Question

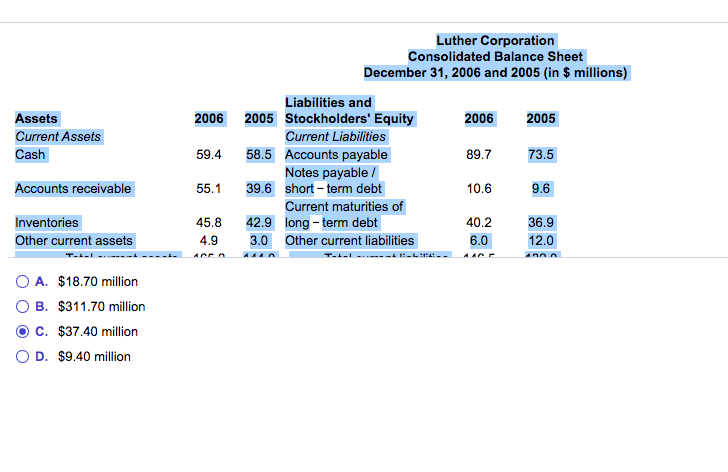

Luther Corporation Consolidated Balance Sheet December 31, 2006 and 2005 (in $ millions) Assets 2006 2005 Liabilities and Stockholders' Equity 2006 2005 Current Assets Current

Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)

| Assets | 2006 | 2005 | Liabilities and Stockholders' Equity | 2006 | 2005 |

| Current Assets | Current Liabilities | ||||

| Cash | 59.4 | 58.5 | Accounts payable | 89.7 | 73.5 |

| Accounts receivable | 55.1 | 39.6 | Notes payable / shortterm debt | 10.6 | 9.6 |

| Inventories | 45.8 | 42.9 | Current maturities of longterm debt | 40.2 | 36.9 |

| Other current assets | 4.9 | 3.0 | Other current liabilities | 6.0 | 12.0 |

| Total current assets | 165.2 | 144.0 | Total current liabilities | 146.5 | 132.0 |

| LongTerm Assets | LongTerm Liabilities | ||||

| Land | 66.5 | 62.1 | Longterm debt | 229.5 | 168.9 |

| Buildings | 109.4 | 91.5 | Capital lease obligations | ||

| Equipment | 116.5 | 99.6 | |||

| Less accumulated depreciation | (56.6) | (52.5) | Deferred taxes | 22.8 | 22.2 |

| Net property, plant, and equipment | 235.8 | 200.7 | Other longterm liabilities | ||

| Goodwill | 60.0 | Total longterm liabilities | 252.3 | 191.1 | |

| Other longterm assets | 63.0 | 42.0 | Total liabilities | 398.8 | 323.1 |

| Total longterm assets | 358.8 | 242.7 | Stockholders' Equity | 125.2 | 63.6 |

| Total Assets | 524 | 386.7 | Total liabilities and Stockholders' Equity | 524 | 386.7 |

Refer to the balance sheet above. What is Luther's net working capital in 2006? please answer this

please answer this

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started