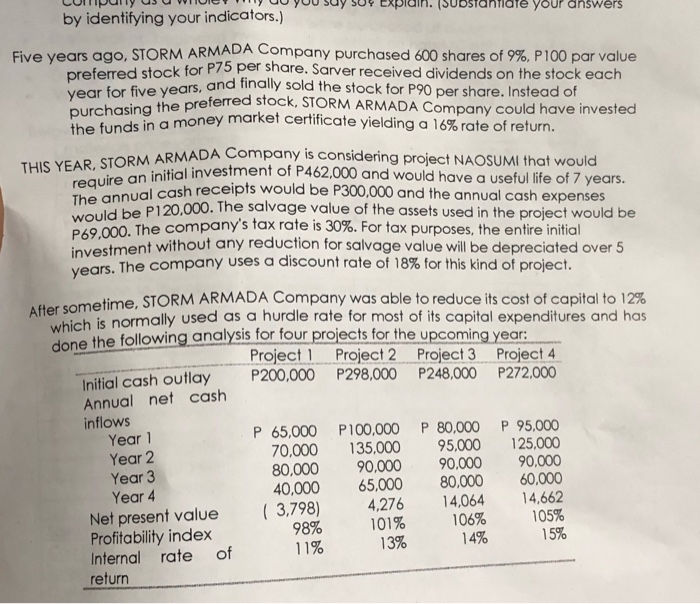

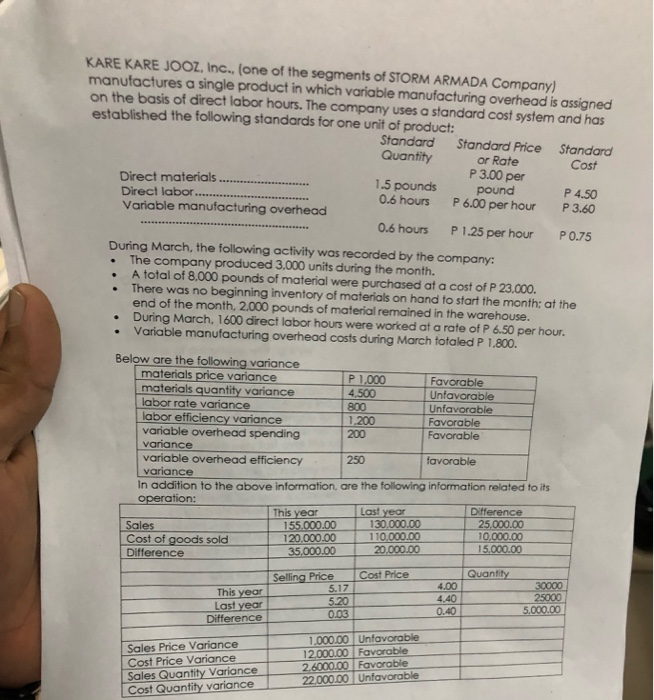

LUITIuriy usu WUICY UU YUU SUY SUY Explain. (Substantiate your answers by identifying your indicators.) Five vears ago, STORM ARMADA Company purchased 600 shares of 9%, P100 par value red stock for P75 per share. Sarver received dividends on the stock each vears, and finally sold the stock for P90 per share. Instead of asing the preferred stock, STORM ARMADA Company could have invested money market certificate yielding a 16% rate of return. year for five years, and finally sold the the funds in a money market certificat THIS YEAR, STORM ARMADA Company is so require an initial investment of P4620 The annual cash receipts wou would be P120,000. The salvage ARMADA Company is considering project NAOSUMI that would tal investment of P462,000 and would have a useful life of 7 years. cash receipts would be P300,000 and the annual cash expenses P120,000. The salvage value of the assets used in the project would be DAO 000. The company s tax rate is 30%. For tax purposes, the entire initial P69,000. The ment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 18% for this kind of project. After sometime, STORM ARMAS ime STORM ARMADA Company was able to reduce its cost of capital to 12% is normally used as a hurdle rate for most of its capital expenditures and has the following analysis for four projects for the upcoming year: Project 1 Project 2 Project 3 Project 4 Initial cash outlay P200,000 P298,000 P248,000 P272,000 Annual net cash inflows P 65,000 P100,000 P 80,000 Year 1 P 95,000 Year 2 70,000 135.000 95.000 125.000 80,000 90,000 90.000 Year 3 90,000 40,000 65,000 80,000 Year 4 60.000 3.798) (3,798) 4,276 14,064 14,662 Net present value 101% 106% 105% Profitability index 15% Internal rate of 13% 11% return 98% 14% PART VI A. Identify problems you see existing in STORM ARMADA Company. B. Identify strengths you see existing in STORM ARMADA Company. C. Make recommendations. KARE KARE JOOZ, Inc., (one of the segments of STORM ARMADA Company) manufactures a single product in which variable manufacturing overhead is assigned on the basis of direct labor hours. The company uses a standard cost system and has established the following standards for one unit of product: Standard Standard Price Standard Quantity or Rate Cost P 3.00 per Direct materials .... 1.5 pounds pound P 4.50 Direct labor... 0.6 hours P6.00 per hour P 3.60 Variable manufacturing overhead 0.6 hours P1.25 per hour P0.75 During March, the following activity was recorded by the company: The company produced 3.000 units during the month. A total of 8,000 pounds of material were purchased at a cost of P 23.000. There was no beginning inventory of materials on hand to start the month: at the end of the month, 2.000 pounds of material remained in the warehouse. During March, 1600 direct labor hours were worked at a rate of P 6.50 per hour. Variable manufacturing overhead costs during March totaled P 1.800. Below are the following variance materials price variance P 1.000 Favorable materials quantity variance 4.500 Unfavorable labor rate variance 800 Unfavorable labor efficiency variance 1.200 Favorable variable overhead spending 200 Favorable variance variable overhead efficiency 2 50 favorable variance In addition to the above information are the following information related to its operation: This year Last year Difference Sales 155,000.00 130.000.00 25,000.00 Cost of goods sold 120,000.00 110.000.00 10.000.00 Difference 35,000.00 20.000.00 15.000.00 Selling Price Cost Price Quantity 5.17 4.00 This year 30000 5.20 4.40 25000 last year 0.40 5.000.00 Difference 0.03 Sales Price Variance Cost Price Variance Sales Quantity Variance Cost Quantity variance 1,000.00 Unfavorable 12000.00 Favorable 2.6000.00 Favorable 22,000.00 Unfavorable PART VI A. Identify problems you see existing in STORM ARMADA Company, B. Identify strengths you see existing in STORM ARMADA Company. C. Make recommendations