M2 Case Analysis M and M nursing home

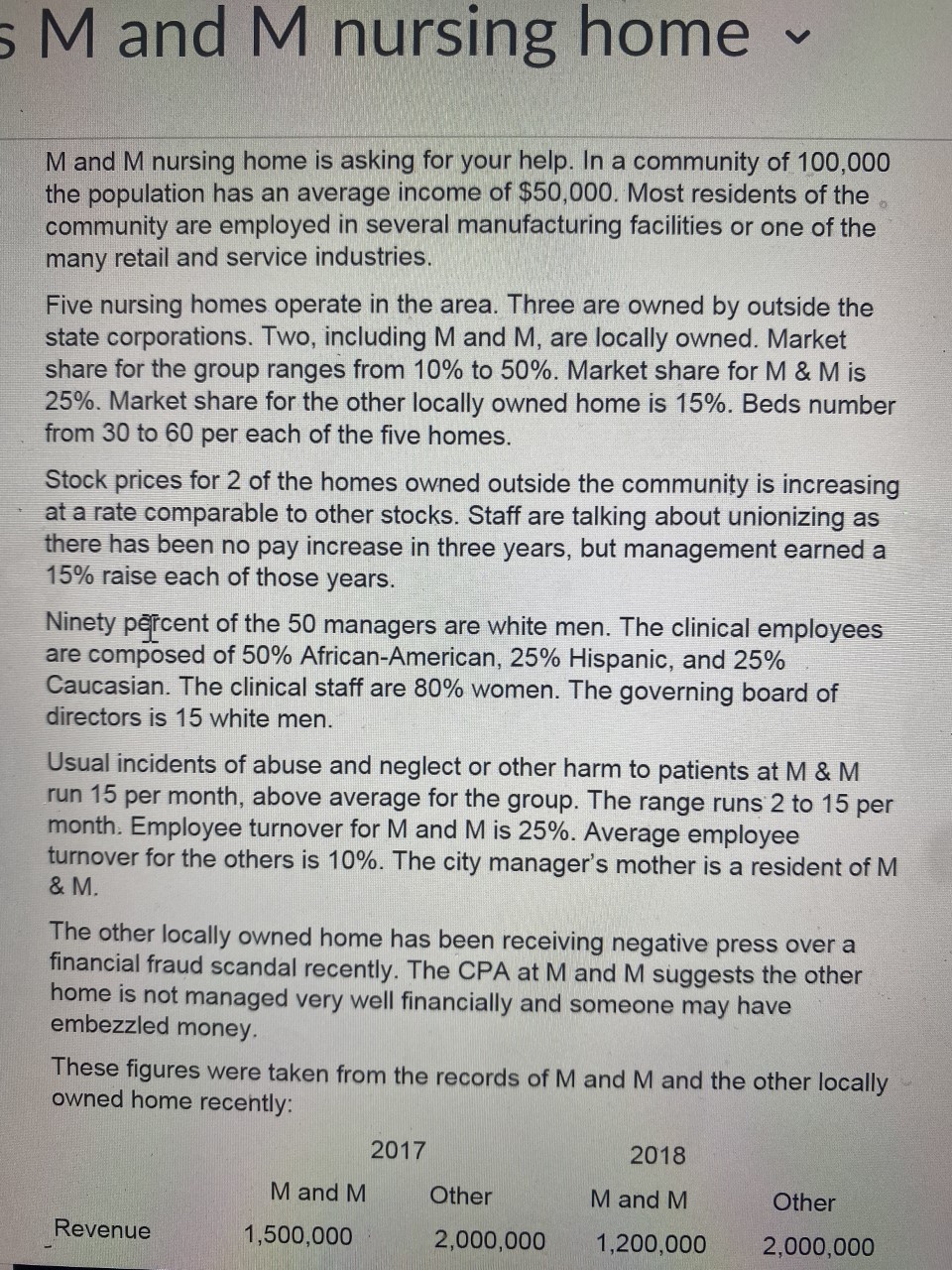

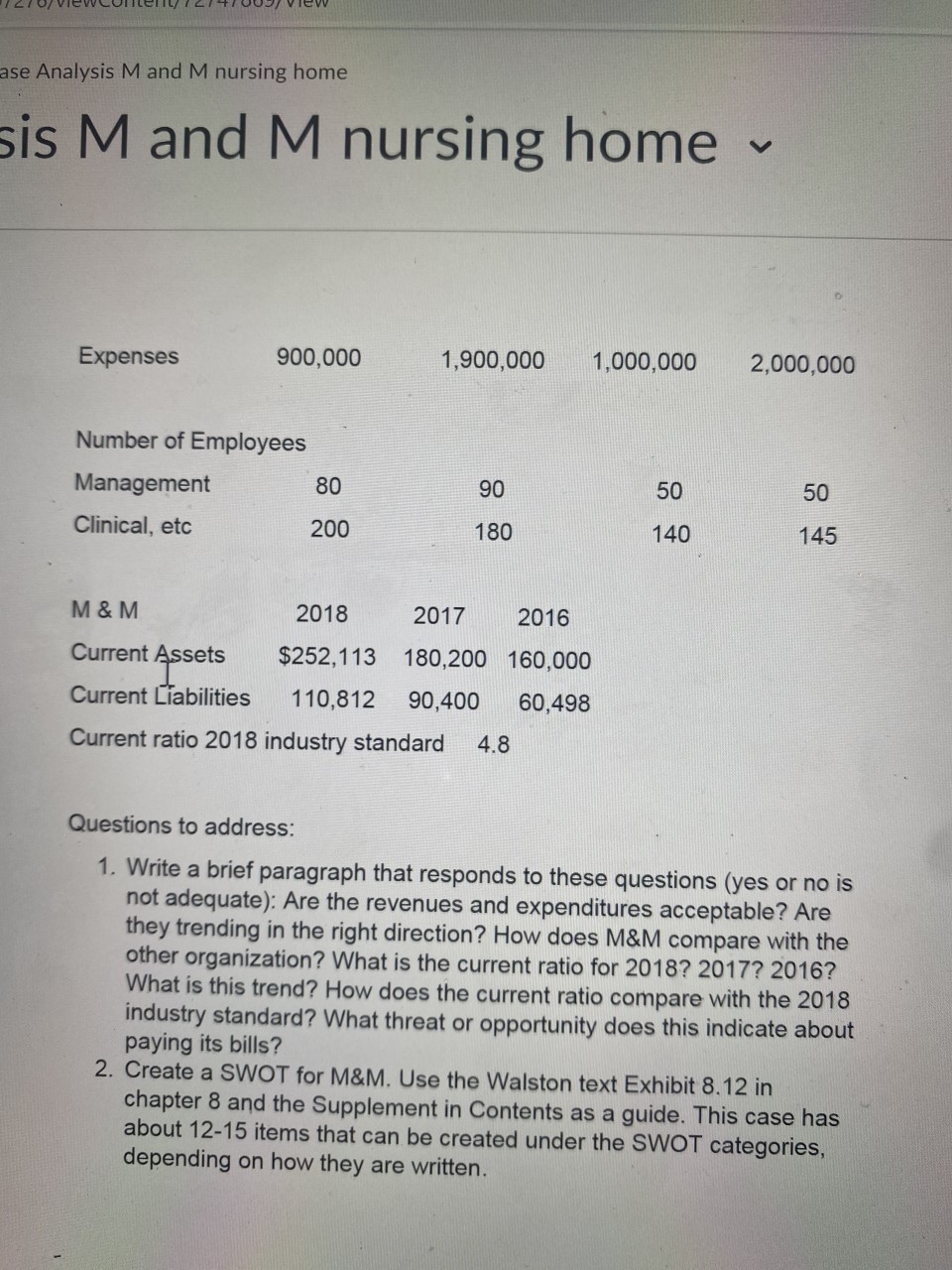

M and M nursing home ~ M and M nursing home is asking for your help. In a community of 100,000 the population has an average income of $50,000. Most residents of the community are employed in several manufacturing facilities or one of the many retail and service industries. Five nursing homes operate in the area. Three are owned by outside the state corporations. Two, including M and M, are locally owned. Market share for the group ranges from 10% to 50%. Market share for M & M is 25%. Market share for the other locally owned home is 15%. Beds number from 30 to 60 per each of the five homes. Stock prices for 2 of the homes owned outside the community is increasing at a rate comparable to other stocks. Staff are talking about unionizing as there has been no pay increase in three years, but management earned a 15% raise each of those years. Ninety percent of the 50 managers are white men. The clinical employees are composed of 50% African-American, 25% Hispanic, and 25% Caucasian. The clinical staff are 80% women. The governing board of directors is 15 white men. Usual incidents of abuse and neglect or other harm to patients at M & M run 15 per month, above average for the group. The range runs 2 to 15 per month. Employee turnover for M and M is 25%. Average employee turnover for the others is 10%. The city manager's mother is a resident of M & M. The other locally owned home has been receiving negative press over a financial fraud scandal recently. The CPA at M and M suggests the other home is not managed very well financially and someone may have embezzled money These figures were taken from the records of M and M and the other locally owned home recently: 2017 2018 M and M Other M and M Other Revenue 1,500,000 2,000,000 1,200,000 2,000,000ase Analysis M and M nursing home sis M and M nursing home ~ Expenses 900,000 1,900,000 1,000,000 2,000,000 Number of Employees Management 80 90 50 50 Clinical, etc 200 180 140 145 M & M 2018 2017 2016 Current Assets $252, 113 180,200 160,000 Current Liabilities 110,812 90,400 60,498 Current ratio 2018 industry standard 4.8 Questions to address: 1. Write a brief paragraph that responds to these questions (yes or no is not adequate): Are the revenues and expenditures acceptable? Are they trending in the right direction? How does M&M compare with the other organization? What is the current ratio for 2018? 2017? 2016? What is this trend? How does the current ratio compare with the 2018 industry standard? What threat or opportunity does this indicate about paying its bills? 2. Create a SWOT for M&M. Use the Walston text Exhibit 8. 12 in chapter 8 and the Supplement in Contents as a guide. This case has about 12-15 items that can be created under the SWOT categories, depending on how they are written