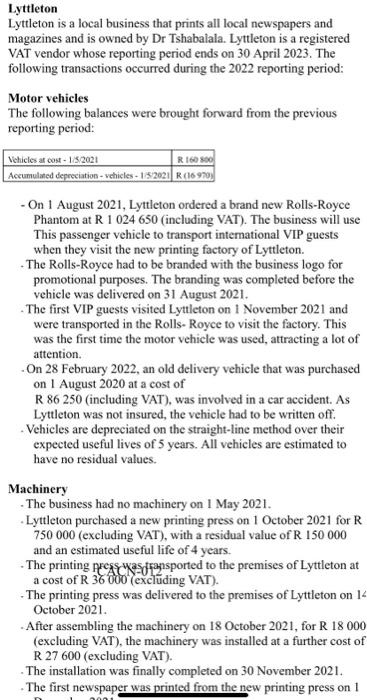

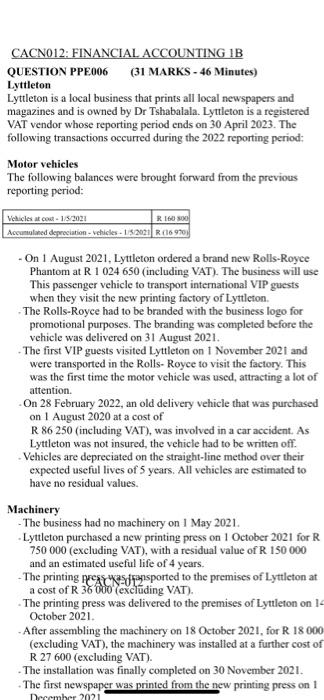

Lyttleton Lyttleton is a local business that prints all local newspapers and magazines and is owned by Dr Tshabalala. Lyttleton is a registered VAT vendor whose reporting period ends on 30 April 2023. The following transactions occurred during the 2022 reporting period: Motor vehicles The following balances were brought forward from the previous reporting period: - On 1 August 2021, Lyttleton ordered a brand new Rolls-Royce Phantom at R 1024650 (including VAT). The business will use This passenger vehicle to transport international VIP guests when they visit the new printing factory of Lyttleton. - The Rolls-Royce had to be branded with the business logo for promotional purposes. The branding was completed before the vehicle was delivered on 31 August 2021. - The first VIP guests visited Lyttleton on 1 November 2021 and were transported in the Rolls- Royce to visit the factory. This was the first time the motor vehicle was used, attracting a lot of attention. - On 28 February 2022 , an old delivery vehicle that was purchased on 1 August 2020 at a cost of R 86250 (including VAT), was involved in a car accident. As Lyttleton was not insured, the vehicle had to be written off. -Vehicles are depreciated on the straight-line method over their expected useful lives of 5 years. All vehicles are estimated to have no residual values. Machinery - The business had no machinery on 1 May 2021. - Lyttleton purchased a new printing press on 1 October 2021 for R 750000 (excluding VAT), with a residual value of R 150000 and an estimated useful life of 4 years. - The printing presscyas dfansported to the premises of Lyttleton at a cost of R 36000 (excluding VAT). - The printing press was delivered to the premises of Lyttleton on 14 October 2021. -After assembling the machinery on 18 October 2021, for R 18000 (excluding VAT), the machinery was installed at a further cost of R 27600 (excluding VAT). - The installation was finally completed on 30 November 2021 . Lyttleton Lyttleton is a local business that prints all local newspapers and magazines and is owned by Dr Tshabalala. Lyttleton is a registered VAT vendor whose reporting period ends on 30 April 2023. The following transactions occurred during the 2022 reporting period: Motor vehicles The following balances were brought forward from the previous reporting period: - On 1 August 2021, Lyttleton ordered a brand new Rolls-Royce Phantom at R 1024650 (including VAT). The business will use This passenger vehicle to transport international VIP guests when they visit the new printing factory of Lyttleton. - The Rolls-Royce had to be branded with the business logo for promotional purposes. The branding was completed before the vehicle was delivered on 31 August 2021. - The first VIP guests visited Lyttleton on 1 November 2021 and were transported in the Rolls- Royce to visit the factory. This was the first time the motor vehicle was used, attracting a lot of attention. - On 28 February 2022 , an old delivery vehicle that was purchased on 1 August 2020 at a cost of R 86250 (including VAT), was involved in a car accident. As Lyttleton was not insured, the vehicle had to be written off. -Vehicles are depreciated on the straight-line method over their expected useful lives of 5 years. All vehicles are estimated to have no residual values. Machinery - The business had no machinery on 1 May 2021. - Lyttleton purchased a new printing press on 1 October 2021 for R 750000 (excluding VAT), with a residual value of R 150000 and an estimated useful life of 4 years. - The printing presscyas dfansported to the premises of Lyttleton at a cost of R 36000 (excluding VAT). - The printing press was delivered to the premises of Lyttleton on 14 October 2021. -After assembling the machinery on 18 October 2021, for R 18000 (excluding VAT), the machinery was installed at a further cost of R 27600 (excluding VAT). - The installation was finally completed on 30 November 2021