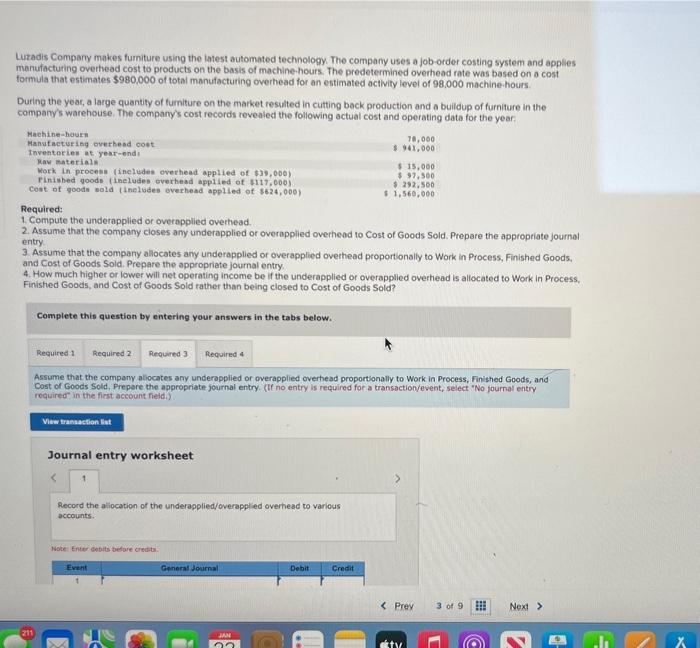

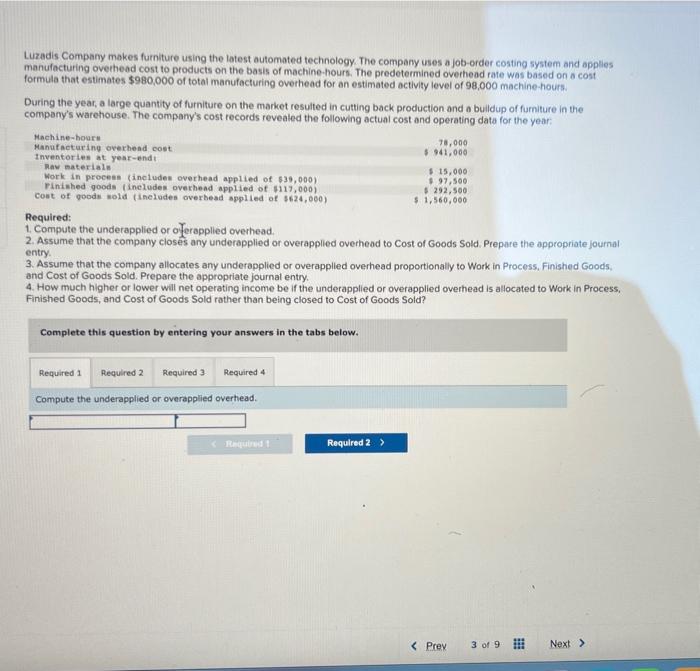

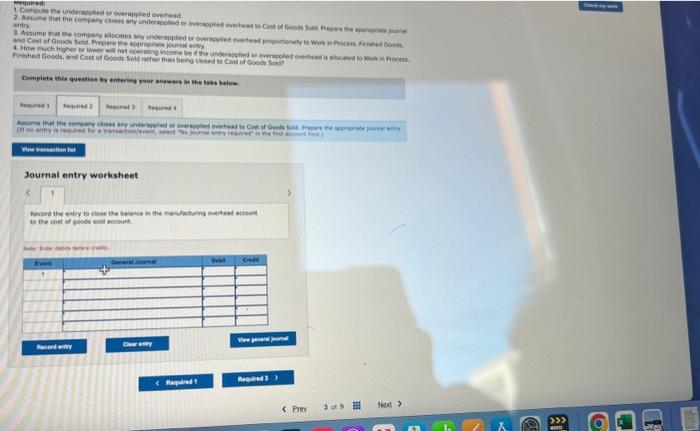

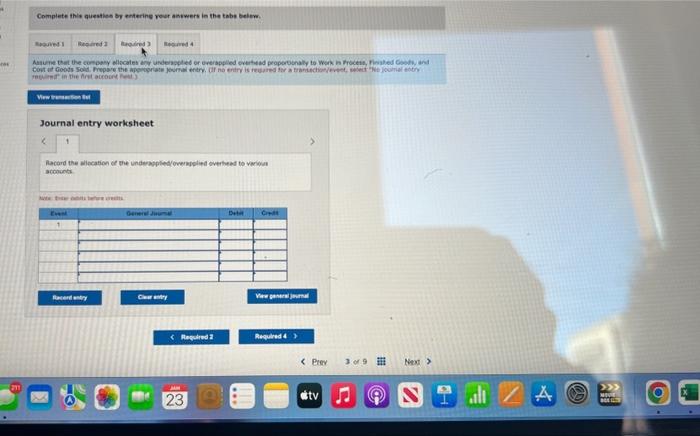

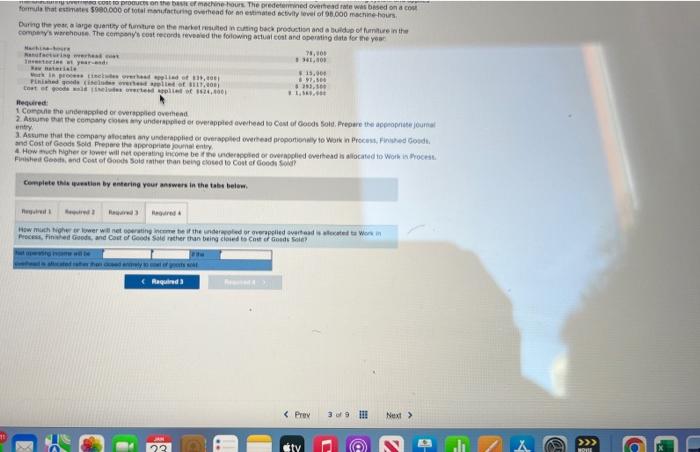

Luradis Company makes fumiture using the latest automated technology The compary uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $980,000 of total manufacturing overhead for an estimated actlity level of 98,000 machine.hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process. Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Assume that the compeny aliocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold, Prepare the appropriate journal entry. (It no entry is required for a transaction/event, select "No fournal entry required in the first account field.) Journal entry worksheet Record the aliocation of the underapplied/overapplied overhead to various accounts. Wote: Enter cobits bedore uredib. Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $980,000 of total manufacturing overhead for an estimated octivity level of 98,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or oJerapplied overhead. 2. Assume that the company closes any underapplied or overapplied overheod to Cost of Goods Sold. Prepare the appropriate journal entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process. Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process. Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Compute the underapplied or overapplied overhead. erritry. Crmpiete this questian hr entering reur anpwere in the bahs helene. Journal entry worksheet Reverd the esey to ciebe the bewave in tha mawfactarma overteut acrocti to the cost of goods whid accourt. Complete this auesties by entering pest askwers in the tabs beiew. Journal entry worksheet acconunta formuin that estimates 5990.000 of fotal nonu,facturisg overthead for an estrinated ectily fovel of 96.000 mochine hours. comperys wirchous. The certpony's cost fecords reveaied the folowing actuai cost and operafiag diats for the year 1 Corpone the unberapoled or cverppolied overthend entry. 3. Astume that the compery alfotates any underapotied of ourappled owertead proportionally to Wark in Procest. Finiehed Gosdi. and Cast of Geods sold Pregere the aporoprime foumat enty. 4. How thoh higher or ioner witl net operating income be if the underopoined or owerapglied overtead is allocatedio Woin in thocest. Filshed Cooits, end Cost of Coots Soid rather than being chosed to Cost af Goods Sovi? Cemplete this iquestian by entering yeur anpwers in the tabt belew