Luke is an accountant who operates a partnership with Robert providing services of accounting and auditing to both local and overseas customers. Apart from

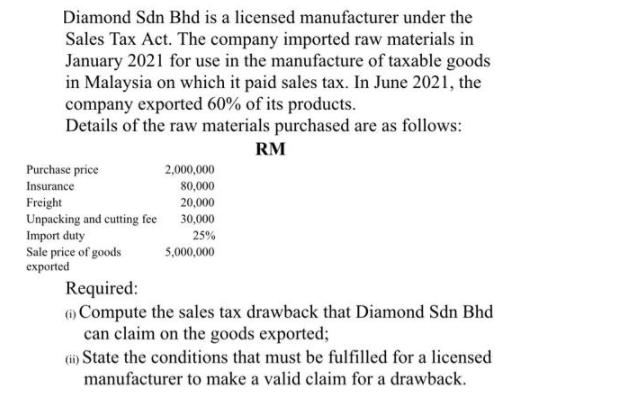

Luke is an accountant who operates a partnership with Robert providing services of accounting and auditing to both local and overseas customers. Apart from accounting and auditing, the partnership also provides caf and parking spaces services. Total value of sales for the year of assessment 2020 is as shown in the table below: Services Accounting and auditing Cafe Parking spaces Total sales (S) 450,000 320,000 210,000 Required: Calculate value of taxable services for the partnership. Diamond Sdn Bhd is a licensed manufacturer under the Sales Tax Act. The company imported raw materials in January 2021 for use in the manufacture of taxable goods in Malaysia on which it paid sales tax. In June 2021, the company exported 60% of its products. Details of the raw materials purchased are as follows: RM Purchase price Insurance Freight Unpacking and cutting fee Import duty Sale price of goods exported 2,000,000 80,000 20,000 30,000 25% 5,000,000 Required: (1) Compute the sales tax drawback that Diamond Sdn Bhd can claim on the goods exported; (ii) State the conditions that must be fulfilled for a licensed manufacturer to make a valid claim for a drawback.

Step by Step Solution

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer i Calculation of sales tax drawback for value of taxable services for the partnership Total v...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started