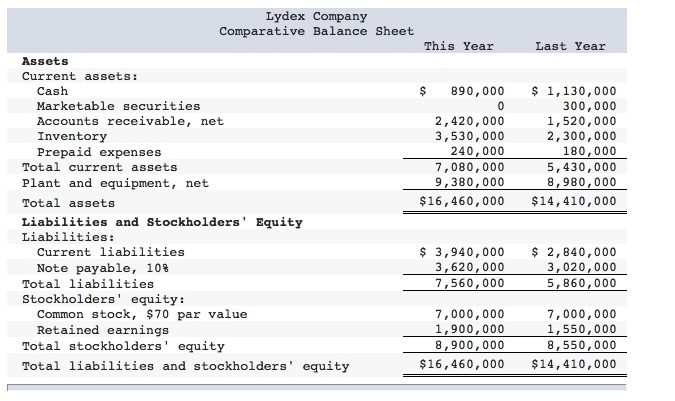

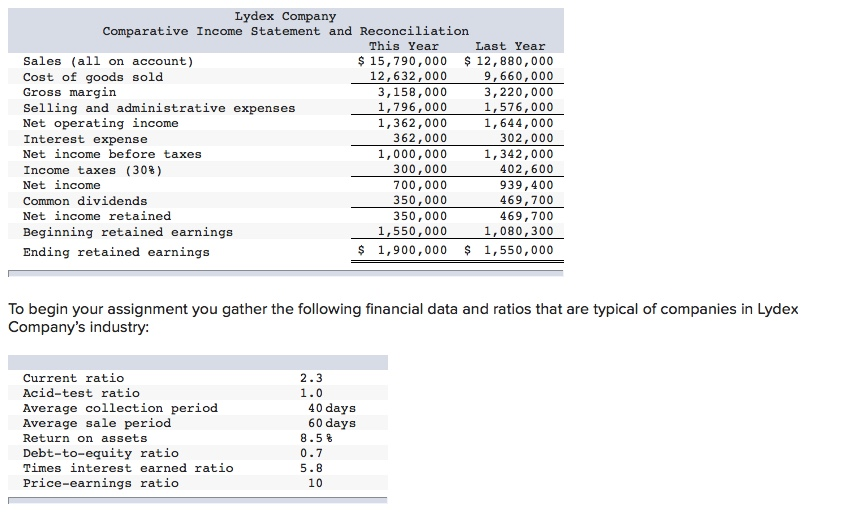

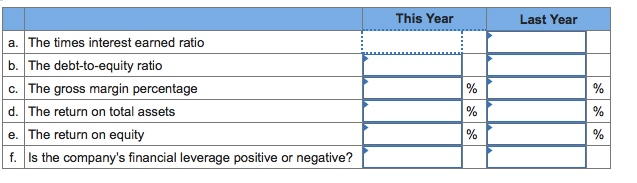

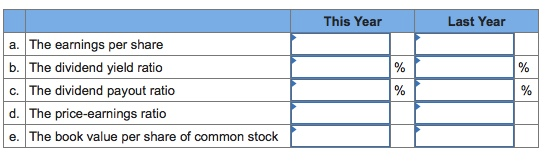

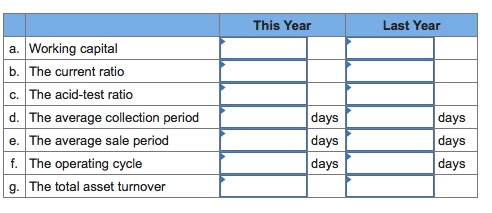

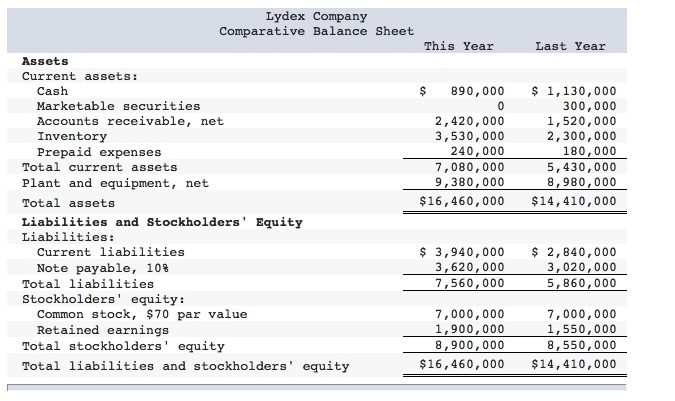

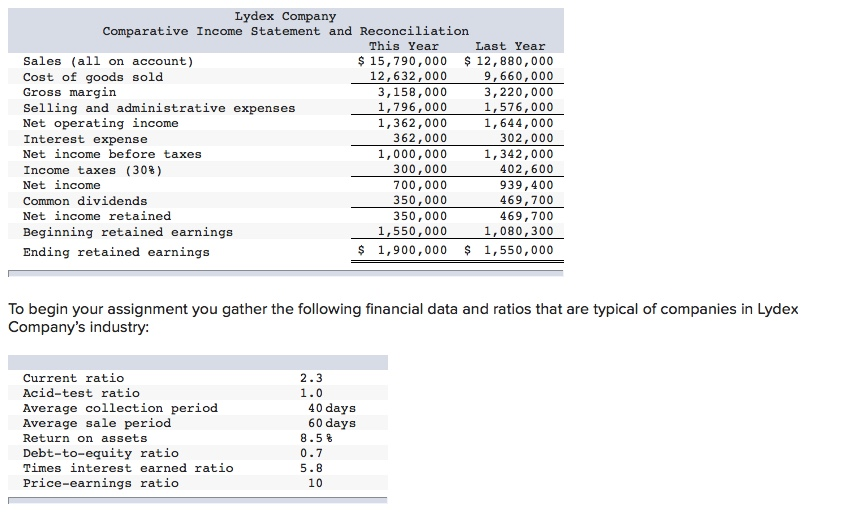

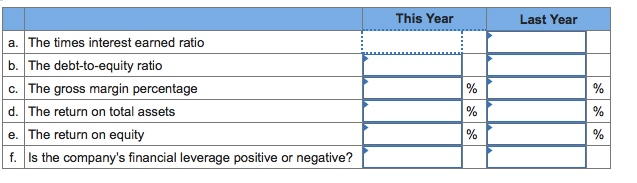

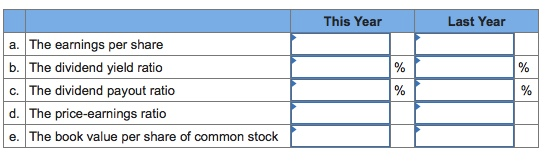

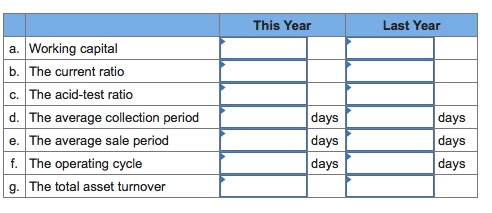

Lydex Company Comparative Balance Sheet This Year Last Year $ 890,000 0 2,420,000 3,530,000 240,000 7,080,000 9,380,000 $16,460,000 $ 1,130,000 300,000 1,520,000 2,300,000 180,000 5,430,000 8,980,000 $14,410,000 Assets Current assets: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities: Current liabilities Note payable, 10% Total liabilities Stockholders' equity: Common stock, $70 par value Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 3,940,000 3,620,000 7,560,000 $ 2,840,000 3,020,000 5,860,000 7,000,000 1,900,000 8,900,000 $16,460,000 7,000,000 1,550,000 8,550,000 $14,410,000 Lydex Company Comparative Income Statement and Reconciliation This Year Last Year Sales (all on account) $ 15,790,000 $ 12,880,000 Cost of goods sold 12,632,000 9,660,000 Gross margin 3,158,000 3,220,000 Selling and administrative expenses 1,796,000 1,576,000 Net operating income 1,362,000 1,644,000 Interest expense 362,000 302,000 Net income before taxes 1,000,000 1,342,000 Income taxes (30%) 300,000 402,600 Net income 700,000 939,400 Common dividends 350,000 469, 700 Net income retained 350,000 469,700 Beginning retained earnings 1,550,000 1,080,300 Ending retained earnings $ 1,900,000 $ 1,550,000 To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry: Current ratio Acid-test ratio Average collection period Average sale period Return on assets Debt-to-equity ratio Times interest earned ratio Price-earnings ratio 2.3 1.0 40 days 60 days 8.5% 0.7 5.8 10 This Year Last Year % a. The times interest earned ratio b. The debt-to-equity ratio c. The gross margin percentage d. The return on total assets e. The return on equity f. Is the company's financial leverage positive or negative? % % % % % This Year Last Year % % a. The earnings per share b. The dividend yield ratio c. The dividend payout ratio d. The price-earnings ratio e. The book value per share of common stock % % This Year Last Year a. Working capital b. The current ratio c. The acid-test ratio d. The average collection period e. The average sale period f. The operating cycle 9. The total asset turnover days days days days days days