Answered step by step

Verified Expert Solution

Question

1 Approved Answer

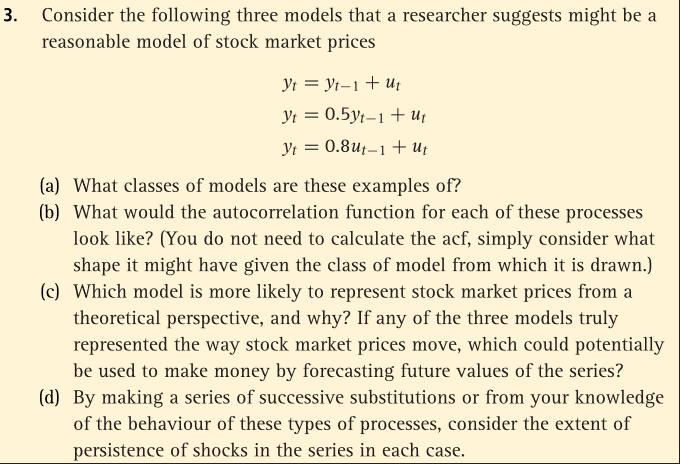

m Consider the following three models that a researcher suggests might be a reasonable model of stock market prices Yt=y1-1 + Ut yt 0.5yt

m Consider the following three models that a researcher suggests might be a reasonable model of stock market prices Yt=y1-1 + Ut yt 0.5yt 1+u y = 0.8ut-1+ ut (a) What classes of models are these examples of? (b) What would the autocorrelation function for each of these processes look like? (You do not need to calculate the acf, simply consider what shape it might have given the class of model from which it is drawn.) (c) Which model is more likely to represent stock market prices from a theoretical perspective, and why? If any of the three models truly represented the way stock market prices move, which could potentially be used to make money by forecasting future values of the series? (d) By making a series of successive substitutions or from your knowledge of the behaviour of these types of processes, consider the extent of persistence of shocks in the series in each case.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started