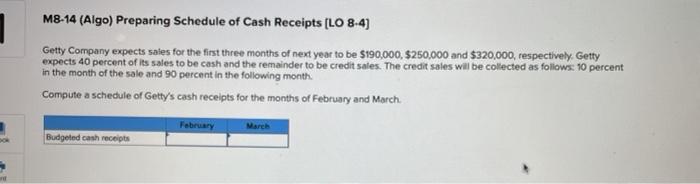

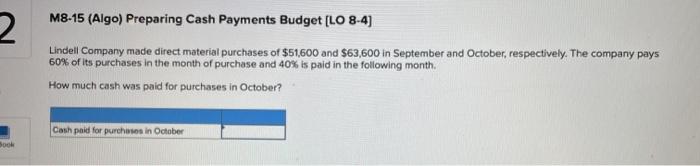

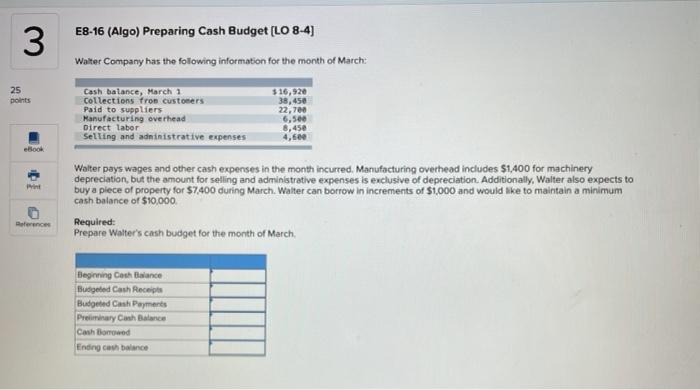

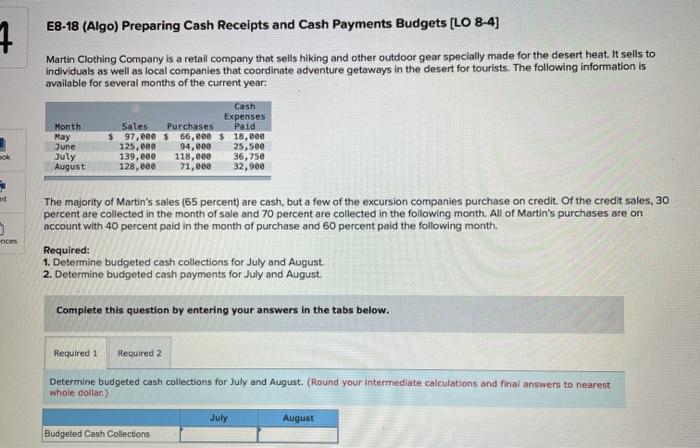

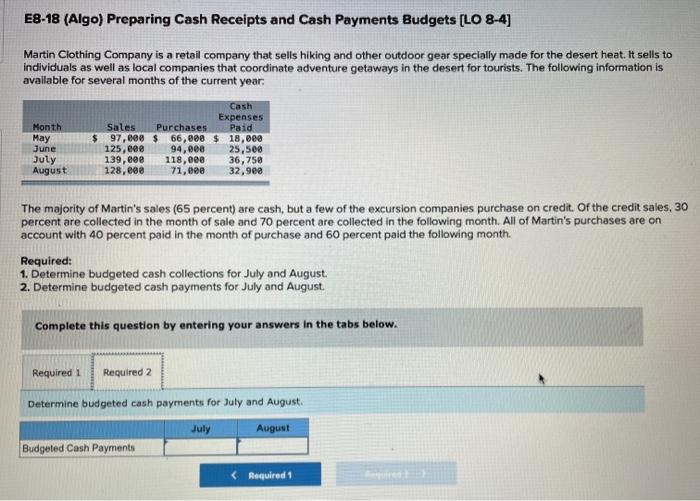

M8-14 (Algo) Preparing Schedule of Cash Receipts (LO 8-4) Getty Company expects sales for the first three months of next year to be $190,000, $250,000 and $320,000, respectively. Getty expects 40 percent of its sales to be cash and the remainder to be credit sales. The credit sales will be collected as follows: 10 percent in the month of the sale and 90 percent in the following month. Compute a schedule of Getty's cash receipts for the months of February and March February March Budgeted cash receipts 2 M8-15 (Algo) Preparing Cash Payments Budget (LO 8-4) Lindell Company made direct material purchases of $51,600 and $63,600 in September and October, respectively. The company pays 60% of its purchases in the month of purchase and 40% is paid in the following month. How much cash was paid for purchases in October? Cash paid for purchases in October 300 3 E8-16 (Algo) Preparing Cash Budget [LO 8-4) Walter Company has the following information for the month of March 25 points Cash balance, March 1 Collections from customers Paid to suppliers Manufacturing overhead Direct labor Selling and administrative expenses $16,920 38,450 22,700 6,500 8,450 4,6 eBook Print Walter pays wages and other cash expenses in the month incurred. Manufacturing overhead includes $1.400 for machinery depreciation, but the amount for selling and administrative expenses is exclusive of depreciation. Additionally, Walter also expects to buy a piece of property for $7.400 during March. Walter can borrow in increments of $1,000 and would like to maintain a minimum cash balance of $10,000 Required: Prepare Walter's cash budget for the month of March, Reference Beginning Cash Balance Budgeted Cash Receipts Budged Cash Payments Preliminary Cash Balance Cash Bord Ending cash balance E8-18 (Algo) Preparing Cash Receipts and Cash Payments Budgets [LO 8-4) 7 Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to individuals as well as local companies that coordinate adventure getaways in the desert for tourists. The following information is available for several months of the current year. Cash Expenses Month Sales Purchases Paid May $ 97,088 $ 66,000 $ 18,888 June 125,000 94,000 25,500 July 139,000 118,000 36,750 August 128,080 71,000 32,900 ncos The majority of Martin's sales (65 percent) are cash, but a few of the excursion companies purchase on credit. Of the credit sales, 30 percent are collected in the month of sale and 70 percent are collected in the following month. All of Martin's purchases are on account with 40 percent paid in the month of purchase and 60 percent paid the following month. Required: 1. Determine budgeted cash collections for July and August. 2. Determine budgeted cash payments for July and August Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted cash collections for July and August. (Round your intermediate calculations and final answers to nearest whole dollar) July August Budgeted Cash Collections E8-18 (Algo) Preparing Cash Receipts and Cash Payments Budgets [LO 8-4) Martin Clothing Company is a retail company that sells hiking and other outdoor gear specially made for the desert heat. It sells to individuals as well as local companies that coordinate adventure getaways in the desert for tourists. The following information is available for several months of the current year. $ Month May June July August Cash Expenses Sales Purchases Paid 97,000 $ 66,000 $ 18,eee 125,00 94,000 25,500 139, eee 118,000 36,750 128,00 71,000 32,900 The majority of Martin's sales (65 percent) are cash, but a few of the excursion companies purchase on credit. Of the credit sales, 30 percent are collected in the month of sale and 70 percent are collected in the following month. All of Martin's purchases are on account with 40 percent paid in the month of purchase and 60 percent paid the following month. Required: 1. Determine budgeted cash collections for July and August 2. Determine budgeted cash payments for July and August Complete this question by entering your answers in the tabs below. Required 1 Required 2 Determine budgeted cash payments for July and August July August Budgeted Cash Payments