Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Property and equipment, net Goodwill and intangible assets, net Deferred income taxes Other non-current assets Current assets Cash and cash equivalents Accounts receivable Inventories

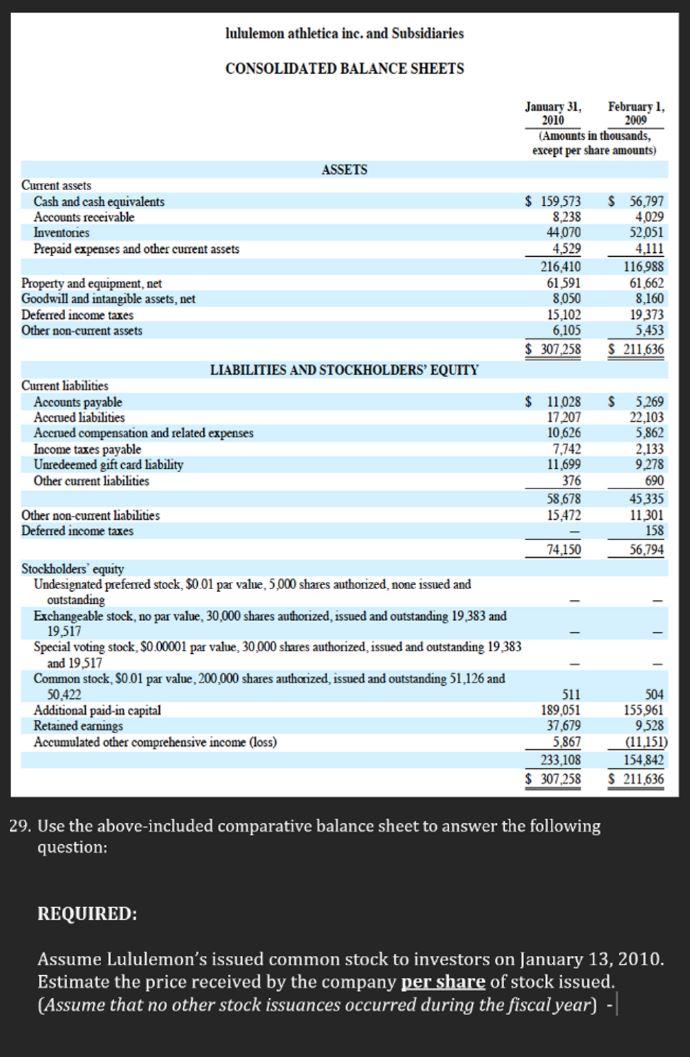

Property and equipment, net Goodwill and intangible assets, net Deferred income taxes Other non-current assets Current assets Cash and cash equivalents Accounts receivable Inventories Prepaid expenses and other current assets Current liabilities Accounts payable Accrued liabilities lululemon athletica inc. and Subsidiaries Unredeemed gift card liability Other current liabilities CONSOLIDATED BALANCE SHEETS Other non-current liabilities Deferred income taxes Accrued compensation and related expenses Income taxes payable LIABILITIES AND STOCKHOLDERS' EQUITY ASSETS Stockholders' equity Undesignated preferred stock, $0.01 par value, 5,000 shares authorized, none issued and outstanding Exchangeable stock, no par value, 30,000 shares authorized, issued and outstanding 19,383 and 19,517 Special voting stock, $0.00001 par value, 30,000 shares authorized, issued and outstanding 19,383 10 5 19.517 and Common stock, $0.01 par value, 200,000 shares authorized, issued and outstanding 51,126 and 50,422 Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) January 31, February 1, 2010 2009 (Amounts in thousands, except per share amounts) $ 159,573 8,238 44,070 4,529 216,410 61.591 8,050 15,102 6,105 $ 307,258 $ 11,028 17,207 10,626 7,742 11,699 376 58,678 15,472 74,150 511 189,051 37,679 5,867 233,108 $ 307,258 29. Use the above-included comparative balance sheet to answer the following question: $ 56,797 4,029 52,051 4,111 116,988 61,662 8,160 19.373 5,453 $ 211,636 $ 5,269 22,103 5,862 2,133 9,278 690 45.335 11,301 158 56,794 504 155,961 9,528 (11,151) 154,842 $ 211,636 REQUIRED: Assume Lululemon's issued common stock to investors on January 13, 2010. Estimate the price received by the company per share of stock issued. (Assume that no other stock issuances occurred during the fiscal year) -|

Step by Step Solution

★★★★★

3.51 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

The price received by Lululemons company per share of stock issue...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started