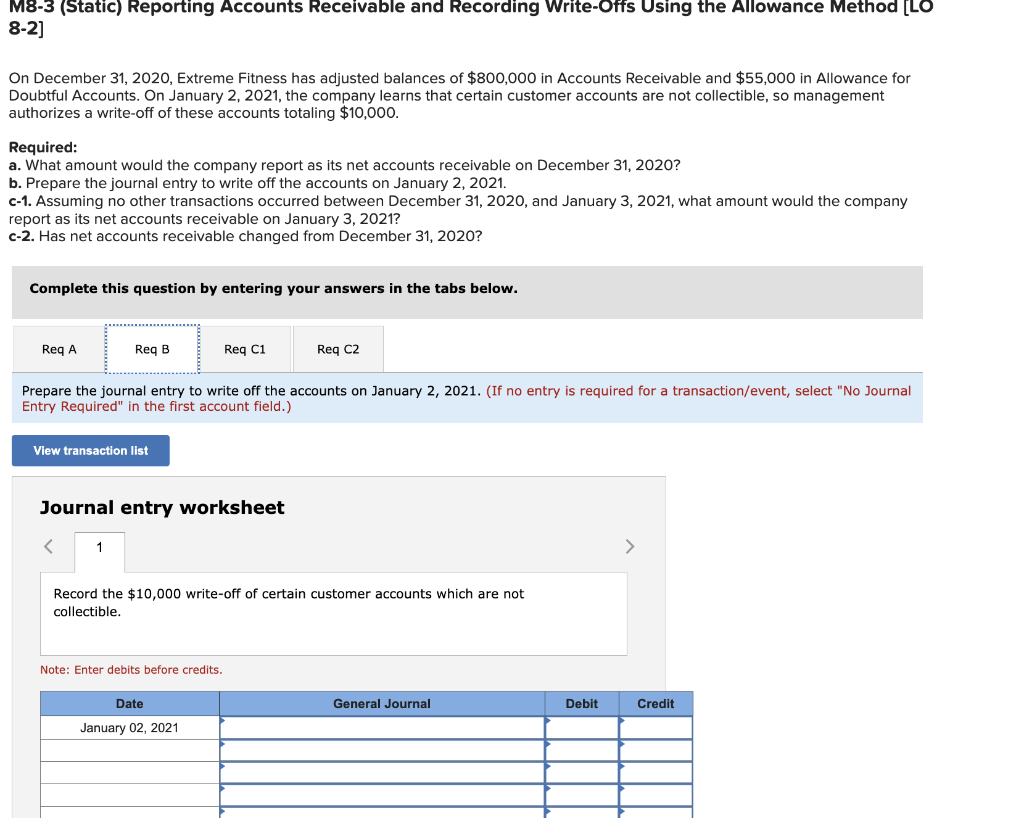

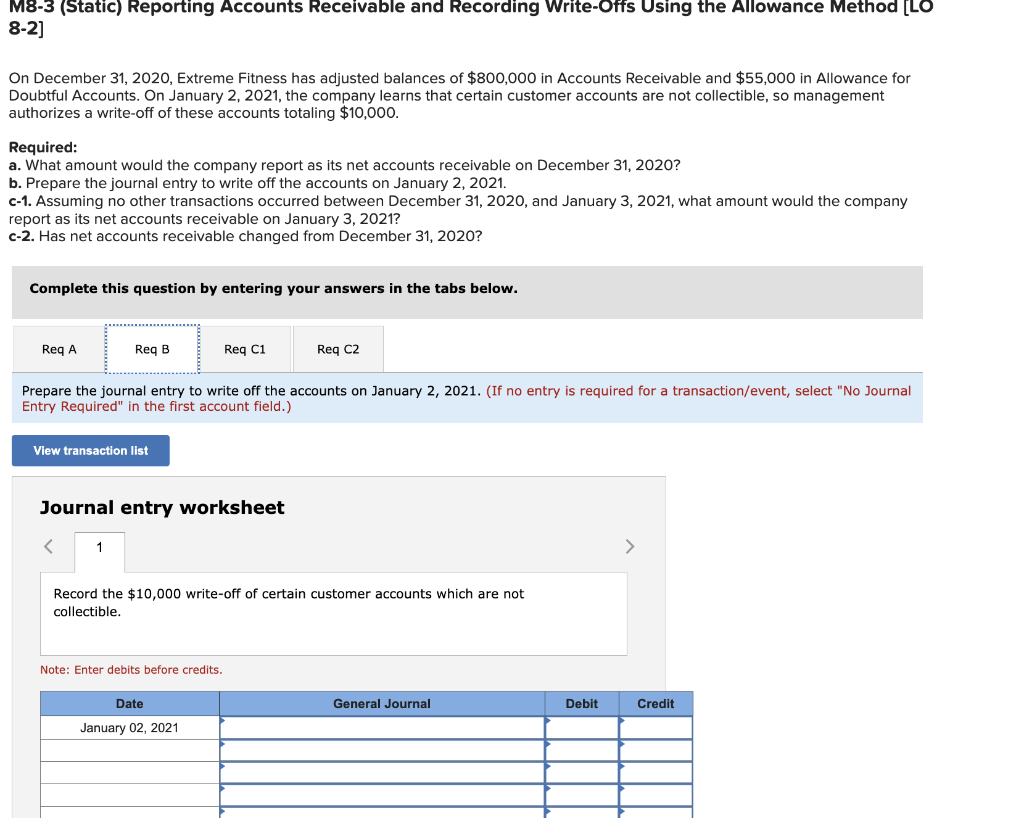

M8-3 (Static) Reporting Accounts Receivable and Recording Write-Offs Using the Allowance Method [LO 8-2] On December 31, 2020, Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $10,000. Required: a. What amount would the company report as its net accounts receivable on December 31, 2020? b. Prepare the journal entry to write off the accounts on January 2,2021. c-1. Assuming no other transactions occurred between December 31,2020 , and January 3,2021 , what amount would the company report as its net accounts receivable on January 3,2021 ? c-2. Has net accounts receivable changed from December 31, 2020? Complete this question by entering your answers in the tabs below. What amount would the company report as its net accounts receivable on December 31,2020 ? 8-2] On December 31, 2020, Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $10,000. Required: a. What amount would the company report as its net accounts receivable on December 31, 2020? b. Prepare the journal entry to write off the accounts on January 2,2021. c-1. Assuming no other transactions occurred between December 31,2020, and January 3, 2021, what amount would the company report as its net accounts receivable on January 3,2021 ? c-2. Has net accounts receivable changed from December 31, 2020? Complete this question by entering your answers in the tabs below. Prepare the journal entry to write off the accounts on January 2, 2021. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the $10,000 write-off of certain customer accounts which are not collectible. Note: Enter debits before credits. M8-3 (Static) Reporting Accounts Receivable and Recording Write-Offs Using the Allowance Method [LO 8-2] On December 31, 2020, Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $10,000. Required: a. What amount would the company report as its net accounts receivable on December 31,2020 ? b. Prepare the journal entry to write off the accounts on January 2,2021. c-1. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the company report as its net accounts receivable on January 3, 2021? c-2. Has net accounts receivable changed from December 31,2020 ? Complete this question by entering your answers in the tabs below. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the company report as its net accounts receivable on January 3,2021 ? M8-3 (Static) Reporting Accounts Receivable and Recording Write-Offs Using the Allowance Method [LO 82] On December 31, 2020, Extreme Fitness has adjusted balances of $800,000 in Accounts Receivable and $55,000 in Allowance for Doubtful Accounts. On January 2, 2021, the company learns that certain customer accounts are not collectible, so management authorizes a write-off of these accounts totaling $10,000. Required: a. What amount would the company report as its net accounts receivable on December 31,2020 ? b. Prepare the journal entry to write off the accounts on January 2,2021. c-1. Assuming no other transactions occurred between December 31, 2020, and January 3, 2021, what amount would the company report as its net accounts receivable on January 3,2021 ? c-2. Has net accounts receivable changed from December 31, 2020? Complete this question by entering your answers in the tabs below. Has net accounts receivable changed from December 31,2020? Has net accounts receivable changed from December 31,2020