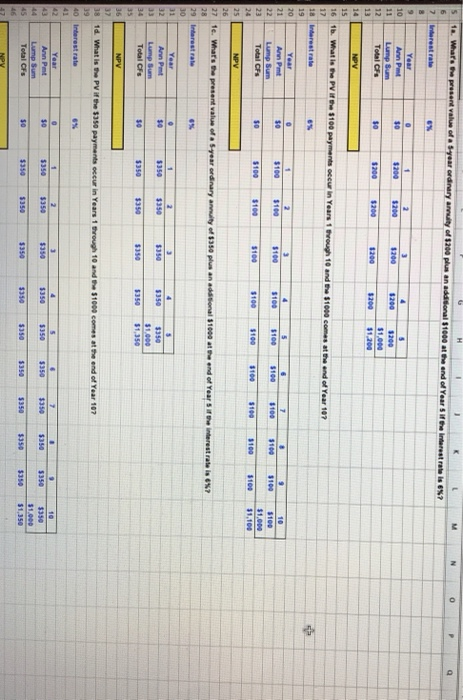

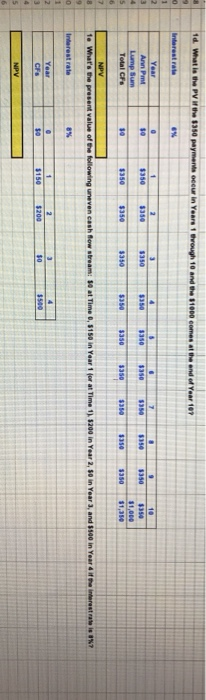

M N H 10. What's the present value of a year ordinary annuity of $200 plus an additional $1000 at the end of Year she Interest rate is ? Interest rate 0 7 2 os + 10 $100 $1.000 31,100 9 Year 0 1 3 5 10 Ann Pet 30 $200 5200 8200 1200 11 Lumpsum 1200 12 Total CFS $1,000 SO 5200 5200 1200 13 5200 $1,200 14 NPV 15 16 1. What is the PV of the 100 payments occur in Years 1 rough 10 and the $1000 comes at the end of Year 107 17 18 estrate 19 20 Year O 2 3 5 6 7 . 21 Au Pmt so 9 $100 $100 $100 $100 1100 22 Lump Sum $100 $100 23 Total CF $0 $100 $100 3100 $100 $100 $100 $100 3100 24 1100 25 NPV 26 27 te Whar's the present value of a year ordinary annuity of $350 plus an additional $1000 at the end of Years of the interest rate is ? 28 29 Interest rate 30 31 Year 1 2 3 4 5 32 Ann Pet $350 $350 $350 $350 Lumpun 51.000 34 Total CFS 30 $350 $350 $350 $350 $1,350 35 36 NPV 37 38 10. What is the PV if the $350 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 107 39 40 Interest rate 6.8 5 42 43 44 0 50 1 $350 4 $350 $350 6 $350 7 $350 . $350 Year Ann Pet Lump Sum Total CFS $350 $350 30 $350 $350 $350 $310 $350 $1.000 $1,350 5350 $350 $350 46 10. What is the PV the $350 paymeria occur in Years 1 through 10 and the $1000 comes at the end of Year 10% Interest rate 2 0 1 2 Year Ann Pm Lumpsum Total CF 30 1 $350 2 $350 3 $350 4 $350 8 3350 . $350 7 $350 a 3350 . $350 10 $350 30 $350 $350 $350 $350 3350 3350 $350 $350 $350 $1,350 5 -6 7 NPV 1e What's the present value of the following uneven cash flow stream: 50 at Time 0, 5150 in Year 1 for at Time 1). 5200 in Year 2,10 in Years, and so in Year of the interest rates X7 Interest rate 8% 9 0 1 2 3 1 Year CFS 2 $200 3 10 4 S500 $0 5 NPV M N H 10. What's the present value of a year ordinary annuity of $200 plus an additional $1000 at the end of Year she Interest rate is ? Interest rate 0 7 2 os + 10 $100 $1.000 31,100 9 Year 0 1 3 5 10 Ann Pet 30 $200 5200 8200 1200 11 Lumpsum 1200 12 Total CFS $1,000 SO 5200 5200 1200 13 5200 $1,200 14 NPV 15 16 1. What is the PV of the 100 payments occur in Years 1 rough 10 and the $1000 comes at the end of Year 107 17 18 estrate 19 20 Year O 2 3 5 6 7 . 21 Au Pmt so 9 $100 $100 $100 $100 1100 22 Lump Sum $100 $100 23 Total CF $0 $100 $100 3100 $100 $100 $100 $100 3100 24 1100 25 NPV 26 27 te Whar's the present value of a year ordinary annuity of $350 plus an additional $1000 at the end of Years of the interest rate is ? 28 29 Interest rate 30 31 Year 1 2 3 4 5 32 Ann Pet $350 $350 $350 $350 Lumpun 51.000 34 Total CFS 30 $350 $350 $350 $350 $1,350 35 36 NPV 37 38 10. What is the PV if the $350 payments occur in Years 1 through 10 and the $1000 comes at the end of Year 107 39 40 Interest rate 6.8 5 42 43 44 0 50 1 $350 4 $350 $350 6 $350 7 $350 . $350 Year Ann Pet Lump Sum Total CFS $350 $350 30 $350 $350 $350 $310 $350 $1.000 $1,350 5350 $350 $350 46 10. What is the PV the $350 paymeria occur in Years 1 through 10 and the $1000 comes at the end of Year 10% Interest rate 2 0 1 2 Year Ann Pm Lumpsum Total CF 30 1 $350 2 $350 3 $350 4 $350 8 3350 . $350 7 $350 a 3350 . $350 10 $350 30 $350 $350 $350 $350 3350 3350 $350 $350 $350 $1,350 5 -6 7 NPV 1e What's the present value of the following uneven cash flow stream: 50 at Time 0, 5150 in Year 1 for at Time 1). 5200 in Year 2,10 in Years, and so in Year of the interest rates X7 Interest rate 8% 9 0 1 2 3 1 Year CFS 2 $200 3 10 4 S500 $0 5 NPV