Answered step by step

Verified Expert Solution

Question

1 Approved Answer

M Question 3 - Week 8: Homework X chegg.com/homework-help/ques X ChatGPT + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F... Week 8: Homework i 3 Saved Help Save & Exit Submit

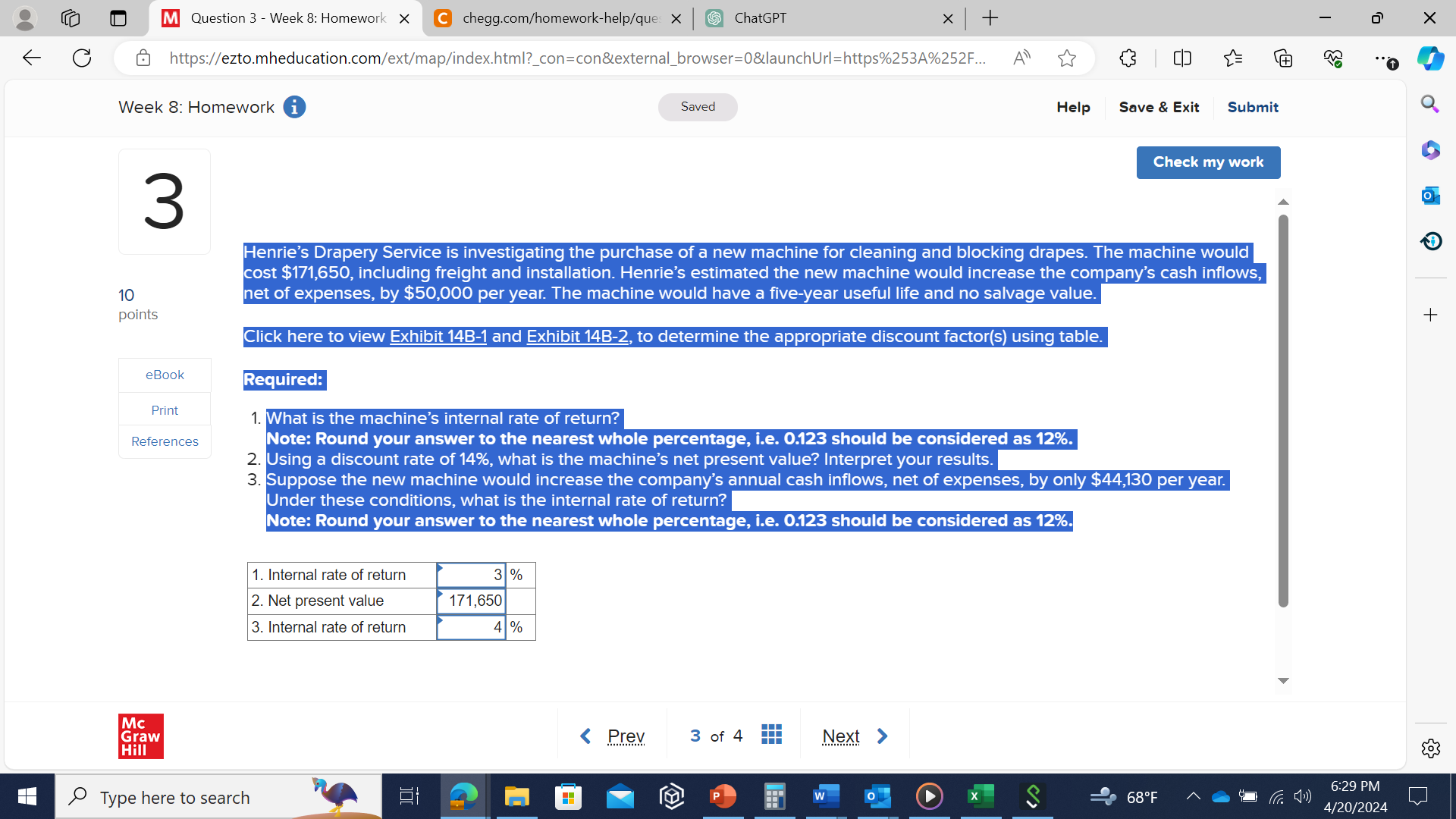

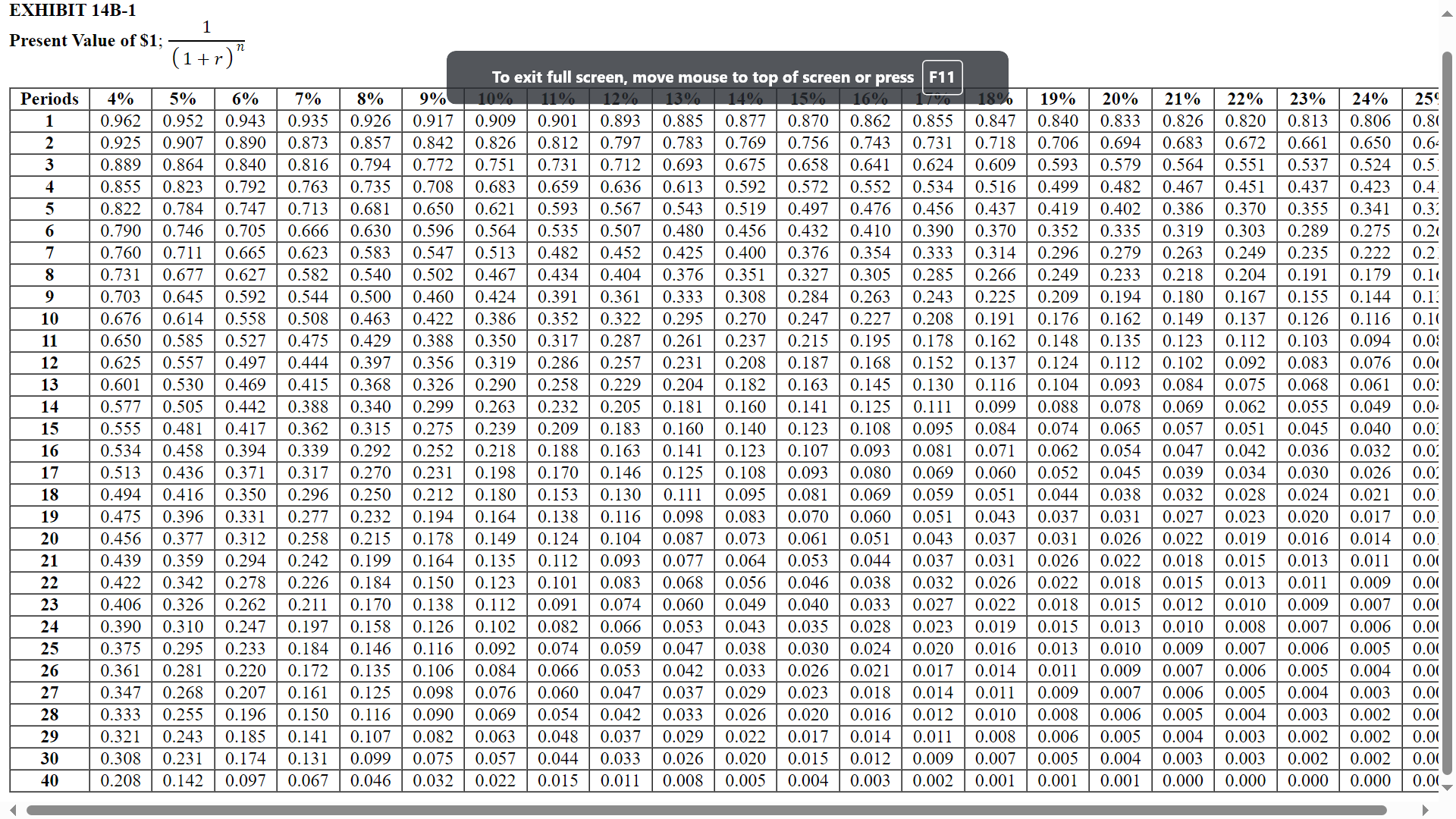

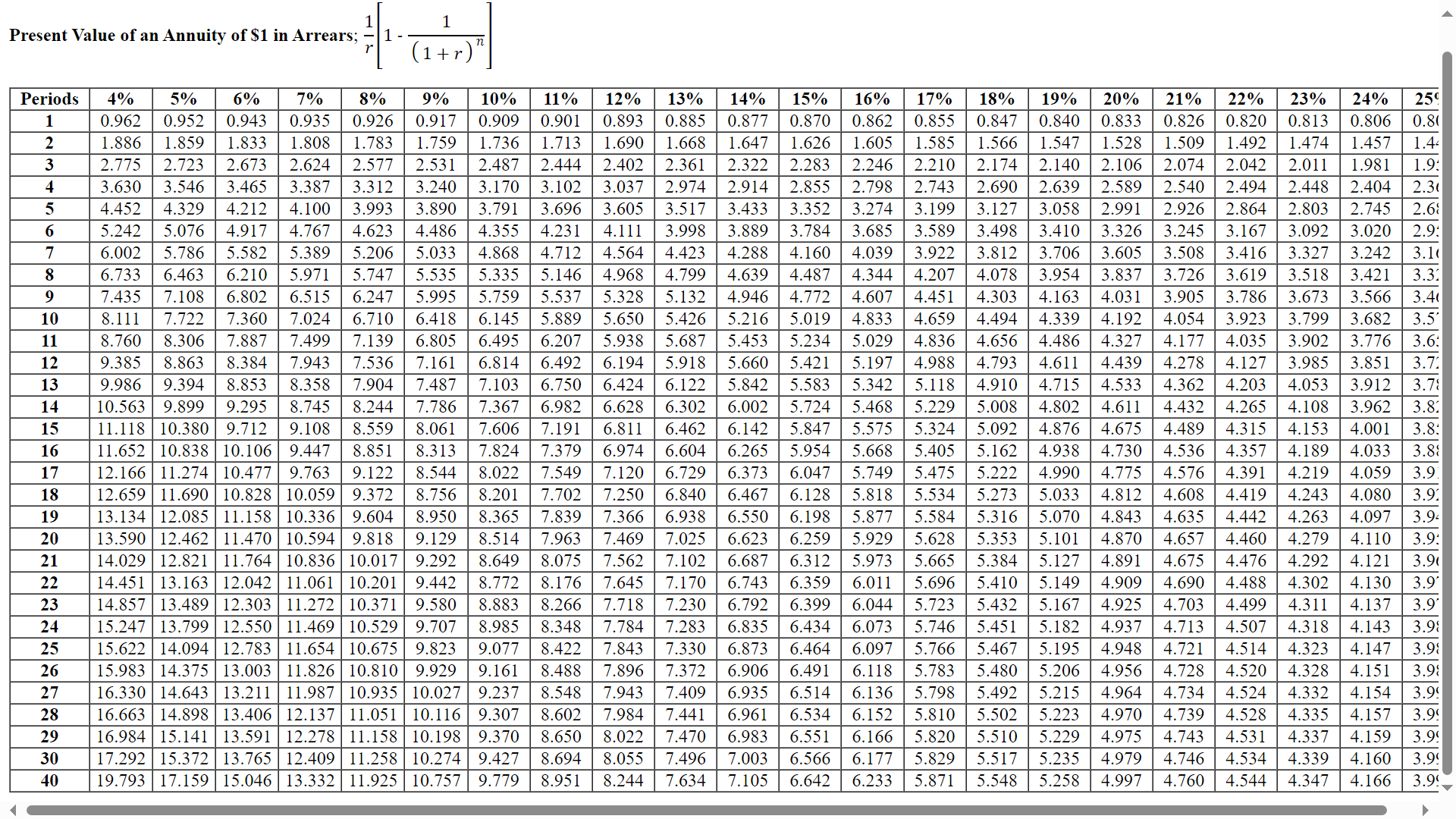

M Question 3 - Week 8: Homework X chegg.com/homework-help/ques X ChatGPT + https://ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F... Week 8: Homework i 3 Saved Help Save & Exit Submit Check my work 6 10 points eBook Print References Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $171,650, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $50,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%. 2. Using a discount rate of 14%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $44,130 per year. Under these conditions, what is the internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%. Mc Graw Hill 1. Internal rate of return 2. Net present value 3. Internal rate of return Type here to search 3% 171,650 4 % < Prev 3 of 4 Next > W + 6:29 PM 68F 4/20/2024 EXHIBIT 14B-1 Present Value of $1; 1 (1+r)" To exit full screen, move mouse to top of screen or press F11 Periods 4% 1 0.962 5% 6% 0.952 0.943 7% 0.935 2 0.925 0.907 0.890 3 4 5 0.889 0.864 0.840 0.855 0.823 0.792 0.822 0.784 0.747 6 0.790 0.746 0.705 0.666 0.630 7 0.760 0.711 8 0.731 0.677 9 10 0.676 0.614 11 0.650 0.585 9% 10% 0.917 0.909 0.842 0.826 0.772 0.751 0.708 0.683 0.650 0.621 0.596 0.564 0.665 0.623 0.583 0.547 0.513 0.627 0.582 0.540 0.502 0.467 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.558 0.508 0.463 0.422 0.386 0.527 0.475 0.429 8% 0.926 0.873 0.857 0.816 0.794 0.763 0.735 0.713 0.681 0.388 0.350 12 0.625 0.557 0.497 0.444 0.397 0.356 0.319 13 0.290 14 0.263 15 16 17 18 19 222222222233 20 21 24 25 26 27 28 0.054 29 30 40 11% 12% 13% 14% 15% 16% 17%| 18% 19% 20% 21% 22% 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.5. 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.4 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.3. 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.20 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.235 0.222 0.2 0.434 0.404 0.376 0.351 0.327 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.391 0.361 0.333 0.308 0.284 0.263 0.243 0.225 0.209 0.194 0.180 0.167 0.155 0.352 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.317 0.287 0.261 0.237 0.215 0.195 0.178 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.09 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.00 0.601 0.530 0.469 0.415 0.368 0.326 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.084 0.075 0.068 0.061 0.0: 0.577 0.505 0.442 0.388 0.340 0.299 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.04 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.03 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.0. 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.02 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.0 0.475 0.396 0.331 0.277 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.0 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.022 0.019 0.016 0.014 0.0 0.439 0.359 0.294 0.242 0.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.00 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.00 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.00 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.00 0.375 0.295 0.233 0.184 0.146 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.00 0.361 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.00 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.00 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.00 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.00 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.00 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.00 23% 24% 259 0.813 0.806 0.80 0.661 0.650 0.64 0.179 0.10 0.144 0.13 0.137 0.126 0.116 0.10 1 1 Present Value of an Annuity of $1 in Arrears; 1- (1+r)" Periods 4% 5% 1 0.962 0.952 6% 0.943 2 1.886 1.859 1.833 3 2.775 2.723 2.673 4 3.630 3.546 3.465 5 6 7 8 4.452 4.329 4.212 5.242 5.076 4.917 6.002 5.786 5.582 6.733 6.463 6.210 9 7.435 7.108 6.802 10 8.111 7.722 7.360 11 8.760 8.306 7.887 12 13 14 15 16 11.652 10.838 10.106 17 18 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 259 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.80 1.808 1.783 1.759 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.44 2.624 2.577 2.531 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.9: 3.387 3.312 3.240 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.404 2.30 4.100 3.993 3.890 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.6% 4.767 4.623 4.486 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.326 3.245 3.167 3.092 3.020 2.9: 5.389 5.206 5.033 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.10 5.971 5.747 5.535 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.31 6.515 6.247 5.995 5.759 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.40 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.192 4.054 3.923 3.799 3.682 3.5' 7.499 7.139 6.805 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.6: 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.72 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.053 3.912 3.79 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.8 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.8: 9.447 8.851 8.313 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.89 12.166 11.274 10.477 9.763 9.122 8.544 8.022 12.659 11.690 10.828 10.059 9.372 8.756 8.201 19 13.134 12.085 11.158 10.336 9.604 8.950 8.365 20 13.590 12.462 11.470 10.594 9.818 9.129 8.514 21 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 22 23 14.451 13.163 12.042 11.061 10.201 9.442 14.857 13.489 12.303 11.272 10.371 9.580 8.772 8.176 7.963 7.469 7.562 7.645 8.883 8.266 7.718 24 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 25 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 26 27 28 29 30 40 15.983 14.375 13.003 11.826 10.810 9.929 9.161 16.330 14.643 13.211 11.987 10.935 10.027 9.237 16.663 14.898 13.406 12.137 11.051 10.116 9.307 16.984 15.141 13.591 12.278 11.158 10.198 9.370 17.292 15.372 13.765 12.409 11.258 10.274 9.427 19.793 17.159 15.046 13.332 11.925 10.757 9.779 8.488 8.548 8.602 8.650 8.694 8.055 8.951 8.244 7.634 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.9 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.92 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.94 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.9: 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.90 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.488 4.302 4.130 3.9' 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.9' 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.98 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4.147 3.99 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.99 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.99 7.984 7.441 6.961 6.534 6.152 5.810 5.502 8.022 7.470 6.983 6.551 6.166 5.820 5.510 7.496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.99 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.99 5.223 4.970 5.229 4.975 4.739 4.528 4.335 4.157 3.99 4.743 4.531 4.337 4.159 3.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started