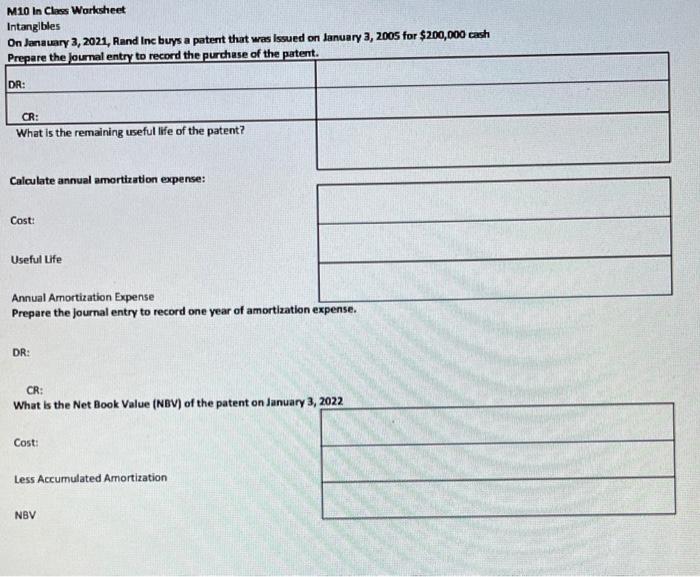

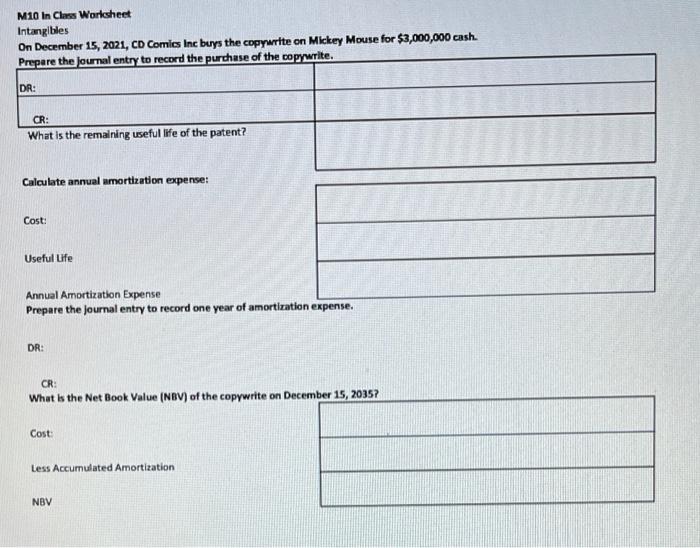

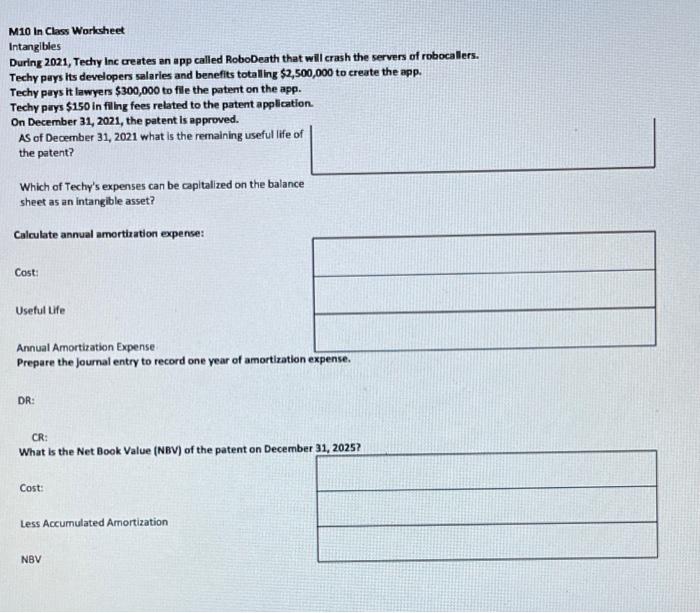

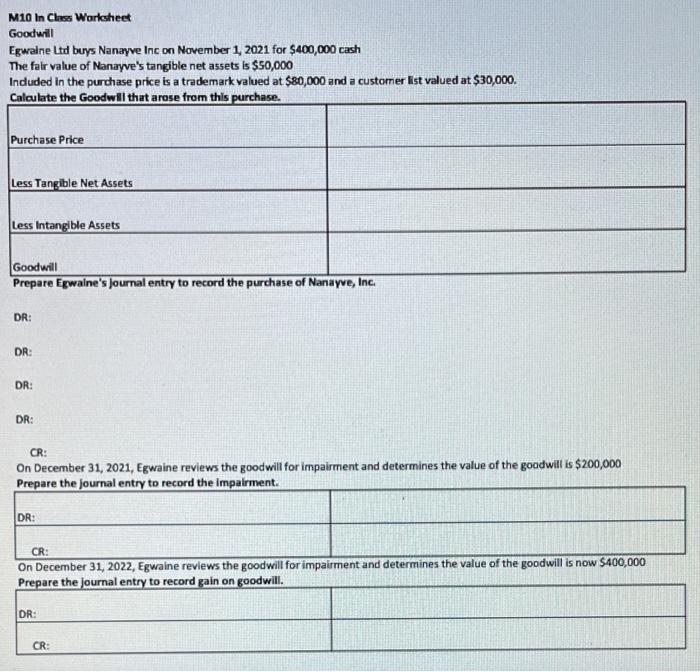

M10 In Class Worksheet Intangibles On January 3, 2021, Rand Inc buys a patent that was issued on January 3, 2005 for $200,000 cash Prepare the journal entry to record the purchase of the patent. DR: CR: What is the remaining useful life of the patent? Calculate annual amortization expense: Cost: Useful Life Annual Amortization Expense Prepare the journal entry to record one year of amortization expense. DR: CR: What is the Net Book Value (NBV) of the patent on January 3, 2022 Cost: Less Accumulated Amortization NBV M10 In Class Worksheet Intangibles On December 15, 2021, CD Comics Inc buys the copywrite on Mickey Mouse for $3,000,000 cash. Prepare the journal entry to record the purchase of the copywrite. DR: CR: What is the remaining useful life of the patent? Calculate annual umortization expense: Cost: Useful Life Annual Amortization Expense Prepare the journal entry to record one year of amortization expense. DR: CR: What is the Net Book Value (NBV) of the copywrite on December 15, 2035? Cost Less Accumulated Amortization NBV M10 In Class Worksheet Intangibles During 2021, Techy Inc creates an app called RoboDeath that will crash the servers of robocallers. Techy pays its developers salaries and benefits totaling $2,500,000 to create the app. Techy pays it lawyers $300,000 to file the patent on the app. Techy pays $150 in filing fees related to the patent application On December 31, 2021, the patent is approved. As of December 31, 2021 what is the remaining useful life of the patent? Which of Techy's expenses can be capitalized on the balance sheet as an intangible asset? Calculate annual amortization expense: Cost: Useful Life Annual Amortization Expense Prepare the journal entry to record one year of amortization expense. DR: CR: What is the Net Book Value (NBV) of the patent on December 31, 2025? Cost: Less Accumulated Amortization NBV M10 In Class Worksheet Goodwill Egwalne Ltd buys Nanayve Inc on November 1, 2021 for $400,000 cash The fair value of Nanayve's tangible net assets is $50,000 Induded in the purchase price is a trademark valued at $80,000 and a customer ist valued at $30,000. Calculate the Goodwill that arose from this purchase. Purchase Price Less Tangible Net Assets Less Intangible Assets Goodwill Prepare Egwalne's journal entry to record the purchase of Nanayve, Inc. DR: DR: DR: DR: CR: On December 31, 2021, Egwaine reviews the goodwill for impairment and determines the value of the goodwill is $200,000 Prepare the journal entry to record the impairment. DR: CR: On December 31, 2022, Egwaine reviews the goodwill for impairment and determines the value of the goodwill is now $400,000 Prepare the journal entry to record gain on goodwill. DR: CR