Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Luke Corporation produces a variety of products, each within its own division. Last year, the managers at Luke developed and began marketing a new

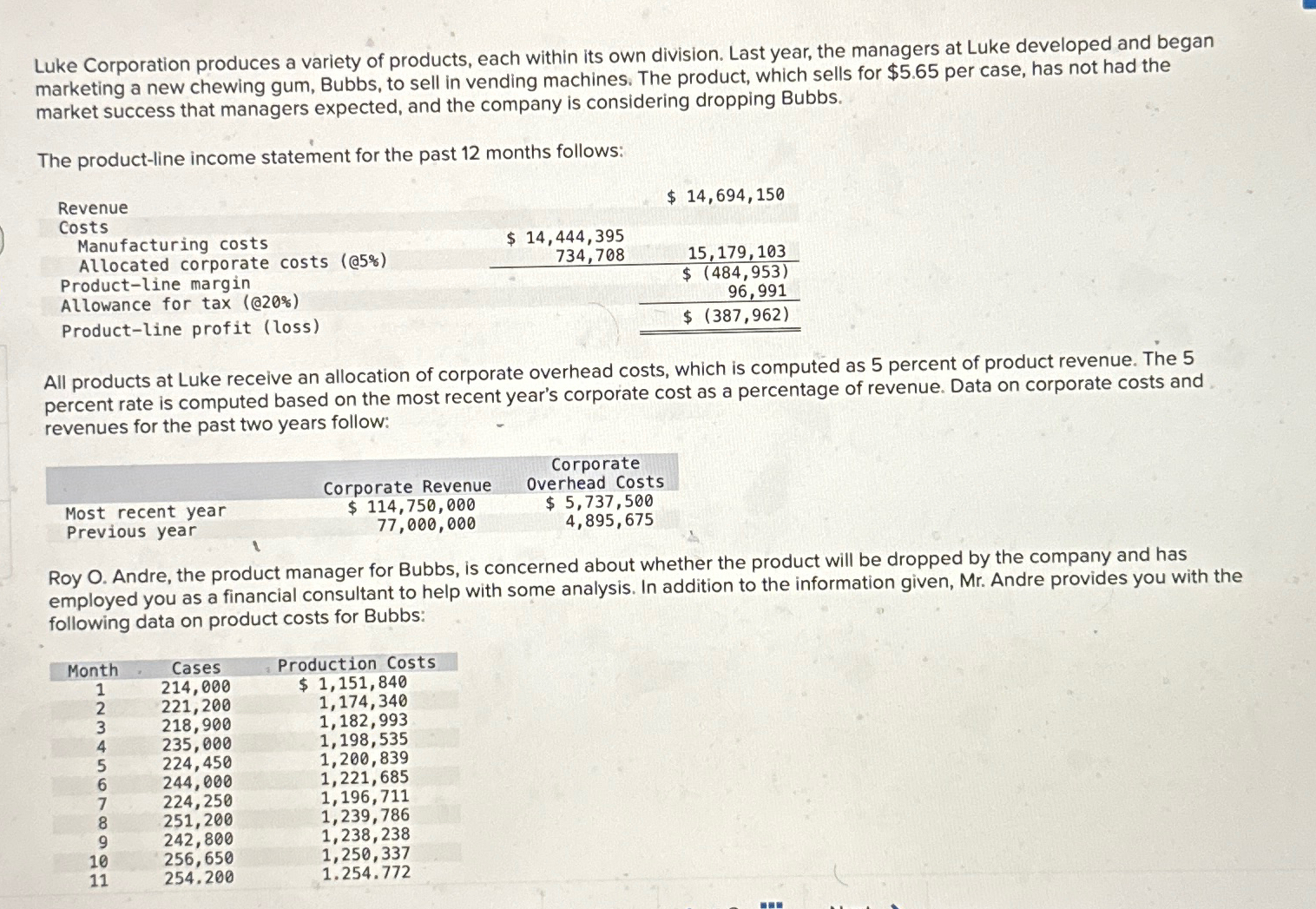

Luke Corporation produces a variety of products, each within its own division. Last year, the managers at Luke developed and began marketing a new chewing gum, Bubbs, to sell in vending machines. The product, which sells for $5.65 per case, has not had the market success that managers expected, and the company is considering dropping Bubbs. The product-line income statement for the past 12 months follows: Revenue Costs Manufacturing costs $ 14,694,150 Allocated corporate costs (@5%) $ 14,444,395 734,708 15,179,103 $ (484,953) 96,991 Product-line margin Allowance for tax (@20%) Product-line profit (loss) $ (387,962) All products at Luke receive an allocation of corporate overhead costs, which is computed as 5 percent of product revenue. The 5 percent rate is computed based on the most recent year's corporate cost as a percentage of revenue. Data on corporate costs and revenues for the past two years follow: Most recent year Previous year Corporate Revenue $ 114,750,000 77,000,000 Corporate Overhead Costs $ 5,737,500 4,895,675 Roy O. Andre, the product manager for Bubbs, is concerned about whether the product will be dropped by the company and has employed you as a financial consultant to help with some analysis. In addition to the information given, Mr. Andre provides you with the following data on product costs for Bubbs: Month Cases Production Costs 1 214,000 $ 1,151,840 2 221,200 1,174,340 3 218,900 1,182,993 4 235,000 1,198,535 5 224,450 1,200,839 6 244,000 1,221,685 7 224,250 1,196,711 8 251,200 1,239,786 9 242,800 1,238,238 10 256,650 1,250,337 11 254.200 1.254.772 www

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started