Answered step by step

Verified Expert Solution

Question

1 Approved Answer

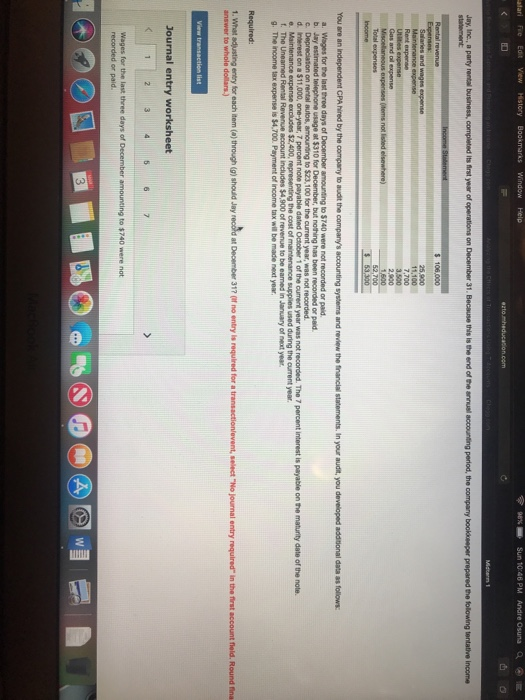

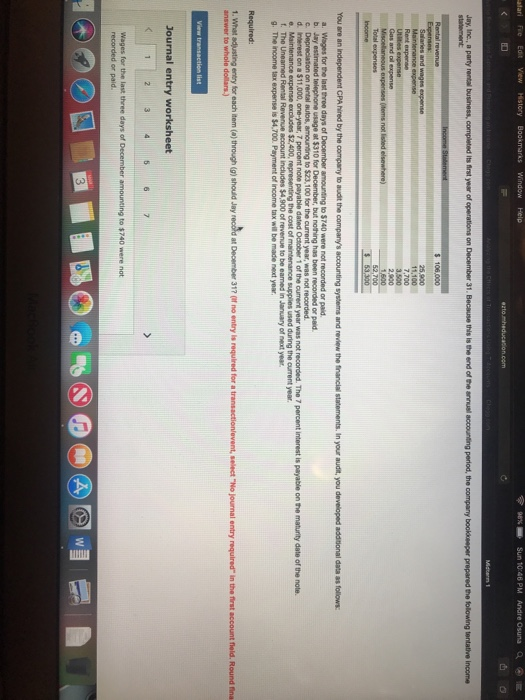

M1 #10 3,500 1,600 rou are an independent CPA hired by the company to audit the company's accounting systems and review the financial statements. In

M1 #10

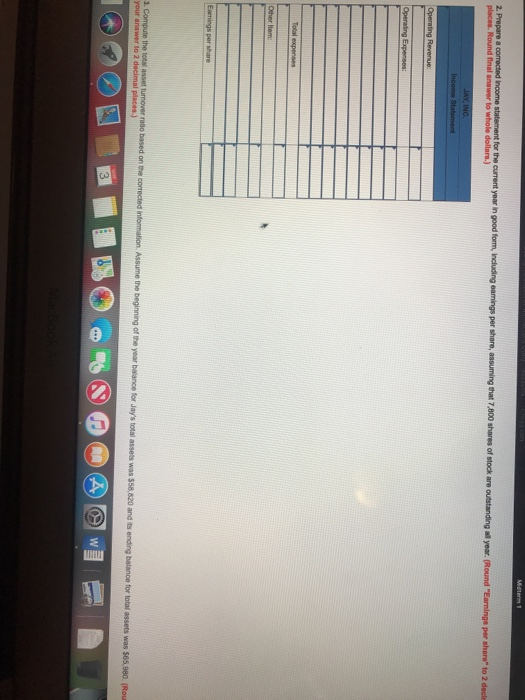

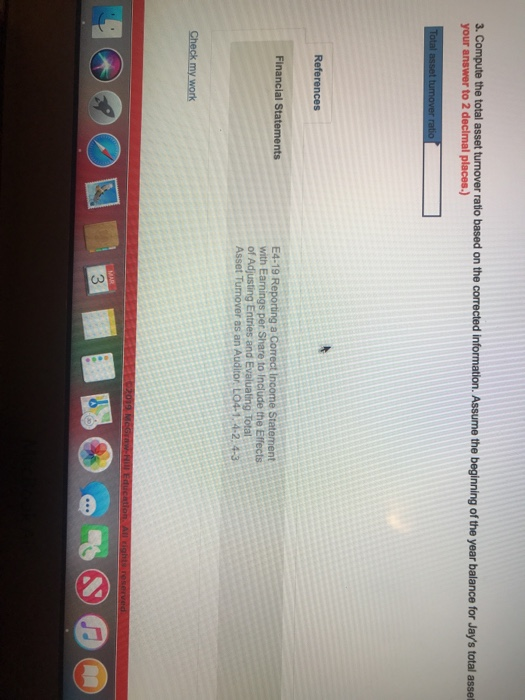

3,500 1,600 rou are an independent CPA hired by the company to audit the company's accounting systems and review the financial statements. In your audit, you developed additional data as follows to $23,100 for the cu 1 of the be made next year. g. The income tax expense is $4.700. Payment of income tax w Required: wer to whole dollars.) places. Round final answer to whole dollars.) 3. Compute the total asset turnover ratio based on your answer to 2 declmal places.) the corrected information. Assume the beginning of the year balance for Jay's total asset References E4-19 with Earnings per Share to Include the Effects of Adjusting Entries and 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started