Answered step by step

Verified Expert Solution

Question

1 Approved Answer

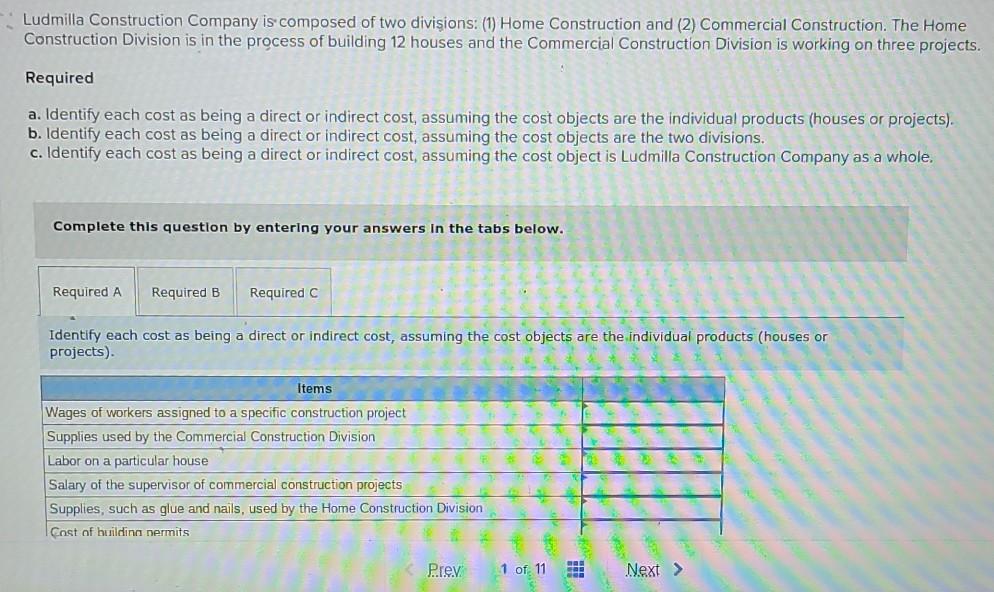

Ludmilla Construction Company is composed of two divisions: (1) Home Construction and (2) Commercial Construction. The Home Construction Division is in the process of building

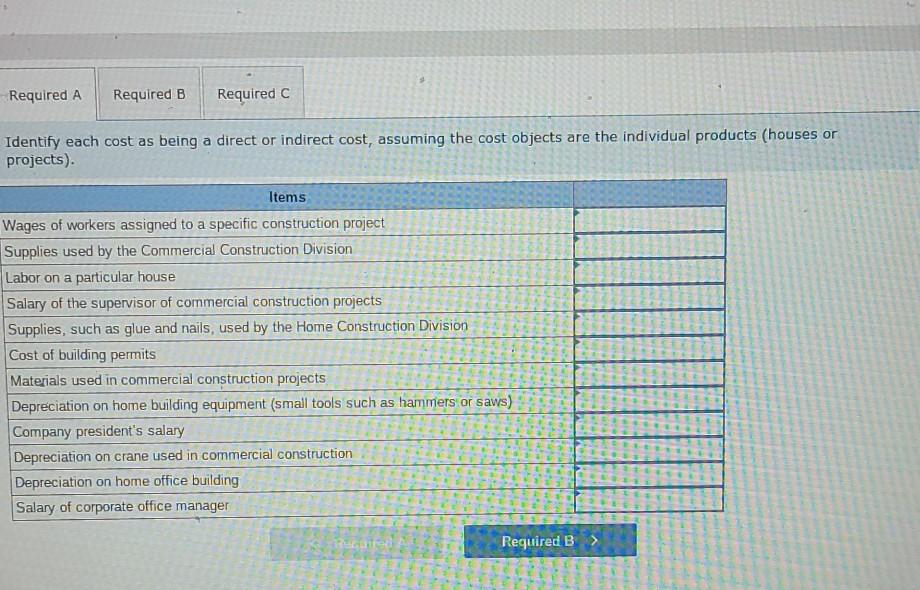

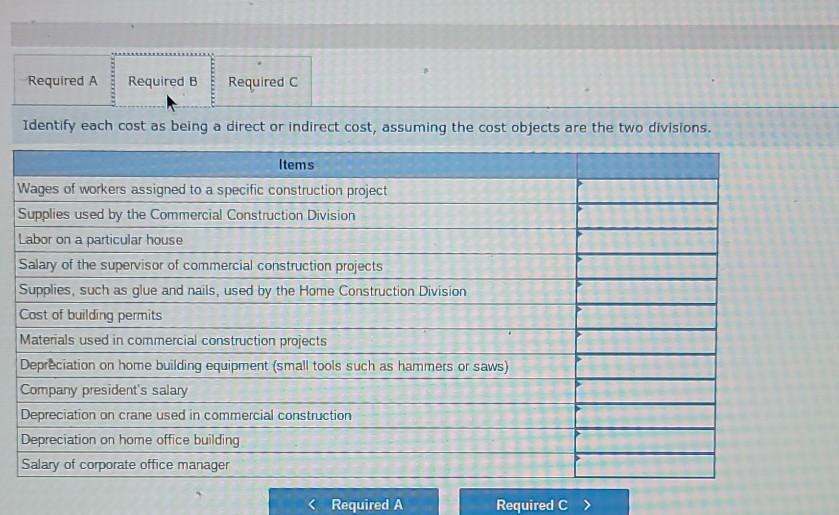

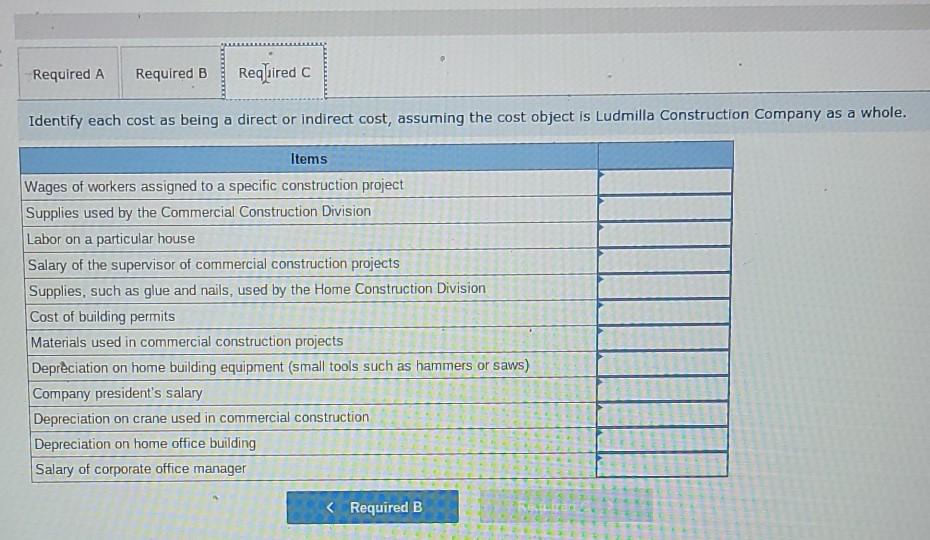

Ludmilla Construction Company is composed of two divisions: (1) Home Construction and (2) Commercial Construction. The Home Construction Division is in the process of building 12 houses and the Commercial Construction Division is working on three projects. Required a. Identify each cost as being a direct or indirect cost, assuming the cost objects are the individual products (houses or projects). b. Identify each cost as being a direct or indirect cost, assuming the cost objects are the two divisions. c. Identify each cost as being a direct or indirect cost, assuming the cost object is Ludmilla Construction Company as a whole. Complete this question by entering your answers in the tabs below. Required A Required B Required C Identify each cost as being a direct or indirect cost, assuming the cost objects are the individual products (houses or projects) Items Wages of workers assigned to a specific construction project Supplies used by the Commercial Construction Division Labor on a particular house Salary of the supervisor of commercial construction projects Supplies, such as glue and nails, used by the Home Construction Division Cost of buildina nermits Prey 1 of 11 Next > Required A Required B Required Identify each cost as being a direct or indirect cost, assuming the cost objects are the individual products (houses or projects) Items Wages of workers assigned to a specific construction project Supplies used by the Commercial Construction Division Labor on a particular house Salary of the supervisor of commercial construction projects Supplies, such as glue and nails, used by the Home Construction Division Cost of building permits Materials used in commercial construction projects Depreciation on home building equipment (small tools such as hammers or saws) Company president's salary Depreciation on crane used in commercial construction Depreciation on home office building Salary of corporate office manager Required B - Required A Required B Required Identify each cost as being a direct or indirect cost, assuming the cost objects are the two divisions. Items Wages of workers assigned to a specific construction project Supplies used by the Commercial Construction Division Labor on a particular house Salary of the supervisor of commercial construction projects Supplies, such as glue and nails, used by the Home Construction Division Cost of building permits Materials used in commercial construction projects Depreciation on home building equipment (small tools such as hammers or saws) Company president's salary Depreciation on crane used in commercial construction Depreciation on home office building Salary of corporate office manager Required A Required B Required C Identify each cost as being a direct or indirect cost, assuming the cost object is Ludmilla Construction Company as a whole. Items Wages of workers assigned to a specific construction project Supplies used by the Commercial Construction Division Labor on a particular house Salary of the supervisor of commercial construction projects Supplies, such as glue and nails, used by the Home Construction Division Cost of building permits Materials used in commercial construction projects Depreciation on home building equipment (small tools such as hammers or saws) Company president's salary Depreciation on crane used in commercial construction Depreciation on home office building Salary of corporate office manager

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started