Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lund's Pro Shop purchased sets of golf clubs for $500 less 40% and 16 2/3%. Expenses are 20% of the regular selling price and

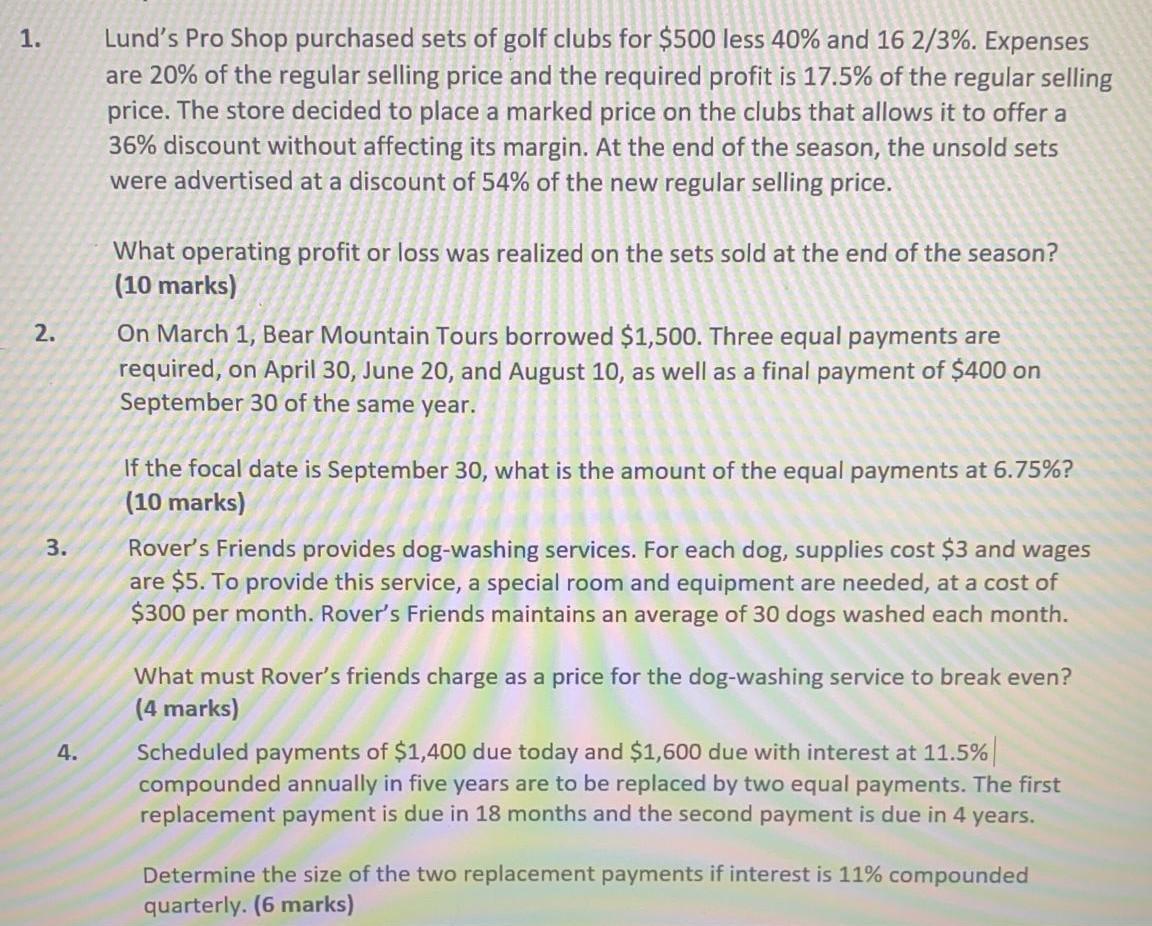

Lund's Pro Shop purchased sets of golf clubs for $500 less 40% and 16 2/3%. Expenses are 20% of the regular selling price and the required profit is 17.5% of the regular selling price. The store decided to place a marked price on the clubs that allows it to offer a 36% discount without affecting its margin. At the end of the season, the unsold sets were advertised at a discount of 54% of the new regular selling price. 1. What operating profit or loss was realized on the sets sold at the end of the season? (10 marks) On March 1, Bear Mountain Tours borrowed $1,500. Three equal payments are required, on April 30, June 20, and August 10, as well as a final payment of $400 on September 30 of the same year. 2. If the focal date is September 30, what is the amount of the equal payments at 6.75%? (10 marks) Rover's Friends provides dog-washing services. For each dog, supplies cost $3 and wages are $5. To provide this service, a special room and equipment are needed, at a cost of $300 per month. Rover's Friends maintains an average of 30 dogs washed each month. 3. What must Rover's friends charge as a price for the dog-washing service to break even? (4 marks) Scheduled payments of $1,400 due today and $1,600 due with interest at 11.5% compounded annually in five years are to be replaced by two equal payments. The first replacement payment is due in 18 months and the second payment is due in 4 years. 4. Determine the size of the two replacement payments if interest is 11% compounded quarterly. (6 marks)

Step by Step Solution

★★★★★

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 A Purchase Calculation Purchase price 500 Discount will be applied in two steps 1 40 on Original Price 500 500 x 40 500 200 300 2 16 23 on Discounte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started