Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Luna Limited ('Luna') is your existing client, and it became a listed company this year. You were the audit engagement manager of Luna for

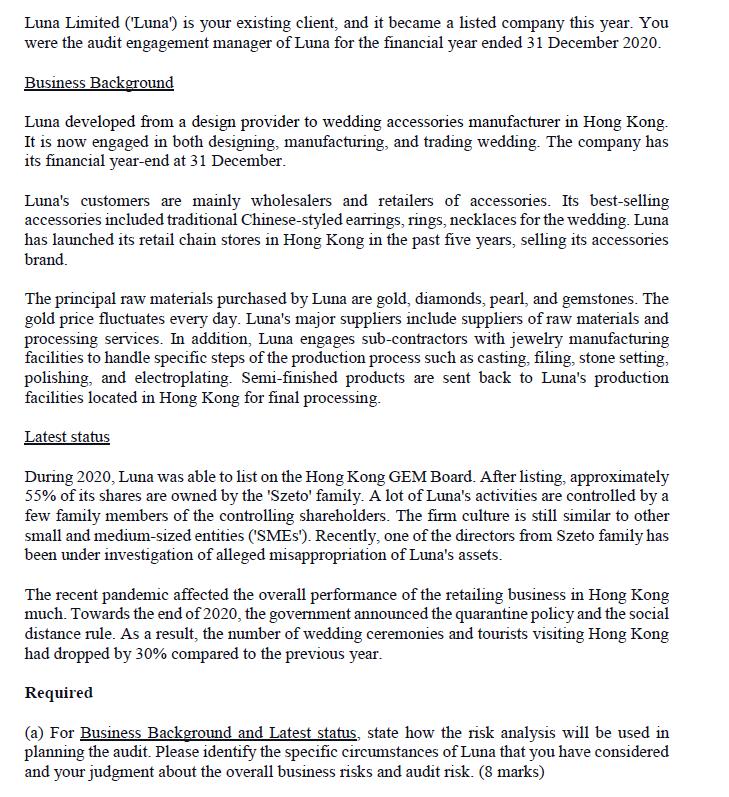

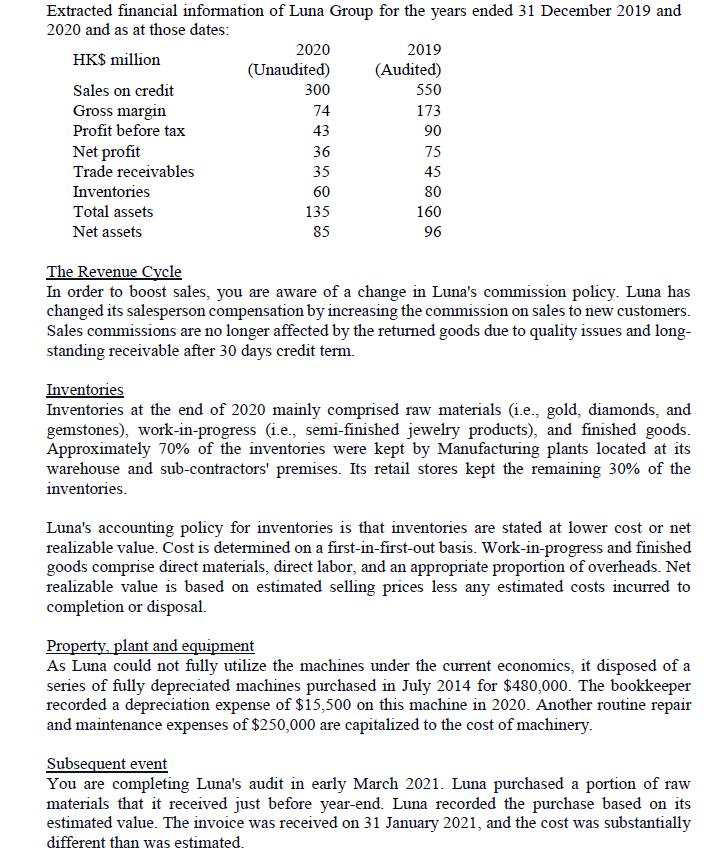

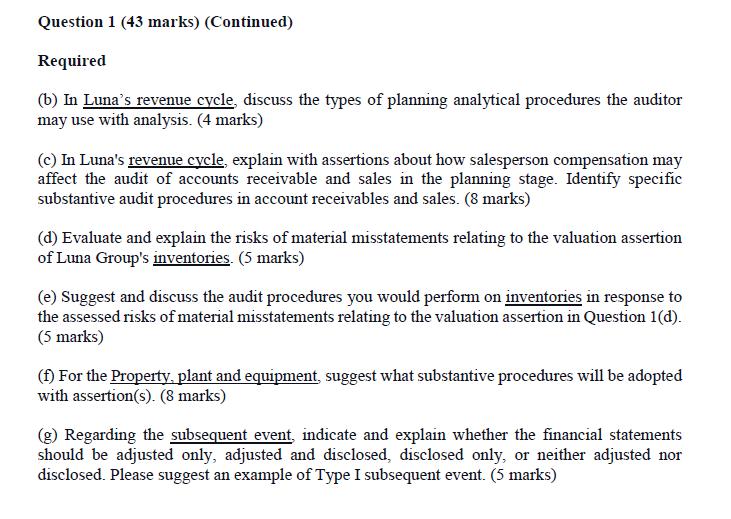

Luna Limited ('Luna') is your existing client, and it became a listed company this year. You were the audit engagement manager of Luna for the financial year ended 31 December 2020. Business Background Luna developed from a design provider to wedding accessories manufacturer in Hong Kong. It is now engaged in both designing, manufacturing, and trading wedding. The company has its financial year-end at 31 December. Luna's customers are mainly wholesalers and retailers of accessories. Its best-selling accessories included traditional Chinese-styled earrings, rings, necklaces for the wedding. Luna has launched its retail chain stores in Hong Kong in the past five years, selling its accessories brand. The principal raw materials purchased by Luna are gold, diamonds, pearl, and gemstones. The gold price fluctuates every day. Luna's major suppliers include suppliers of raw materials and processing services. In addition, Luna engages sub-contractors with jewelry manufacturing facilities to handle specific steps of the production process such as casting, filing, stone setting, polishing, and electroplating. Semi-finished products are sent back to Luna's production facilities located in Hong Kong for final processing. Latest status During 2020, Luna was able to list on the Hong Kong GEM Board. After listing, approximately 55% of its shares are owned by the 'Szeto' family. A lot of Luna's activities are controlled by a few family members of the controlling shareholders. The firm culture is still similar to other small and medium-sized entities (SMEs). Recently, one of the directors from Szeto family has been under investigation of alleged misappropriation of Luna's assets. The recent pandemic affected the overall performance of the retailing business in Hong Kong much. Towards the end of 2020, the government announced the quarantine policy and the social distance rule. As a result, the number of wedding ceremonies and tourists visiting Hong Kong had dropped by 30% compared to the previous year. Required (a) For Business Background and Latest status, state how the risk analysis will be used in planning the audit. Please identify the specific circumstances of Luna that you have considered and your judgment about the overall business risks and audit risk. (8 marks) Extracted financial information of Luna Group for the years ended 31 December 2019 and 2020 and as at those dates: HK$ million Sales on credit Gross margin Profit before tax Net profit Trade receivables Inventories Total assets Net assets 2020 (Unaudited) 300 74 43 36 35 60 135 85 2019 (Audited) 550 173 90 75 45 80 160 96 The Revenue Cycle In order to boost sales, you are aware of a change in Luna's commission policy. Luna has changed its salesperson compensation by increasing the commission on sales to new customers. Sales commissions are no longer affected by the returned goods due to quality issues and long- standing receivable after 30 days credit term. Inventories Inventories at the end of 2020 mainly comprised raw materials (i.e., gold, diamonds, and gemstones), work-in-progress (i.e., semi-finished jewelry products), and finished goods. Approximately 70% of the inventories were kept by Manufacturing plants located at its warehouse and sub-contractors' premises. Its retail stores kept the remaining 30% of the inventories. Luna's accounting policy for inventories is that inventories are stated at lower cost or net realizable value. Cost is determined on a first-in-first-out basis. Work-in-progress and finished goods comprise direct materials, direct labor, and an appropriate proportion of overheads. Net realizable value is based on estimated selling prices less any estimated costs incurred to completion or disposal. Property, plant and equipment As Luna could not fully utilize the machines under the current economics, it disposed of a series of fully depreciated machines purchased in July 2014 for $480,000. The bookkeeper recorded a depreciation expense of $15,500 on this machine in 2020. Another routine repair and maintenance expenses of $250,000 are capitalized to the cost of machinery. Subsequent event You are completing Luna's audit in early March 2021. Luna purchased a portion of raw materials that it received just before year-end. Luna recorded the purchase based on its estimated value. The invoice was received on 31 January 2021, and the cost was substantially different than was estimated. Question 1 (43 marks) (Continued) Required (b) In Luna's revenue cycle, discuss the types of planning analytical procedures the auditor may use with analysis. (4 marks) (c) In Luna's revenue cycle, explain with assertions about how salesperson compensation may affect the audit of accounts receivable and sales in the planning stage. Identify specific substantive audit procedures in account receivables and sales. (8 marks) (d) Evaluate and explain the risks of material misstatements relating to the valuation assertion of Luna Group's inventories. (5 marks) (e) Suggest and discuss the audit procedures you would perform on inventories in response to the assessed risks of material misstatements relating to the valuation assertion in Question 1(d). (5 marks) (f) For the Property, plant and equipment, suggest what substantive procedures will be adopted with assertion(s). (8 marks) (g) Regarding the subsequent event, indicate and explain whether the financial statements should be adjusted only, adjusted and disclosed, disclosed only, or neither adjusted nor disclosed. Please suggest an example of Type I subsequent event. (5 marks) Luna Limited ('Luna') is your existing client, and it became a listed company this year. You were the audit engagement manager of Luna for the financial year ended 31 December 2020. Business Background Luna developed from a design provider to wedding accessories manufacturer in Hong Kong. It is now engaged in both designing, manufacturing, and trading wedding. The company has its financial year-end at 31 December. Luna's customers are mainly wholesalers and retailers of accessories. Its best-selling accessories included traditional Chinese-styled earrings, rings, necklaces for the wedding. Luna has launched its retail chain stores in Hong Kong in the past five years, selling its accessories brand. The principal raw materials purchased by Luna are gold, diamonds, pearl, and gemstones. The gold price fluctuates every day. Luna's major suppliers include suppliers of raw materials and processing services. In addition, Luna engages sub-contractors with jewelry manufacturing facilities to handle specific steps of the production process such as casting, filing, stone setting, polishing, and electroplating. Semi-finished products are sent back to Luna's production facilities located in Hong Kong for final processing. Latest status During 2020, Luna was able to list on the Hong Kong GEM Board. After listing, approximately 55% of its shares are owned by the 'Szeto' family. A lot of Luna's activities are controlled by a few family members of the controlling shareholders. The firm culture is still similar to other small and medium-sized entities (SMEs). Recently, one of the directors from Szeto family has been under investigation of alleged misappropriation of Luna's assets. The recent pandemic affected the overall performance of the retailing business in Hong Kong much. Towards the end of 2020, the government announced the quarantine policy and the social distance rule. As a result, the number of wedding ceremonies and tourists visiting Hong Kong had dropped by 30% compared to the previous year. Required (a) For Business Background and Latest status, state how the risk analysis will be used in planning the audit. Please identify the specific circumstances of Luna that you have considered and your judgment about the overall business risks and audit risk. (8 marks) Extracted financial information of Luna Group for the years ended 31 December 2019 and 2020 and as at those dates: HK$ million Sales on credit Gross margin Profit before tax Net profit Trade receivables Inventories Total assets Net assets 2020 (Unaudited) 300 74 43 36 35 60 135 85 2019 (Audited) 550 173 90 75 45 80 160 96 The Revenue Cycle In order to boost sales, you are aware of a change in Luna's commission policy. Luna has changed its salesperson compensation by increasing the commission on sales to new customers. Sales commissions are no longer affected by the returned goods due to quality issues and long- standing receivable after 30 days credit term. Inventories Inventories at the end of 2020 mainly comprised raw materials (i.e., gold, diamonds, and gemstones), work-in-progress (i.e., semi-finished jewelry products), and finished goods. Approximately 70% of the inventories were kept by Manufacturing plants located at its warehouse and sub-contractors' premises. Its retail stores kept the remaining 30% of the inventories. Luna's accounting policy for inventories is that inventories are stated at lower cost or net realizable value. Cost is determined on a first-in-first-out basis. Work-in-progress and finished goods comprise direct materials, direct labor, and an appropriate proportion of overheads. Net realizable value is based on estimated selling prices less any estimated costs incurred to completion or disposal. Property, plant and equipment As Luna could not fully utilize the machines under the current economics, it disposed of a series of fully depreciated machines purchased in July 2014 for $480,000. The bookkeeper recorded a depreciation expense of $15,500 on this machine in 2020. Another routine repair and maintenance expenses of $250,000 are capitalized to the cost of machinery. Subsequent event You are completing Luna's audit in early March 2021. Luna purchased a portion of raw materials that it received just before year-end. Luna recorded the purchase based on its estimated value. The invoice was received on 31 January 2021, and the cost was substantially different than was estimated. Question 1 (43 marks) (Continued) Required (b) In Luna's revenue cycle, discuss the types of planning analytical procedures the auditor may use with analysis. (4 marks) (c) In Luna's revenue cycle, explain with assertions about how salesperson compensation may affect the audit of accounts receivable and sales in the planning stage. Identify specific substantive audit procedures in account receivables and sales. (8 marks) (d) Evaluate and explain the risks of material misstatements relating to the valuation assertion of Luna Group's inventories. (5 marks) (e) Suggest and discuss the audit procedures you would perform on inventories in response to the assessed risks of material misstatements relating to the valuation assertion in Question 1(d). (5 marks) (f) For the Property, plant and equipment, suggest what substantive procedures will be adopted with assertion(s). (8 marks) (g) Regarding the subsequent event, indicate and explain whether the financial statements should be adjusted only, adjusted and disclosed, disclosed only, or neither adjusted nor disclosed. Please suggest an example of Type I subsequent event. (5 marks)

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer a Risk analysis will be crucial in planning the audit for Luna Limited Considering the business background and latest status provided several specific circumstances of Luna need to be considere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started