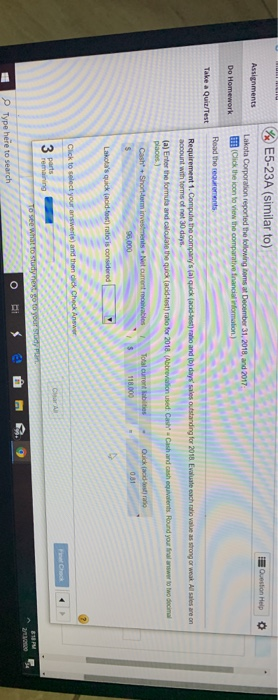

Lurul corpul a ll reported the following items at December 31, 2018, and 2017: Click the icon to view the comparative financial information.) Read the requirements. 0 Requirements be as strong or weak. All sales a Requirement 1. Compute the compar account with terms of net 30 days. (a) Enter the formula and calculate the places.) ind your final answer to two deci 1. Compute the company's (a) quick (acid-test) ratio and (b) days' sales outstanding for 2018. Evaluate each ratio value as strong or weak. All sales are on account with terms of net 30 days. 2. Recommend two ways for Lakota to speed up its cash flow from receivables. Cash + Short-term investments + N 96,000 Lakota's quick (acid-test) ratio is cong Print Done Click to select your answer(s) and then click Check Answer. Final Check Clear All 3 parts remaining To see what to study next, go to your Study Plan. O RA e B .9 e here to search op Question Help Assignments E5-23A (similar to) Lakota Corporation reported the following toms at December 31, 2018 and 201 Click the icon to view the comparative fnancial information. Do Homework Read the requirements Take a Quiz/Test Requirement 1. Compute the company's (a quick acist who and bday sales outstanding for 2018. Evaluate each tato value as strong or weak All sales are on account with forms of net 30 days. (a) Enter the forma and calculate the quick (acid.lost) toto for 2018. (Abbreviation used: Cash and cash equivalent. Round your finanswer to two decimal places) Cash Shorter investments Nel currenciales Total current labor Lakota's quick (acid-test) ratio is considered select your answers) and then click Check Check remaining To Se What to studyner got your stop Type here to search Lurul corpul a ll reported the following items at December 31, 2018, and 2017: Click the icon to view the comparative financial information.) Read the requirements. 0 Requirements be as strong or weak. All sales a Requirement 1. Compute the compar account with terms of net 30 days. (a) Enter the formula and calculate the places.) ind your final answer to two deci 1. Compute the company's (a) quick (acid-test) ratio and (b) days' sales outstanding for 2018. Evaluate each ratio value as strong or weak. All sales are on account with terms of net 30 days. 2. Recommend two ways for Lakota to speed up its cash flow from receivables. Cash + Short-term investments + N 96,000 Lakota's quick (acid-test) ratio is cong Print Done Click to select your answer(s) and then click Check Answer. Final Check Clear All 3 parts remaining To see what to study next, go to your Study Plan. O RA e B .9 e here to search op Question Help Assignments E5-23A (similar to) Lakota Corporation reported the following toms at December 31, 2018 and 201 Click the icon to view the comparative fnancial information. Do Homework Read the requirements Take a Quiz/Test Requirement 1. Compute the company's (a quick acist who and bday sales outstanding for 2018. Evaluate each tato value as strong or weak All sales are on account with forms of net 30 days. (a) Enter the forma and calculate the quick (acid.lost) toto for 2018. (Abbreviation used: Cash and cash equivalent. Round your finanswer to two decimal places) Cash Shorter investments Nel currenciales Total current labor Lakota's quick (acid-test) ratio is considered select your answers) and then click Check Check remaining To Se What to studyner got your stop Type here to search