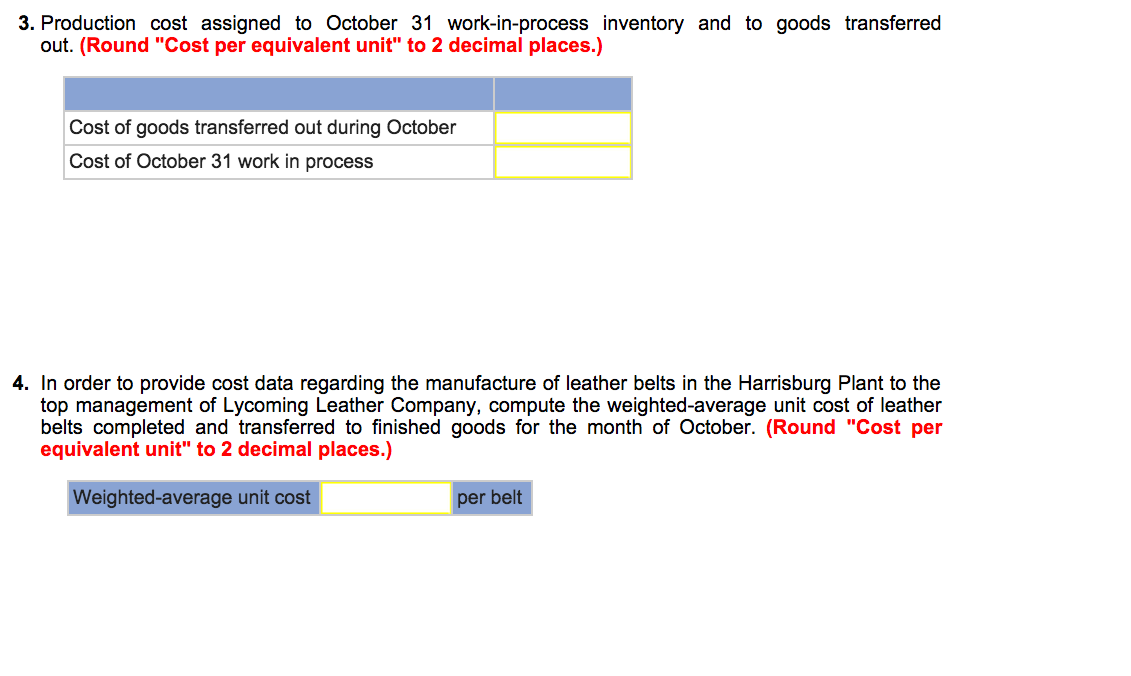

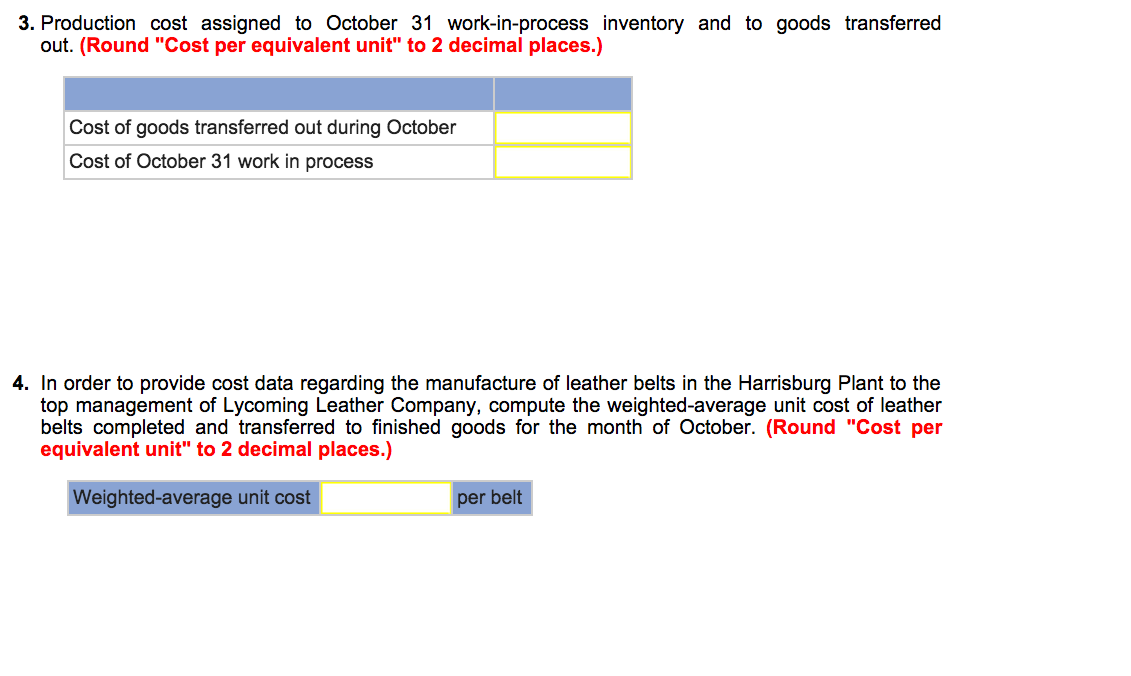

Lycoming Leather Company manufactures leather goods in central Pennsylvania. The company's profits have declined during the past nine months. In an attempt to isolate the causes of poor profit performance, management is investigating the manufacturing operations of each of its products. One of the company's main products is leather belts. The belts are produced in a single, continuous process in the Harrisburg Plant. During the process, leather strips are sewn, punched, and dyed. The belts then enter a final finishing stage to conclude the process. Labor and overhead are applied continuously during the manufacturing process. All materials, leather strips, and buckles are introduced at the beginning of the process. The firm uses the weighted-average method to calculate its unit costs. The leather belts produced at the Harrisburg Plant are sold wholesale for $9.80 each. Management wants to compare the current manufacturing costs per unit with the market prices for leather belts. Top management has asked the plant controller to submit data on the cost of manufacturing the leather belts for the month of October. These cost data will be used to determine whether modifications in the production process should be initiated or whether an increase in the selling price of the belts is justified. The cost per belt used for planning and control is $5.35. The work-in-process inventory consisted of 400 partially completed units on October 1. The belts were 25 percent complete as to conversion. The costs included in the inventory on October 1 were as follows: During October 7,400 leather strips and buckles were placed into production. A total of 6,900 leather belts were completed. The work-in-process inventory on October 31 consisted of 900 belts, which were 50 percent complete as to conversion. The costs charged to production during October were as follows: In order to provide cost data regarding the manufacture of leather belts in the Harrisburg Plant to the top management of Lycoming Leather Company, calculate the following. Equivalent units for material and conversion. Cost per equivalent unit of material and conversion. (Round "Cost per equivalent unit" to 2 decimal places.). 3. Production cost assigned to October 31 work-in-process inventory and to goods transferred out. (Round "Cost per equivalent unit" to 2 decimal places.). In order to provide cost data regarding the manufacture of leather belts in the Harrisburg Plant to the top management of Lycoming Leather Company, compute the weighted-average unit cost of leather belts completed and transferred to finished goods for the month of October. (Round "Cost per equivalent unit" to 2 decimal places.). Lycoming Leather Company manufactures leather goods in central Pennsylvania. The company's profits have declined during the past nine months. In an attempt to isolate the causes of poor profit performance, management is investigating the manufacturing operations of each of its products. One of the company's main products is leather belts. The belts are produced in a single, continuous process in the Harrisburg Plant. During the process, leather strips are sewn, punched, and dyed. The belts then enter a final finishing stage to conclude the process. Labor and overhead are applied continuously during the manufacturing process. All materials, leather strips, and buckles are introduced at the beginning of the process. The firm uses the weighted-average method to calculate its unit costs. The leather belts produced at the Harrisburg Plant are sold wholesale for $9.80 each. Management wants to compare the current manufacturing costs per unit with the market prices for leather belts. Top management has asked the plant controller to submit data on the cost of manufacturing the leather belts for the month of October. These cost data will be used to determine whether modifications in the production process should be initiated or whether an increase in the selling price of the belts is justified. The cost per belt used for planning and control is $5.35. The work-in-process inventory consisted of 400 partially completed units on October 1. The belts were 25 percent complete as to conversion. The costs included in the inventory on October 1 were as follows: During October 7,400 leather strips and buckles were placed into production. A total of 6,900 leather belts were completed. The work-in-process inventory on October 31 consisted of 900 belts, which were 50 percent complete as to conversion. The costs charged to production during October were as follows: In order to provide cost data regarding the manufacture of leather belts in the Harrisburg Plant to the top management of Lycoming Leather Company, calculate the following. Equivalent units for material and conversion. Cost per equivalent unit of material and conversion. (Round "Cost per equivalent unit" to 2 decimal places.). 3. Production cost assigned to October 31 work-in-process inventory and to goods transferred out. (Round "Cost per equivalent unit" to 2 decimal places.). In order to provide cost data regarding the manufacture of leather belts in the Harrisburg Plant to the top management of Lycoming Leather Company, compute the weighted-average unit cost of leather belts completed and transferred to finished goods for the month of October. (Round "Cost per equivalent unit" to 2 decimal places.)