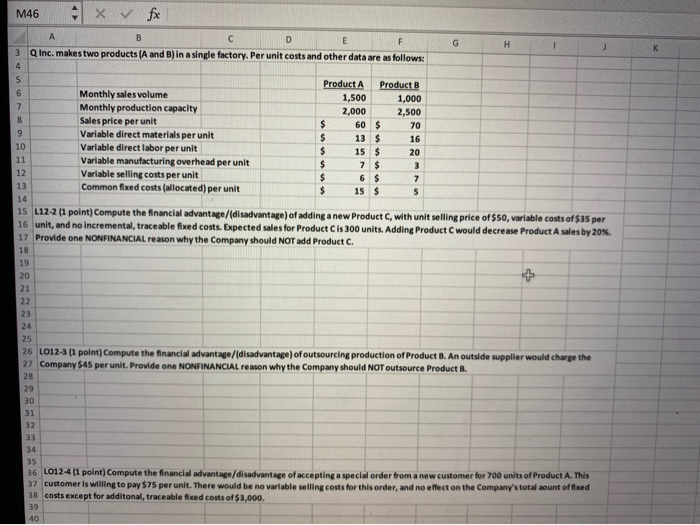

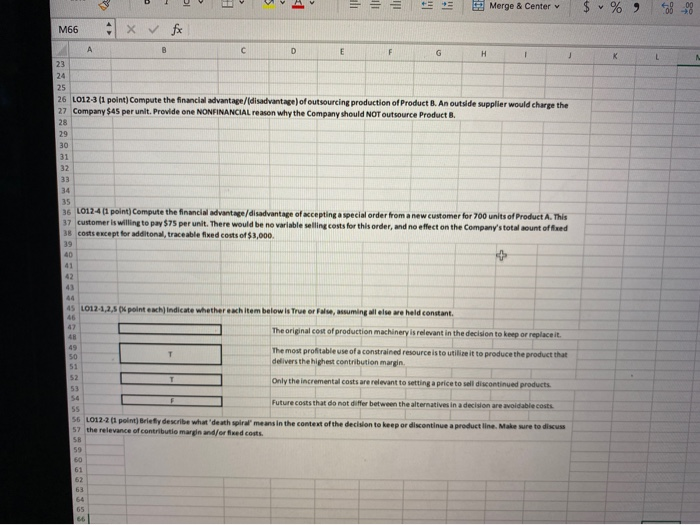

M46 Ax & fx B D E F 3 QInc, makes two products (A and B) in a single factory. Per unit costs and other data are as follows: J 4 5 6 7 Product A Product B Monthly sales volume 1,500 1,000 Monthly production capacity 2,000 2,500 8 Sales price per unit $ 60 $ 70 9 Variable direct materials per unit $ 13 $ 16 10 Variable direct labor per unit $ 15 $ 20 11 Variable manufacturing overhead per unit $ 7 $ 3 12 Variable selling costs per unit $ 6 $ 7 13 Common fixed costs (allocated) per unit $ 15 $ 5 14 15 L12-2 (1 point) Compute the financial advantage/(disadvantage) of adding a new Product C, with unit selling price of $50, variable costs of $35 per 16 unit, and no incremental, traceable fixed costs. Expected sales for Product is 300 units. Adding Product C would decrease Product A sales by 20%. 17 Provide one NONFINANCIAL reason why the Company should NOT add Product C. 18 19 20 21 22 23 24 25 26 L012-3 (1 point) Compute the financial advantage/(disadvantage of outsourcing production of Product B. An outside supplier would charge the 27 Company $45 per unit. Provide one NONFINANCIAL reason why the Company should NOT outsource Product B. 28 29 30 31 32 33 35 36 L012-4 (1 point) Compute the financial advantage/disadvantage of accepting a special order from a new customer for 700 units of Product A. This 37 customer is willing to pay $75 per unit. There would be no variable selling costs for this order, and no effect on the Company's total aount of fixed 38 costs except for additonal, traceable fixed costs of $3,000. 39 40 10 = Merge & Center $ % 68 - M66 1 x 1 K B D E F G H J 23 24 25 26 L012-3 (1 point) Compute the financial advantage/disadvantage of outsourcing production of Product B. An outside supplier would charge the 27 Company $45 per unit. Provide one NONFINANCIAL reason why the Company should NOT outsource Product B. 28 29 30 31 32 33 34 35 36 L012-41 point) Compute the financial advantage/disadvantage of accepting a special order from a new customer for 700 units of Product A. This 37 customer is willing to pay $75 per unit. There would be no variable selling costs for this order, and no effect on the Company's total sount of fixed 38 costs except for additonal, traceable fixed costs of $3,000 40 41 42 45 L012-1,2,5 point each indicate whether each item below is True or False, assuming allelse are held constant. 46 The original cost of production machinery is relevant in the decision to keep or replace it. 48 49 The most profitable use of a constrained resource is to utilize it to produce the product that 50 delivers the highest contribution margin 51 52 Only the incremental costs are relevant to setting a price to sell discontinued products 53 54 Future costs that do not differ between the alternatives in a decision are avoidable costs 55 56 L012-21 point) Briefly describe what 'death spiral' means in the context of the decision to keep or discontinue a product line. Make sure to discuss 57 the relevance of contributie margin and/or fixed costs. 58 59 60 61 62 63 64 65 36