lutions).pdf 4 / 20 67% + Sale Income statement Year Ended December 15, 2018 $ 100,000 Cost of goods sold Rent Expense Wages and

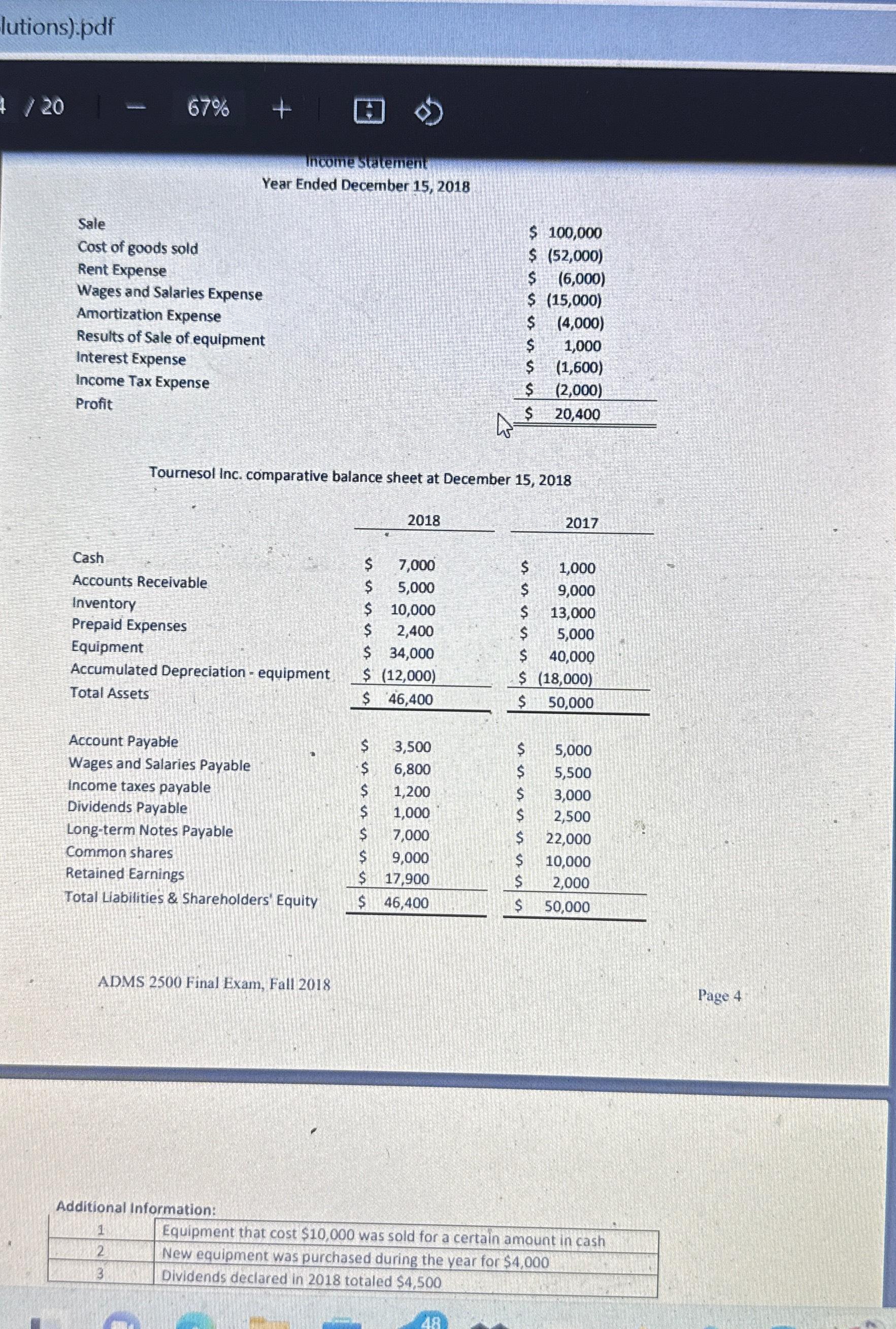

lutions).pdf 4 / 20 67% + Sale Income statement Year Ended December 15, 2018 $ 100,000 Cost of goods sold Rent Expense Wages and Salaries Expense Amortization Expense Results of Sale of equipment Interest Expense Income Tax Expense Profit $ (52,000) $ (6,000) $ (15,000) $ (4,000) $ 1,000 $ (1,600) $ (2,000) $ 20,400 Tournesol Inc. comparative balance sheet at December 15, 2018 2018 2017 Cash $ 7,000 $ 1,000 Accounts Receivable $ 5,000 $ 9,000 Inventory $ 10,000 $ 13,000 Prepaid Expenses $ 2,400 $ 5,000 Equipment $ 34,000 $ 40,000 Accumulated Depreciation - equipment $ (12,000) $ (18,000) Total Assets $ 46,400 $ 50,000 Account Payable $ 3,500 $ 5,000 Wages and Salaries Payable $ 6,800 $ 5,500 Income taxes payable $ 1,200 $ 3,000 Dividends Payable $ 1,000 $ 2,500 Long-term Notes Payable $ 7,000 $ 22,000 Common shares $ 9,000 $ 10,000 Retained Earnings $ 17,900 $ 2,000 Total Liabilities & Shareholders' Equity $ 46,400 $ 50,000 ADMS 2500 Final Exam, Fall 2018 Additional Information: 1 2 3 Equipment that cost $10,000 was sold for a certain amount in cash New equipment was purchased during the year for $4,000 Dividends declared in 2018 totaled $4,500 48 Page 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started