Question

Lynda is a manager of an investment center. Her division has been performing below expectations recently because one of its larger projects has not been

Lynda is a manager of an investment center. Her division has been performing below expectations recently because one of its larger projects has not been as successful as anticipated.

Given the poor performance of her division, Lynda is facing pressure to improve her results. In particular, Lynda has been informed that her division's ROI (which was only about 9% last year) must improve significantly in order for her to retain her position as manager.

If Lynda does not make any changes, she believes next year's performance will be similar to the previous year. Specifically, Lynda's division will have a net asset base of $530,000 and expected operating income of $47,700.

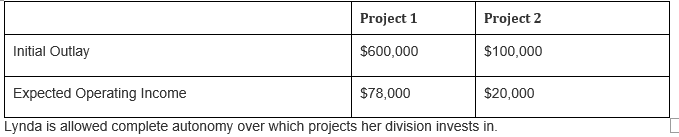

While evaluating how to proceed, Lynda determines that discontinuing any of the ongoing projects is not a viable option. She discovers, however, the opportunity to invest in two additional, independent projects. Both potential projects will only last one year and any assets purchased with the initial outlay are expected to have zero salvage value at the end of the year. Specific details regarding each project follow:

Initial Outlay Project 1 Project 2 $600,000 $100,000 $78,000 $20,000 Expected Operating Income Lynda is allowed complete autonomy over which projects her division invests in.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Return on Investment Operating Income Net Assets 47700 530000 9 Evaluation of Project 1 Initial Outl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started