Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Luther Industries is considering investing in a new fiber glass manufacturing machine which will initially cost $3.5 million to buy and $60,000 to install. The

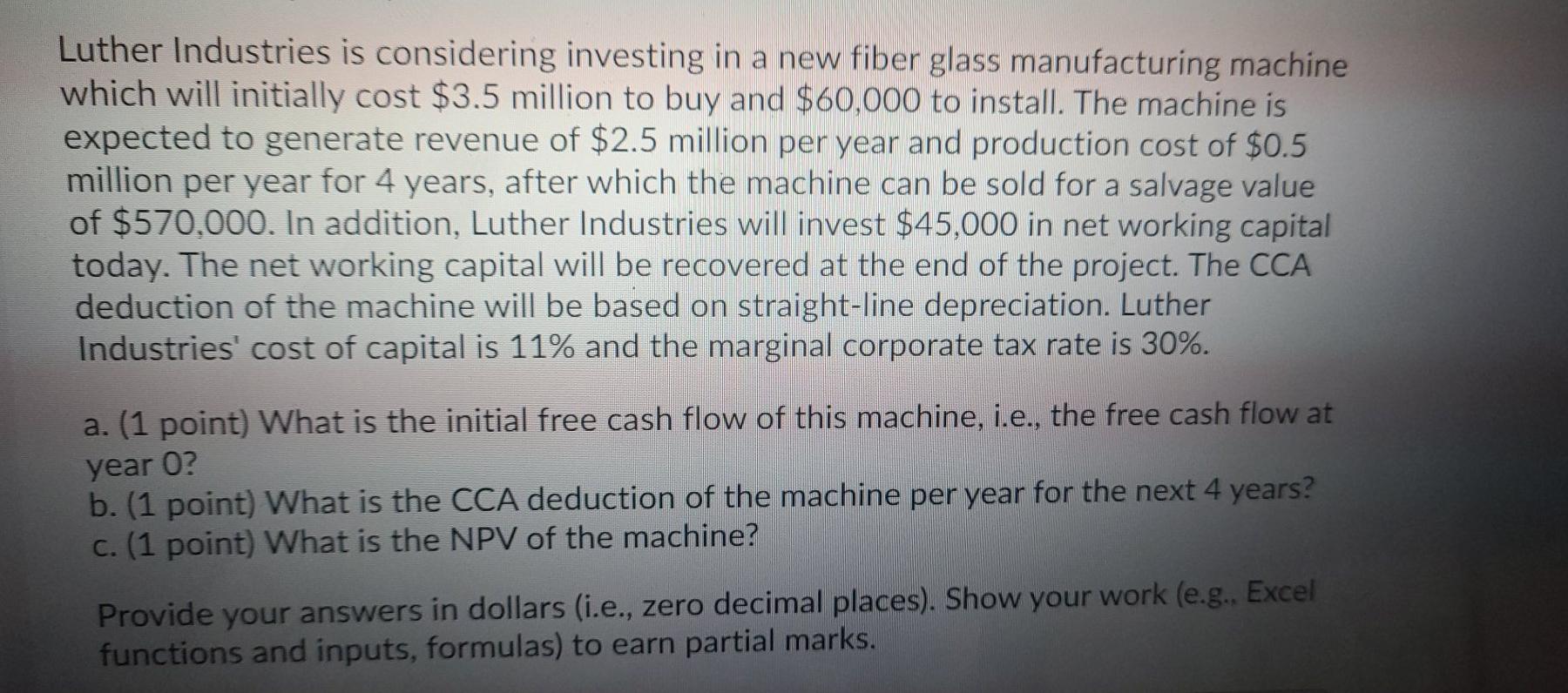

Luther Industries is considering investing in a new fiber glass manufacturing machine which will initially cost $3.5 million to buy and $60,000 to install. The machine is expected to generate revenue of $2.5 million per year and production cost of $0.5 million per year for 4 years, after which the machine can be sold for a salvage value of $570,000. In addition, Luther Industries will invest $45,000 in net working capital today. The net working capital will be recovered at the end of the project. The CCA deduction of the machine will be based on straight-line depreciation. Luther Industries' cost of capital is 11% and the marginal corporate tax rate 30%. a. (1 point) What is the initial free cash flow of this machine, i.e., the free cash flow at year 0? b.(1 point) What is the CCA deduction of the machine per year for the next 4 years? c. (1 point) What is the NPV of the machine? Provide your answers in dollars (i.e., zero decimal places). Show your work (e.g.. Excel functions and inputs, formulas) to earn partial marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started