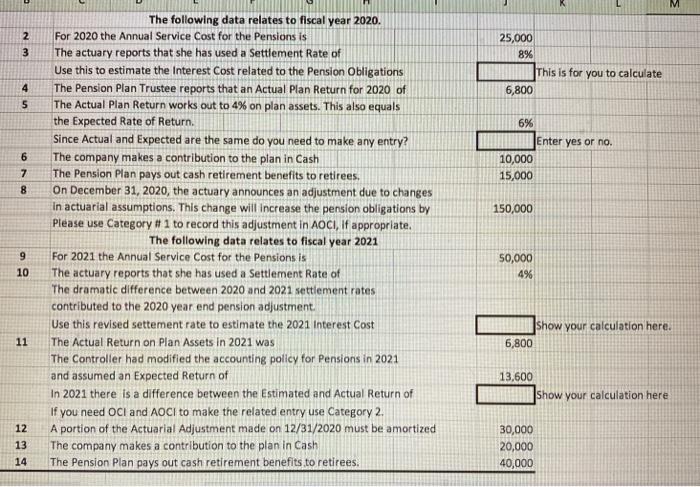

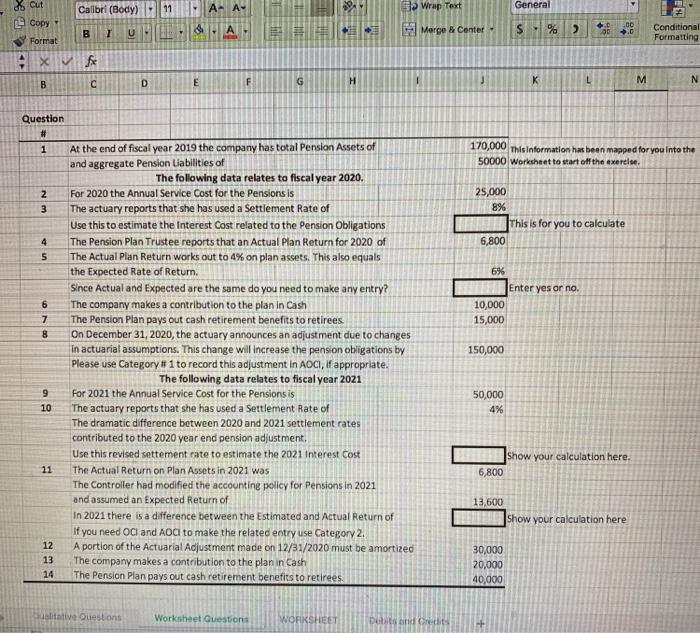

M 2 3 25,000 8% This is for you to calculate 6,800 4 5 6% 6 7 8 Enter yes or no. 10,000 15,000 150,000 The following data relates to fiscal year 2020. For 2020 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of Use this to estimate the Interest Cost related to the Pension Obligations The Pension Plan Trustee reports that an Actual Plan Return for 2020 of The Actual Plan Return works out to 4% on plan assets. This also equals the Expected Rate of Return. Since Actual and Expected are the same do you need to make any entry? The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. On December 31, 2020, the actuary announces an adjustment due to changes In actuarial assumptions. This change will increase the pension obligations by Please use Category # 1 to record this adjustment in AOCI, If appropriate. The following data relates to fiscal year 2021 For 2021 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of The dramatic difference between 2020 and 2021 settlement rates contributed to the 2020 year end pension adjustment Use this revised settement rate to estimate the 2021 Interest Cost The Actual Return on Plan Assets in 2021 was The Controller had modified the accounting policy for Pensions in 2021 and assumed an Expected Return of In 2021 there is a difference between the Estimated and Actual Return of If you need OCI and AOCI to make the related entry use Category 2. A portion of the Actuarial Adjustment made on 12/31/2020 must be amortized The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. 9 10 50,000 4% show your calculation here. 6,800 11 13,600 show your calculation here 12 13 14 30,000 20,000 40,000 Calibri (Body) 11 A A 3 Wrap Text Xcut Copy General HA % T S Merge & Center 2 B U ,00 .0 OD Conditional Formatting Format 4 x fx B D E F G L H M K N 1 170,000 This information has been mapped for you into the 50000 Worksheet to start off the exercise 2 3 25,000 8% This is for you to calculate 6,800 4 5 6% Enter yes or no. 10,000 15,000 6 7 8 Question # At the end of fiscal year 2019 the company has total Pension Assets of and aggregate Pension Liabilities of The following data relates to fiscal year 2020. For 2020 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of Use this to estimate the Interest Cost related to the Pension Obligations The Pension Plan Trustee reports that an Actual Plan Return for 2020 of The Actual Plan Return works out to 4% on plan assets. This also equals the Expected Rate of Return. Since Actual and Expected are the same do you need to make any entry? The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. On December 31, 2020, the actuary announces an adjustment due to changes In actuarial assumptions. This change will increase the pension obligations by Please use Category# 1 to record this adjustment in AOCI, If appropriate. The following data relates to fiscal year 2021 For 2021 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of The dramatic difference between 2020 and 2021 settlement rates contributed to the 2020 year end pension adjustment, Use this revised settement rate to estimate the 2021 Interest Cost The Actual Return on Plan Assets in 2021 was The Controller had modified the accounting policy for Pensions in 2021 and assumed an expected Return of In 2021 there is a difference between the Estimated and actual Return of If you need OCI and AOCI to make the related entry use Category 2. A portion of the Actuarial Adjustment made on 12/31/2020 must be amortized The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees 150,000 9 10 50,000 4% Show your calculation here. 11 6,800 13,600 show your calculation here NAS 30,000 20,000 40,000 Stative Questions Worksheet Question WOFIKSHEET Duits M 2 3 25,000 8% This is for you to calculate 6,800 4 5 6% 6 7 8 Enter yes or no. 10,000 15,000 150,000 The following data relates to fiscal year 2020. For 2020 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of Use this to estimate the Interest Cost related to the Pension Obligations The Pension Plan Trustee reports that an Actual Plan Return for 2020 of The Actual Plan Return works out to 4% on plan assets. This also equals the Expected Rate of Return. Since Actual and Expected are the same do you need to make any entry? The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. On December 31, 2020, the actuary announces an adjustment due to changes In actuarial assumptions. This change will increase the pension obligations by Please use Category # 1 to record this adjustment in AOCI, If appropriate. The following data relates to fiscal year 2021 For 2021 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of The dramatic difference between 2020 and 2021 settlement rates contributed to the 2020 year end pension adjustment Use this revised settement rate to estimate the 2021 Interest Cost The Actual Return on Plan Assets in 2021 was The Controller had modified the accounting policy for Pensions in 2021 and assumed an Expected Return of In 2021 there is a difference between the Estimated and Actual Return of If you need OCI and AOCI to make the related entry use Category 2. A portion of the Actuarial Adjustment made on 12/31/2020 must be amortized The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. 9 10 50,000 4% show your calculation here. 6,800 11 13,600 show your calculation here 12 13 14 30,000 20,000 40,000 Calibri (Body) 11 A A 3 Wrap Text Xcut Copy General HA % T S Merge & Center 2 B U ,00 .0 OD Conditional Formatting Format 4 x fx B D E F G L H M K N 1 170,000 This information has been mapped for you into the 50000 Worksheet to start off the exercise 2 3 25,000 8% This is for you to calculate 6,800 4 5 6% Enter yes or no. 10,000 15,000 6 7 8 Question # At the end of fiscal year 2019 the company has total Pension Assets of and aggregate Pension Liabilities of The following data relates to fiscal year 2020. For 2020 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of Use this to estimate the Interest Cost related to the Pension Obligations The Pension Plan Trustee reports that an Actual Plan Return for 2020 of The Actual Plan Return works out to 4% on plan assets. This also equals the Expected Rate of Return. Since Actual and Expected are the same do you need to make any entry? The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees. On December 31, 2020, the actuary announces an adjustment due to changes In actuarial assumptions. This change will increase the pension obligations by Please use Category# 1 to record this adjustment in AOCI, If appropriate. The following data relates to fiscal year 2021 For 2021 the Annual Service Cost for the Pensions is The actuary reports that she has used a Settlement Rate of The dramatic difference between 2020 and 2021 settlement rates contributed to the 2020 year end pension adjustment, Use this revised settement rate to estimate the 2021 Interest Cost The Actual Return on Plan Assets in 2021 was The Controller had modified the accounting policy for Pensions in 2021 and assumed an expected Return of In 2021 there is a difference between the Estimated and actual Return of If you need OCI and AOCI to make the related entry use Category 2. A portion of the Actuarial Adjustment made on 12/31/2020 must be amortized The company makes a contribution to the plan in Cash The Pension Plan pays out cash retirement benefits to retirees 150,000 9 10 50,000 4% Show your calculation here. 11 6,800 13,600 show your calculation here NAS 30,000 20,000 40,000 Stative Questions Worksheet Question WOFIKSHEET Duits