Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Lynnwood Corporation purchased equipment on December 30, 2019 at a cost of $140,000. Lynnwood then leased the equipment to the Washington Company on January

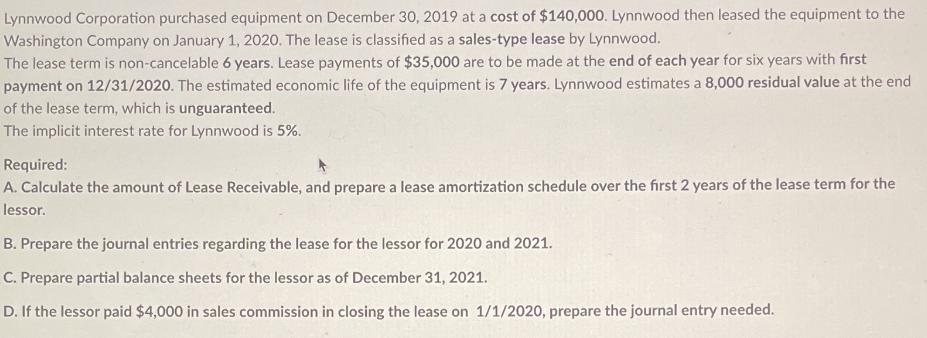

Lynnwood Corporation purchased equipment on December 30, 2019 at a cost of $140,000. Lynnwood then leased the equipment to the Washington Company on January 1, 2020. The lease is classified as a sales-type lease by Lynnwood. The lease term is non-cancelable 6 years. Lease payments of $35,000 are to be made at the end of each year for six years with first payment on 12/31/2020. The estimated economic life of the equipment is 7 years. Lynnwood estimates a 8,000 residual value at the end of the lease term, which is unguaranteed. The implicit interest rate for Lynnwood is 5%. Required: A. Calculate the amount of Lease Receivable, and prepare a lease amortization schedule over the first 2 years of the lease term for the lessor. B. Prepare the journal entries regarding the lease for the lessor for 2020 and 2021. C. Prepare partial balance sheets for the lessor as of December 31, 2021. D. If the lessor paid $4,000 in sales commission in closing the lease on 1/1/2020, prepare the journal entry needed.

Step by Step Solution

★★★★★

3.35 Rating (179 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started