitled to claim an input tax credit in respect of the car purchase Required: Advise CRU about the fringe benefits tax liability for the cument FBT taxyear ending 31 March 2022 arising from the above facts. (SLO1, SLO2 and SLO3) Your answer should show relevant calculations and be clearly supported by nferences to relevant legislation, case law or tax rulings. NB You are not required to include the Medicare Levy in your calculations Lucy is the Director of Clothes r Us Pty Ltd (CRU), a private company which is an importer and wholesale supplier of children's clothes to independent retailers in the Sydney region. Lucy owns most of the shares in CRU. On 1 May 2021, CRU purchased a new car costing $90,000 (GST-inclusive)* The car has a fuel consumption that does not exceed 7 litres per 100 kilometres. The car was garaged at Lucy's house most nights. The particulars for the year regarding the car and for which invoices are retained, including a log book, include: Lucy uses the car to travel from home to work in the mornings, and sometimes uses the car during the day to travel to meet with wholesale customers and market the new range of clothes being imported. Otherwise, the car is usually garaged at a parking station near CRU's offices. Lucy pays the parking fee of $20 a day and is reimbursed the cost by CRU. The parking fee is a deductible business expense. On 1 July 2021, following resolution at the company's Annual General Meeting. CRU agreed to provide Lucy with a $20,000 loan at 2% pa to help pay the school fees for her eldest daughter. The articles of association of RRU prohibit the making of loans to directors. Lucy also bought children's clothes from CRU for her two youngest children. She paid $500 for the clothes which cost $200 to produce but are sold to wholesale customers for $900. * CRU is entitled to claim an input tax credit in respect of the car purchase Required: Advise CRU about the fringe benefits tax liability for the cument FBT taxyear ending 31 March 2022 arising from the above facts. (SLO1, SLO2 and SLO3) Your answer should show relevant calculations and be clearly supported by nferences to relevant legislation, case law or tax rulings. NB You are not required to include the Medicare Levy in your calculations