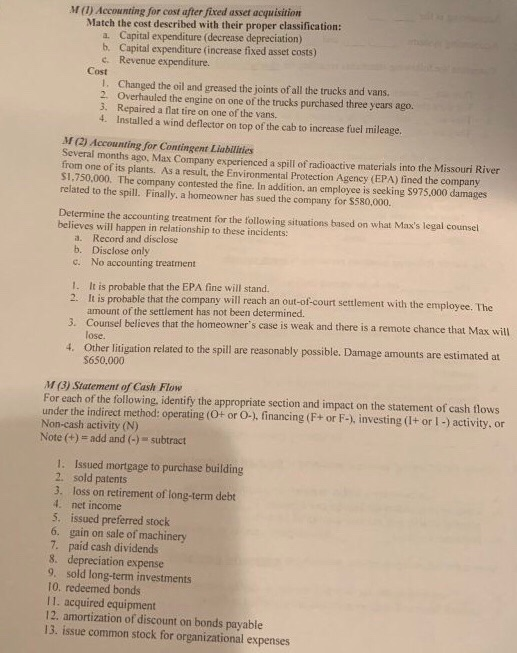

M (1) Accounting for cost after fixed asset acquisition Match the cost described with their proper classification: a. Capital expenditure (decrease depreciation) b. Capital expenditure (increase fixed asset costs) c. Revenue expenditure. Cost I. Changed the oil and greased the joints of all the trucks and vans. 2 Overhauled the engine on one of the trucks purchased three years ago. 3. Repaired a flat tire on one of the vans. 4. Installed a wind deflector on top of the cab to increase fuel mileage M (2) Accounting for Contingent Liabilities Several months ago, Max Company experienced a spill of radioactive materials into the Missouri River from one of its plants. As a result, the Environmental Protection Agency (EPA) fined the company S1.750,000. The company contested the fine. In addition, an employee is seeking $975.000 damages related to the spill. Finally, a homeowner has sued the company for $580,000. Determine the accounting treatment for the following situations based on what Max's legal counsel believes will happen in relationship to these incidents: Record and disclose Disclose only No accounting treatment a. b. c. It is probable that the EPA fine will stand. It is probabl amount of the settlement has not been determined. Counsel believes that the homeowner' lose. Other litigation related to the spillare reasonably possible. Damage amounts are estimated at $650,000 1. le that the company will reach an out-of-court settlement with the employee. The 2. 3. 4. s case is weak and there is a remote chance that Max will M (3) Statement of Cash Flow For each of the following, identify the appropriate section and impact on the statement of cash flows under the indirect method: operating (O+ or O-, financing (F+ or F-), investing (I+ or I-) activity, or Non-cash activity (N) Note (+)- add and () subtract 1. Issued mortgage to purchase building 2. sold patents 3. loss on retirement of Iong-term debt 4. net income 5, issued preferred stoclk 6. gain on sale of machinery 7. paid cash dividends 8. depreciation expense 9. sold long-term investments 10. redeemed bonds 11. acquired equipment 12. amortization of discount on bonds payable 13. issue common stock for organizational expenses