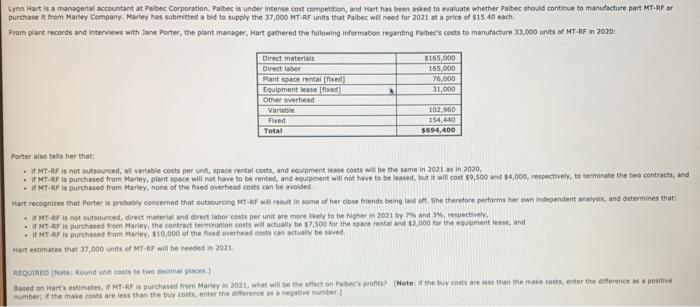

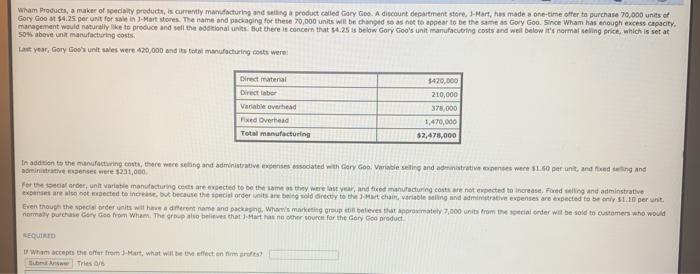

Lynn Hart is a managerial accountant at Pabec Corporation. Palbec is under intense cost competition, and Hart has been asked to evaluate whether Palbec should continue to manufacture part MT-RF or purchase it from Marley Company. Marley has submitted a bid to supply the 37,000 MT-RF units that Palbec will need for 2021 at a price of $15.40 each From plant records and interviews with Jane Porter, the plant manager, Hart gathered the following information regarding Paibee's costs to manufacture 33,000 units of MT-RF in 2020: $165.000 165,000 76,000 31,000 Direct materiais Director Plant space rental (ned) Equipment leased Other Overhead Variable Fived Total 102,960 154.440 $694,400 Porter also tells her that - MT RF is not outsourced, all variable costs per unit, space rental costs, and intense costs will be the same in 2021 as in 2020, INTRF is purchased from Marley, blot space will not have to be rented, and equipment will not have to be leated, but it will cost $9.500 and 14,000, respectively, to terminate the two contracts, and . INT. is purchased from Marley, none of the fived overhead costs can be avoided Hurt recognizes that Porter is probably concerned that outsourcing HT-RF il rest in some of her close friends being wort. She therefore performs her ww independent analysis and determines that: MT. Is not outsourced direct material and direct labor costs per unit are more likely to be higher in 2021 by and respectively IMT AF is purchased from Marley, the contract termination costs will actually the $7,500 for the space and $2,000 for the mentand If MT. RF is purchased from Marley, $10,000 of the fived overhead costs actually be saved Hart estimates that 37,000 units of MTF will beneded in 2021 REQUIRED IN Roundunt cost two decimalla Based on Hart's estimates, if MTRFs purchased from Maryi 2021, what will be the effect on beprot (Note: If you are than the make costs, enter the difference positive number if the make contre less than the buy costs, enter the difference avenue Wham Products, a maker of specialty products, is currently manufacturing and sing product called Gary Goo. A discount department store, 1. Hart, has made a one-time offer to purchase 70,000 units of Gory Goo 4.25 per ut for sale in 1-Martstores. The name and packaging for these 70,000 units will be changed so as not to appear to be the same as Gory Goo. Since Wham has enough excess capacity management would naturally ke to produce and sell the additional units. But there is concern that $4.25 is below Gary Goo's unit manufacuting costs and well below it's normal selling price, which is set at 50% above unit manufacturing costs. Last year, Gory Goo's unit sales were 420,000 and it to manufacturing costs were: $420,000 210,000 Direct material Director Variable overhead Fixed Overhead Total manufacturing 378,000 1.470,000 $2,478,000 In addition to the manufacturing costs, there were seling and administrative des sociated with Gary Goswa seling and stratives were 1.60 per unit, and feeding and administrative expenses were 231,000 For the order, unitati manufacturing cots are sected to be the same as they were stranded manufacturing costs are not rected to increase Foxed selling and administrative repected to increase but because the social orders are sold incy to the chain, variable selling and administrative expenses are expected to be only $1.10 per unit Even thoug the secretarder units will have different name and packaging Who's marketing group levestat approximately 7,000 units from the special order wit be sold to customers who would nomaly purchase Go Go from Wham The believes that has no other source for the Gary Go product SEQUERID Wham accept the offer from Hart, what will be effect on Tries/