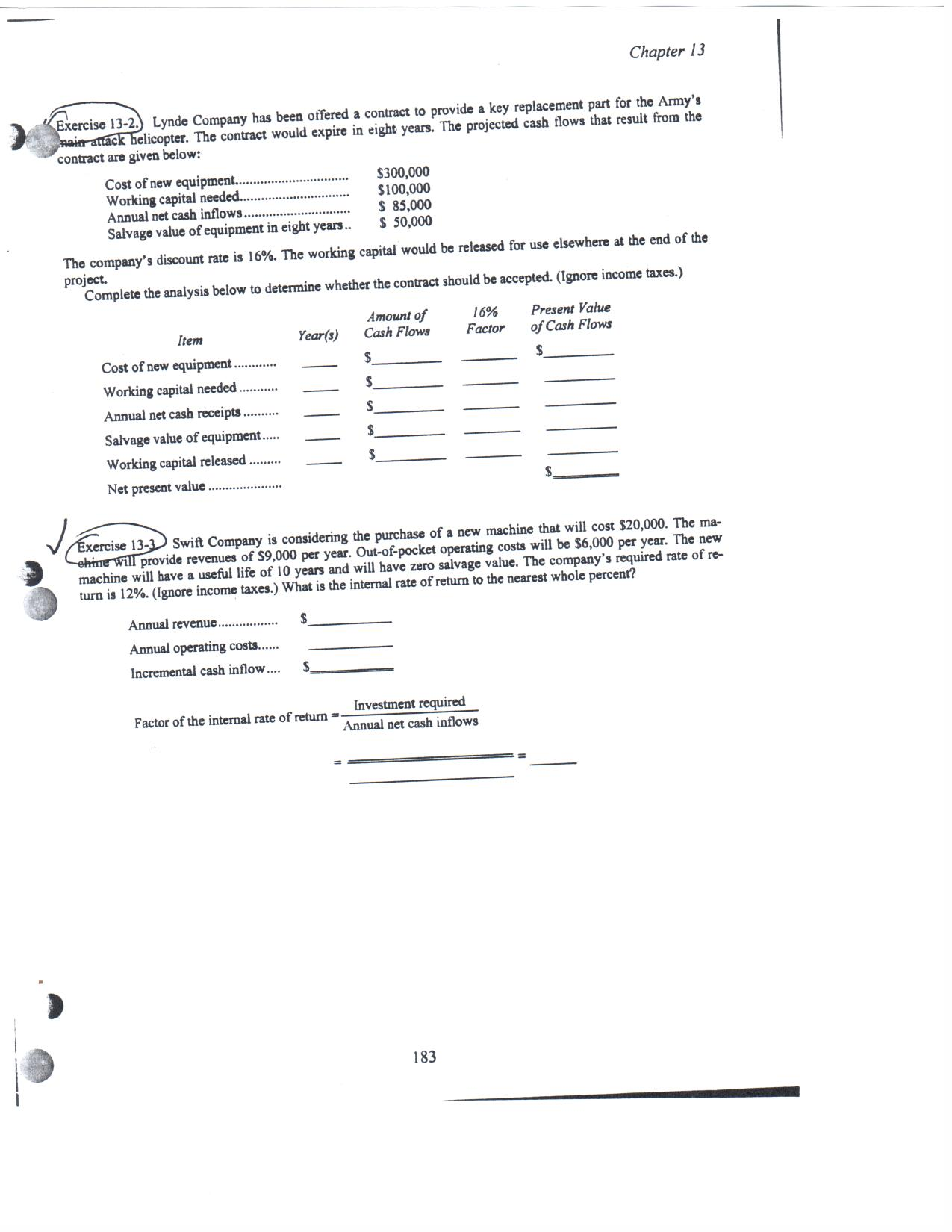

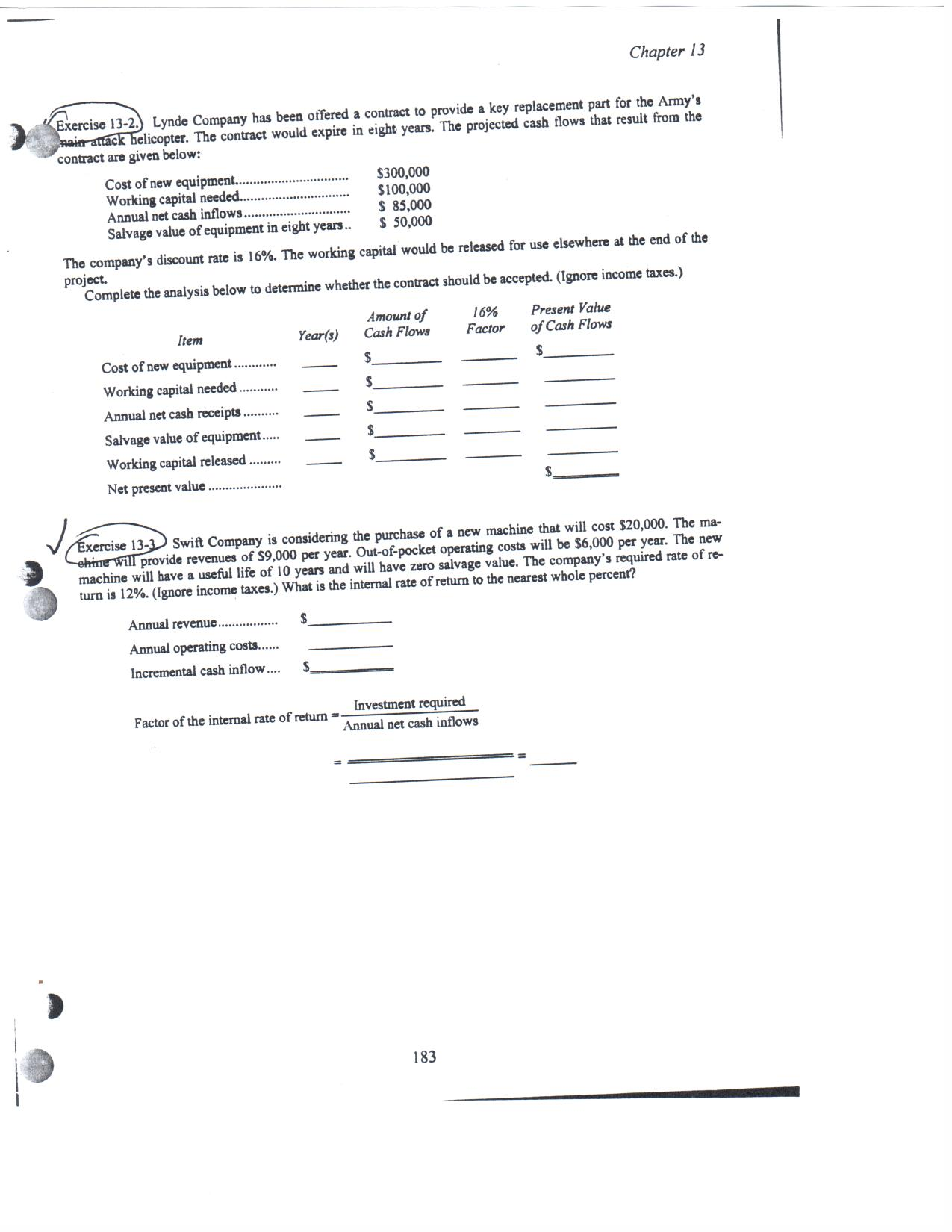

Lynde Company has been offered a contract to provide a key replacement part for the Army's main attack helicopter. The contract would expire in eight years. The projected cash flows that result from the contract are given below: are given below: Cost of new equipment..................... $300,000 Working capital needed....................$100,000 Annual net cash inflows........ $ 85,000 Salvage value of equipment m eight years.$ 50,000 The company's discount rate is 16%. The working capital would be released for use elsewhere at the end of the project. Complete the analysis below to determine whether the contract should be accepted. (Ignore income taxes.) Swift Company is considering the purchase of a new machine that will cost $20,000. The machine will provide revenues of $9,000 per year. Out-of-pocket operating costs will be $6,000 per year. The new machine will have a useful life of 10 years and will have zero salvage value. The company's required rate of return is 12%. (Ignore income taxes.) What is the internal rate of return to the nearest whole percent? Annual revenue.$ Annual operating costs.$ Incremental cash inflow.$ Factor of the internal rate of return = Investment required/Annual net cash inflows Lynde Company has been offered a contract to provide a key replacement part for the Army's main attack helicopter. The contract would expire in eight years. The projected cash flows that result from the contract are given below: are given below: Cost of new equipment..................... $300,000 Working capital needed....................$100,000 Annual net cash inflows........ $ 85,000 Salvage value of equipment m eight years.$ 50,000 The company's discount rate is 16%. The working capital would be released for use elsewhere at the end of the project. Complete the analysis below to determine whether the contract should be accepted. (Ignore income taxes.) Swift Company is considering the purchase of a new machine that will cost $20,000. The machine will provide revenues of $9,000 per year. Out-of-pocket operating costs will be $6,000 per year. The new machine will have a useful life of 10 years and will have zero salvage value. The company's required rate of return is 12%. (Ignore income taxes.) What is the internal rate of return to the nearest whole percent? Annual revenue.$ Annual operating costs.$ Incremental cash inflow.$ Factor of the internal rate of return = Investment required/Annual net cash inflows