Answered step by step

Verified Expert Solution

Question

1 Approved Answer

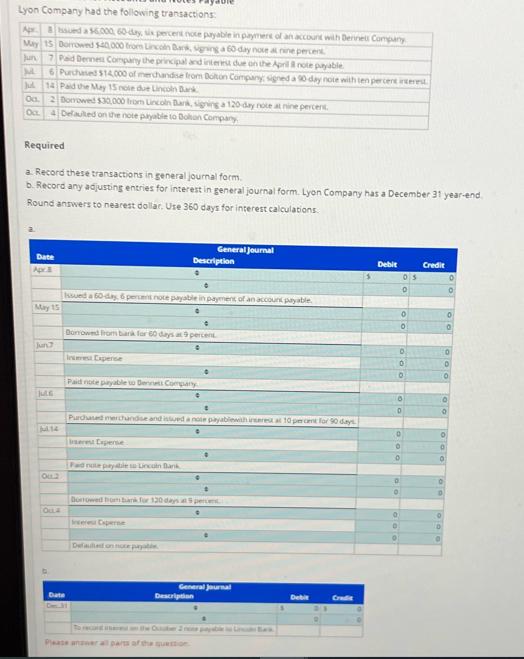

Lyon Company had the following transactions: Apr 8ssued a $5,000, 60-day, six percent note payable in payment of an account with Dernets Company May

Lyon Company had the following transactions: Apr 8ssued a $5,000, 60-day, six percent note payable in payment of an account with Dernets Company May 15 Dorrowed $40,000 from Lincoln Bank, signing a 60-day nove at nine percent Jun 7 Paid Denness Company the principal and interest due on the April 8 note payable M 6 Purchased $14,000 of merchandise from Bolton Company signed a 90 day note with ten percent interest Jul 14 Paid the May 15 nole due Lincoln Bank Oa. 2 Borrowed $30,000 from Lincoln Bank, signing a 120-day note at nine percent Oct 4 Defaulted on the note payable to Bolton Company Required a. Record these transactions in general journal form. b. Record any adjusting entries for interest in general journal form. Lyon Company has a December 31 year-end Round answers to nearest dollar. Use 360 days for interest calculations. Date Apr May 15 Jun JULE OLL2 OLLA Issued a 60-day, 6 percent note payable in payment of an account payable Date # Borrowed from bank for 60 days at 9 percent Iniest Expense Paid note payable to Dents Company Purchased merchandise and issued a note payablewith interest at 10 percent for 90 days erest Expense General Journal Description Paid not payable to Lincoln Bank Borrowed from bank for 120 days at 5 percent Insert Caperne Defaulled on note payabl General Journal Description Please answer all parts of the question Debit Credit $ Debit 0 0 D 0 0 10 0 0 O 0 0 D 0 0 0. 0 Credit 0 0 0 D O O 0 D 0

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Journal entry date account and explanation Debit Credit Apr 8 Acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started