Question

Luton Homes is a leading builder of luxury houses. Three years ago, Luton expanded its business by acquiring Clarity Homes, which gave Luton a significant

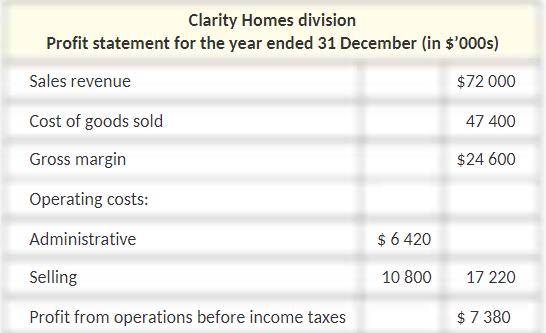

Investments made by Luton Homes and its Clarity division are expected to earn a minimum return of 15 per cent before income taxes. Clarity’s ROI has ranged from 19.3 to 22.1 per cent since it was acquired. Last year, Clarity considered an investment opportunity with an estimated ROI of 18 per cent. Clarity’s management decided against the investment because they believed it would decrease their overall ROI. Last year’s profit statement for Clarity is provided below. The division’s productive assets were $37 800 000 at year end, a 5 per cent increase over the prior year-end balance

Required:

1.Calculate the following performance measures for last year for the Clarity Homes division:

1.(a)return on investment (ROI)

2.(b)residual income.

2. Would the management of the Clarity Homes division have been more likely to accept the investment opportunity if residual income had been used as a performance measure instead of ROI? Explain your answer.

3. Construct an Excel spreadsheet to show how the answers to requirement 1 will change if: 1.

(a)profit from operations was $8 100 000 2.

(b)productive assets at year-end were $ 54,000,000.

Profit statement Sales revenue Cost of goods sold Gross margin Operating costs: Administrative Clarity Homes division for the year ended 31 December (in $'000s) $72 000 Selling Profit from operations before income taxes $ 6 420 10 800 47 400 $24 600 17 220 $ 7380

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

q31 Clarity Division is not likely going to invest in the new investment oppurtunity if ROI is used ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started